We’re Partnering with U.S. Bank Instant Card™ To Revolutionize Digital Payments For Work

In an innovative move, we have partnered with U.S. Bank to offer an integrated virtual card, expense management, and travel solution.

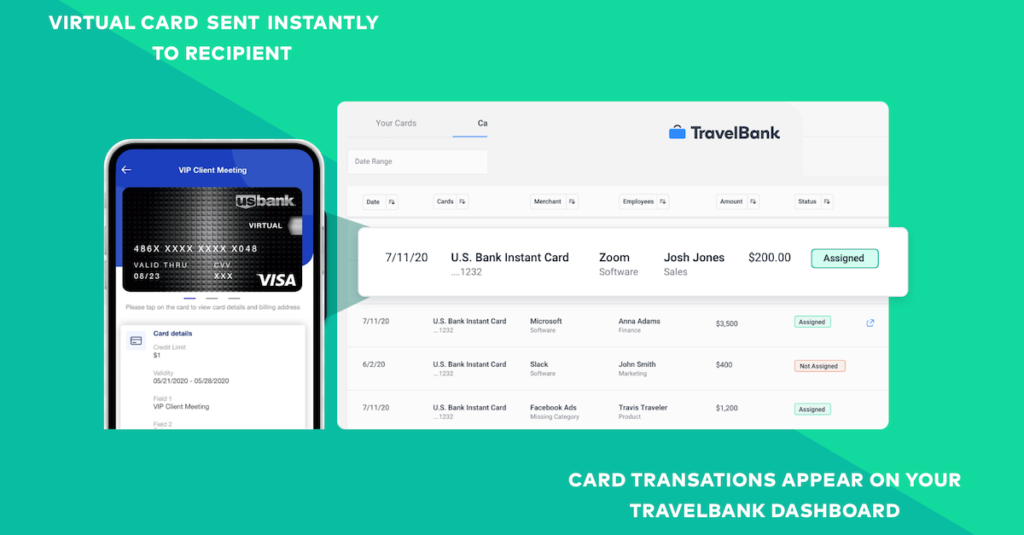

The new U.S. Bank Instant Card integrates directly into the TravelBank travel and expense management application, making it simple for businesses to provision virtual corporate cards to control and track spend in real time, and manage business travel and expense in a single, all-in-one solution, all while earning market-leading card spend rebates and providing employees with safe and convenient contactless payment options.

Since the spread of COVID-19, consumers have shown a significant shift in the way they make purchases. Prior to the global pandemic, 13% of consumers prioritized businesses that offer pickup, curbside or contactless services. That percentage has jumped to 49% and will affect the way employees choose to make business purchases moving forward, making virtual cards a vital component to business expense management programs.

Fortunately, Instant Card allows organizations to set spending limits, block merchant category codes (MCCs), and customize expiration dates specific to a business purpose, giving them more power to control spend and reduce fraud before it occurs. Paired with the TravelBank app, businesses can issue virtual cards to anyone who needs to make in-person or contactless payments on behalf of the business in just a few clicks, and track and review that spend as it occurs. This could include employees purchasing laptops and software subscriptions for remote work, a consultant buying materials for a project, or a candidate traveling to interview for a new position.

Digital payments will transform expense management, allowing finance teams to fully capture and control the $150B travel spend that infrequent travelers and contingent workers currently charge to their personal cards and then submit for reimbursement. Moreover, program managers will be able to access and manage spend from every aspect of their U.S. Bank Corporate Travel Card program—whether physical or virtual—from directly within the TravelBank application, and empower their employees to book their own travel within budget in app as well.

This partnership is uniquely designed to provide a fuller all in-one solution for corporate expense management, while providing a modern and seamless experience for the virtual card end user. It begins with a pre-approved budget assigned to each Instant Card issued, and continues with the real-time reporting, expense capture, policy management and approvals, reimbursements, general ledger sync, and analytics provided by TravelBank’s award-winning design and user experience. On top of that, customers can seamlessly manage their business travel program through TravelBank’s online booking platform, which includes 24/7 traveler support.

Together, TravelBank and U.S. Bank address the increasingly common payment challenges many organizations face, including contactless payments, and help keep business operations running smoothly while reducing the burden of expense management and reconciliation.