Manage Expenses More Efficiently with These 6 TravelBank Features

The goal of expense management is to help employees track business expenses more easily and accurately, and simplify the approval and reconciliation experience for faster reimbursements and processing. TravelBank is built to make the experience painless and intuitive for both your employees and your finance and accounting teams, so you get better insights into real-time spend, can enforce policy compliance, and eliminate wasteful spend.

Listed below are six features your team can take advantage of for better expense tracking and management.

Expense Capture

Let’s start where the expense tracking process begins: expense capture. At the beginning of every expense report is an employee purchase that needs to be captured for your business financial records.

With TravelBank, employees can track expenses easily from any web or mobile device. TravelBank supports expense capture from a photo receipt, importing transactions over from a synced credit card, or forwarding email receipts to their TravelBank inbox. Every receipt is scanned with OCR technology to automatically fill in expense details. Expenses incurred in other currencies will be converted to US Dollars with the real time conversion rate when created. Employees can create mileage expenses by submitting the number of miles driven and see it converted to a reimbursement rate based on the IRS mileage rate.

These features make it not only simple for employees to capture spend, but also decreases the time spent manually entering expense data and increases the data accuracy making reconciliation easier for finance and accounting.

Custom Expense Categories

When tracked expenses are submitted in an expense report, they need to be categorized correctly so they align with categories in your company’s general ledger. If not, reconciliation becomes an outright nightmare.

TravelBank allows admin users to create, customize, and manage expense categories for employees to select from when they are creating expenses, and map them to the appropriate general ledger expense accounts. This enables employees to quickly and accurately categorize their expenses, while ensuring the data flows to the right expense accounts. No need for a tradeoff between ease of use for your employees and efficiencies for you managing your books.

This automation works with your accounting team’s existing systems, and helps ensure data quality and ease of use.

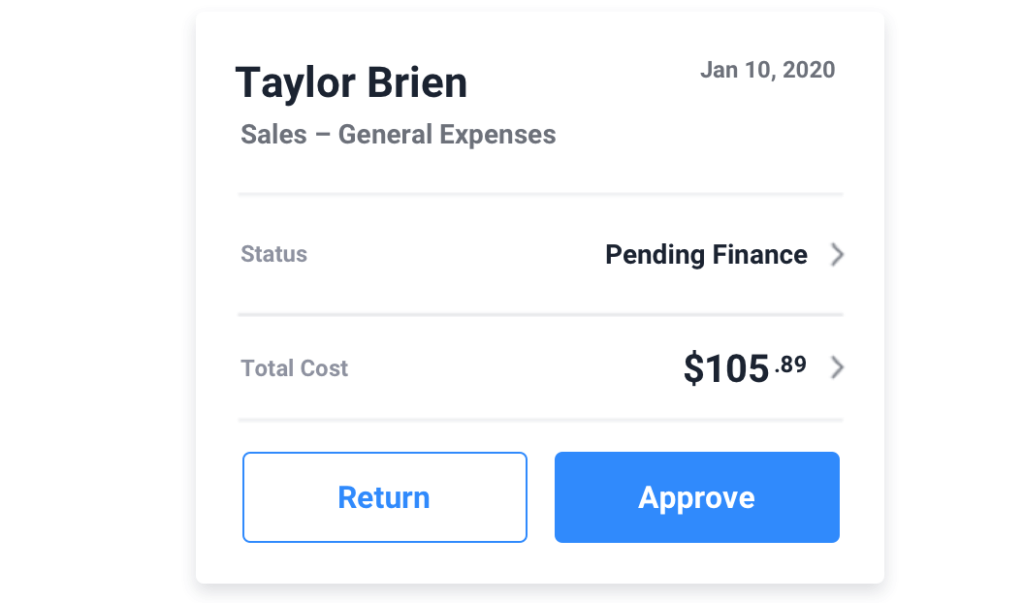

Expense Policy, Approvals, & Reimbursements

A seamless approval and reimbursement flow is the key to ensuring expense policies are complied with and wasteful spend is caught early.

TravelBank gives you company admin the power to customize the minimum dollar amount for requiring photo receipts with expenses, decide whether manager approval is sufficient for processing reimbursements, and set how frequently employee reimbursements can be processed.

Administrators can strike a balance between employee happiness and ease of use while still ensuring compliance. Reimbursements can be processed in as little as 24 hours, getting employees their money back as quickly as possible for their business purchases.

General Ledger Integration

After expenses are tracked and processed, they must be reconciled with the general ledger accounts.

TravelBank allows companies to set up and manage direct integrations with their general ledger to create transactions for approved expense reports and reimbursements. TravelBank supports integration with the most popular general ledgers, including:

- QuickBooks Online

- QuickBooks Enterprise

- NetSuite

- Bill.com

- Xero

Finance teams can easily set up their general ledger integrations to capture all approved expense reports and reimbursements, as well as customize transaction data to align with existing business finances. Set it once and see data flow through to the general ledger without additional work.

Expense Data Export

At the end of the day (or month) your employee’s spend is your company’s data, so we want to make it easy for your team to manage and analyze. Using TravelBank, your finance and accounting teams can export their organization’s expense data by department and report approval date in a CSV file.

Your team can access their organization’s expense data and prepare for their own spend analysis and report building, or for importing into other systems. Expense export allows admin users access to the spend data they need, with the data they want, for anything their business needs.

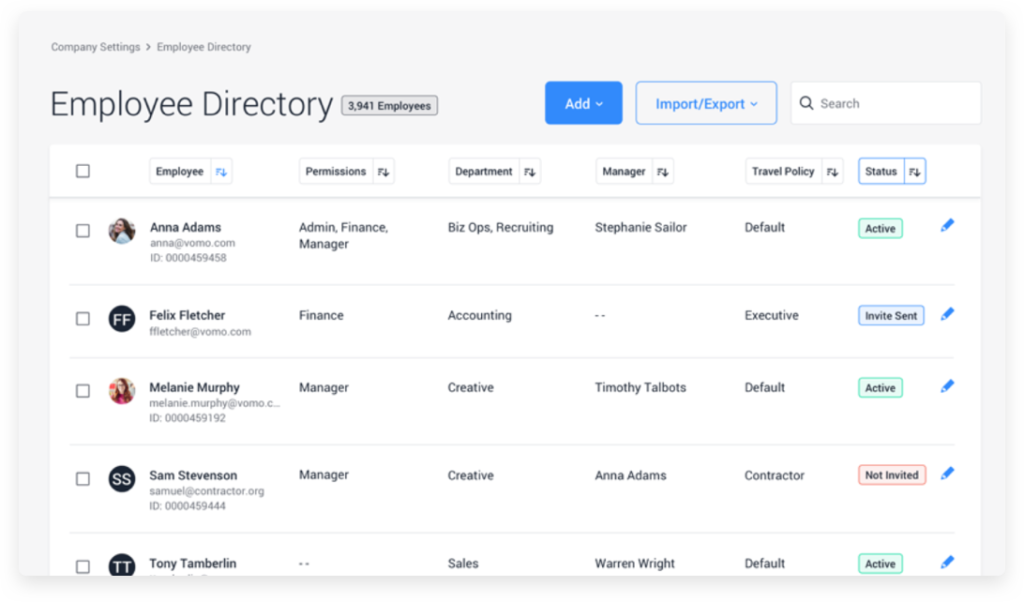

Employee Directory

As your company grows and changes, adding and changing users within your TravelBank account should be simple.

Our employee directory feature allows admin users to invite and manage their organization’s employees by syncing with their HRIS, uploading a CSV file, or adding them directly through the TravelBank interface. Employee permissions, departments managers, and policies can be updated at any time.

Company setup and employee management is a breeze with TravelBank. Your employee directory can be managed in aggregate or with each employee. Know exactly what each employee’s role and access is in TravelBank and add or remove as needed.