If keeping an eye on the bottom line sounds familiar, you’re not alone. Use real numbers on business travel and cost-saving tips in this article to take more control over your travel spending.

Business Trip Costs

Destination and length of the trip can obviously cause business trips to have vastly different total costs. Understanding the kind of travel your business requires is essential to create an accurate budget.

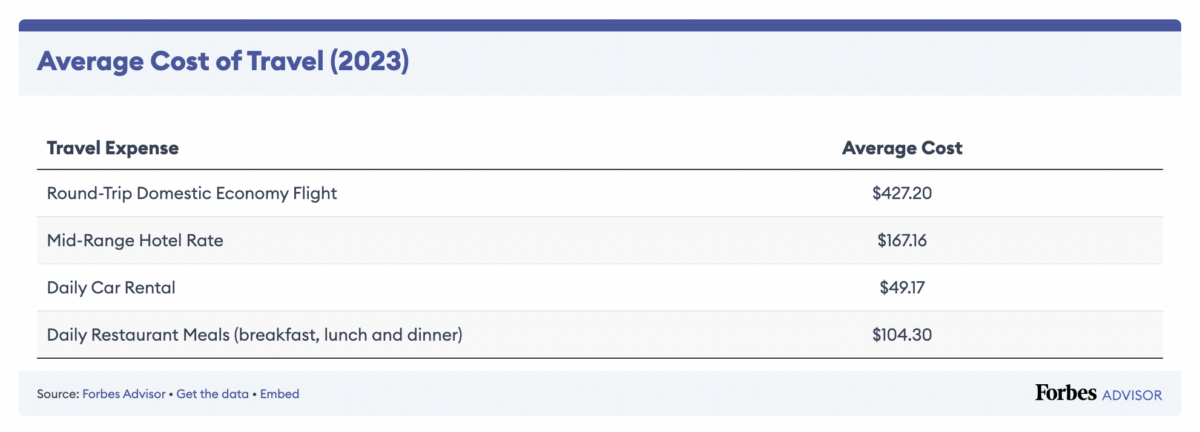

With that said, you can use some figures to guide “average” expectations. For a three-day domestic trip (the average length of a business trip), a realistic target might be $1,389.09 or more, depending on your destination city and whether you need a plane to get there.

How Do You Calculate Travel Costs?

So how do these average costs break down into specific expenses? Planning a business trip usually involves four primary costs:

- Airfare

- Lodging

- Ground transport

- Daily allowance for food and incidental expenses like parking fees

The best way to predict an accurate travel budget is to set clear parameters, and then use an algorithm that can take real-time market rates into consideration along with those parameters. TravelBank starts with default settings like nonstop economy flights, for example, or hotels with 3-star ratings or higher that can easily be customized for each company within the app. A startup with a lean budget and employees willing to weather a little discomfort for the team might opt for a cheaper flight with a layover. A business planning a trip for top executives might prefer business class seats or a top-notch hotel. The U.S. General Services Administration (GSA) per diem standard is a good gauge for daily allowance, or you might reward frequent travelers with a higher allowance as a perk.

In other words, get specific about what plans are right for a typical trip within your business. Companies at different stages of their travel program will have different requirements. When you know what’s right for you, use current market rates to get the most accurate cost estimates.

Business Travel Mistakes to Avoid

If you’re concerned about overspend or want some extra ideas to lower trip spending, watch out for these common issues that can push you over budget.

Put (Less) Money Where Your Mouth Is

Quick, what’s the biggest expense companies pay on business trips? Are you surprised to hear it’s meals? More than 20% of a typical business travel budget goes to food expenses—more than flights, hotels, or car rentals.

Lowering your per diem, or tweaking it for higher-cost vs. lower-cost destinations, might help. So can updating your travel policy to be clear about when it makes sense to entertain clients or business associates, when employees can purchase alcohol, and similar points. You might also want to keep an eye on grocery bills when employees stay at an apartment-style accommodation, and distinguish between per diem meal costs and personal grocery expenses.

Forgetting Airfare Tax

One trap it’s easy for travelers (and business travel managers) to fall into is checking a travel aggregator website for flight deals and forgetting to factor taxes into the cost. Sales tax and various fees can add up to more than 25 percent of the fare! If you’ve already set your budget based on the face value of the ticket, you can quickly end up overspending.

Overlooking Hotel Expense

Airfare can feel like the biggest line item to focus on to reduce trip spending. While the plane ticket often costs more than a single night in a hotel, hotel rates can multiply into an even higher expense. The daily hotel average in the top 100 U.S. cities is $148.83, and hotels make up an average of 13% of travel budgets (compared to 17% for flights).

An easy way to get travelers on board with lowering hotel expenses is to reward them for coming in under budget. A travel rewards program provides great incentive for employees to take extra measures to find cost-effective options.

Also, don’t forget to watch out for daily resort fees and hotel taxes, that like airfare, can accidentally send your traveler over budget—especially if the hotel nightly rate was paid up front and the resort fee is charged upon checkout.

Should You Set a Hard Cap or Dynamic Budget?

There are two basic approaches to setting a business trip budget. Here are the pros and cons of both.

Hard Cap

A hard cap budget model sets one limit across the board for your business travel. You’ve got one number to remember, and a black-and-white approach to monitoring compliance. Did the trip cost less than the hard cap? You’re good to go. Over the limit? Supervisors or accounting might need to take a look at traveler compliance.

The benefit of a hard cap is its simplicity. Companies booking only a few very similar trips per year might be able to run with this system fairly well.

The downside of hard cap budgets is that they don’t offer much nuance or flexibility. You’re going to hit administrative issues if employees travel during the destination’s high season, or over a holiday. Hard cap budgets aren’t a “set it and forget it” method, either. You’ll need to review and revise the budget at least every 12 months to keep up with market fluctuations, and probably more often.

Dynamic Budgeting

Dynamic budgets work with real-time data to adjust price expectations to the market rates, travel dates, and destination city. Managers compare data on the average costs of similar trips to the travel plans the employee requests to book.

Dynamic budgeting is a little more complicated on the surface, but it’s a much more realistic way to budget. With a hard cap, your best bet is usually to set the cap based on your most expensive travel destination so you don’t blow your budget. You sacrifice a lot of insight and accountability when it comes to how much travelers spend on cheaper trips. With dynamic budgeting, you have a realistic profile for expenses on every kind of trip your employees take.

A dynamic model is also easier to develop over time, because you’re used to working with real-time data. You’re shaping travel policies and budget expectations around the real world of travel, instead of squeezing trips into the mold of the spend max you set. The result is often more accountability and more appropriate budget guidelines for a wider range of destinations.

Want to beat your budget this year? Learn more about how to set travel benchmarks that fit your business.

About TravelBank

TravelBank delights the back office by getting the books closed faster and providing peace of mind that their employees are complying with policies and budgets, and the traveler by delivering a simple, modern booking and expense tool that takes the business out of business travel.