TravelBank Innovation in 2024

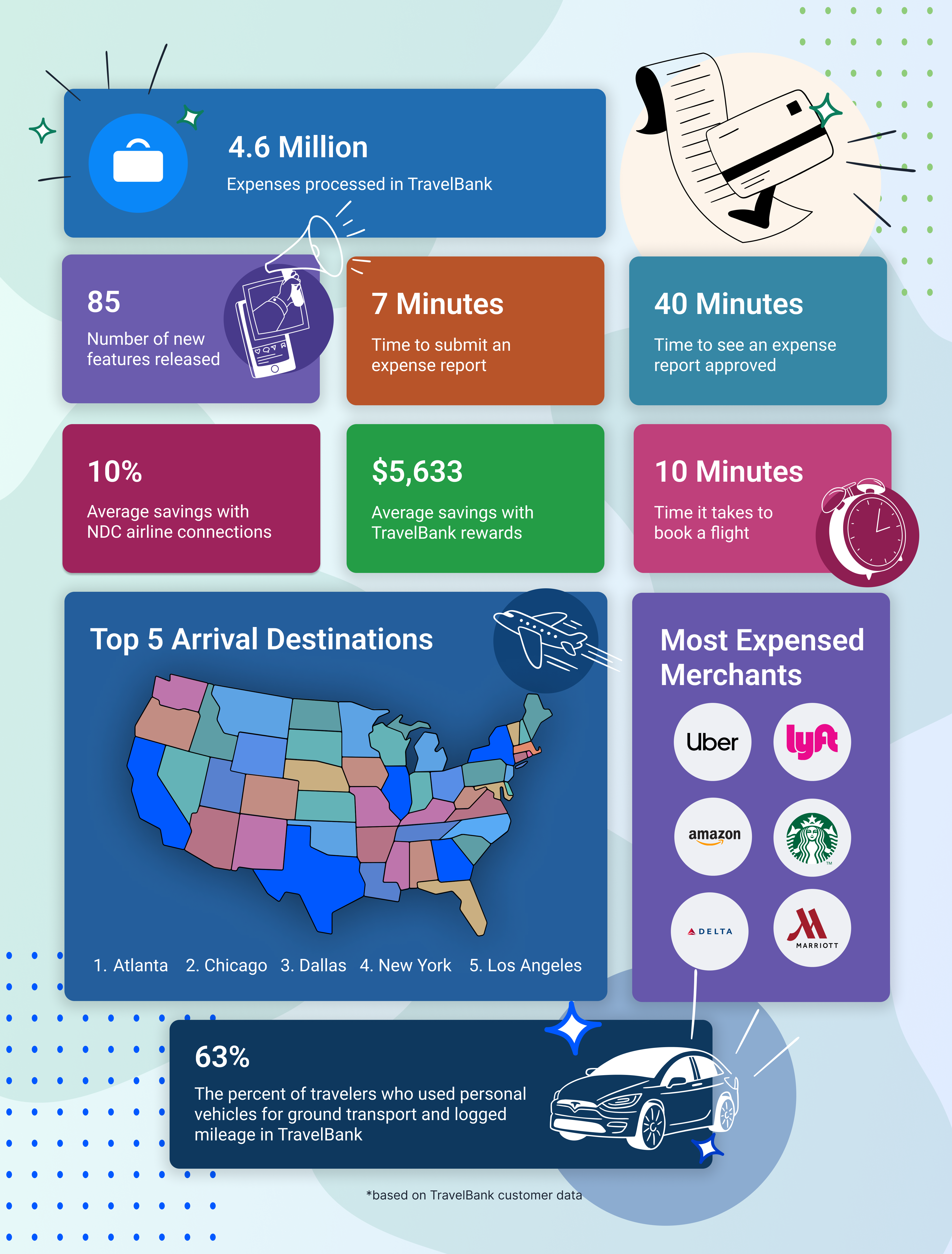

2024 was a big year for TravelBank, packed with exciting updates that made managing business travel and expenses even easier for our customers. We released 85+ features designed to streamline corporate travel bookings, cut down on expense reporting time, effortlessly manage corporate cards, and unlock new insights into company spend.

Our dedication to an all-in-one solution did not go unnoticed with U.S. News & World Report, who named TravelBank the Best Booking, Travel, and Expense Tool.

Here’s a look at how TravelBank helped redefine business travel and expense management in 2024.

Smarter Expense Management with OCR Technology

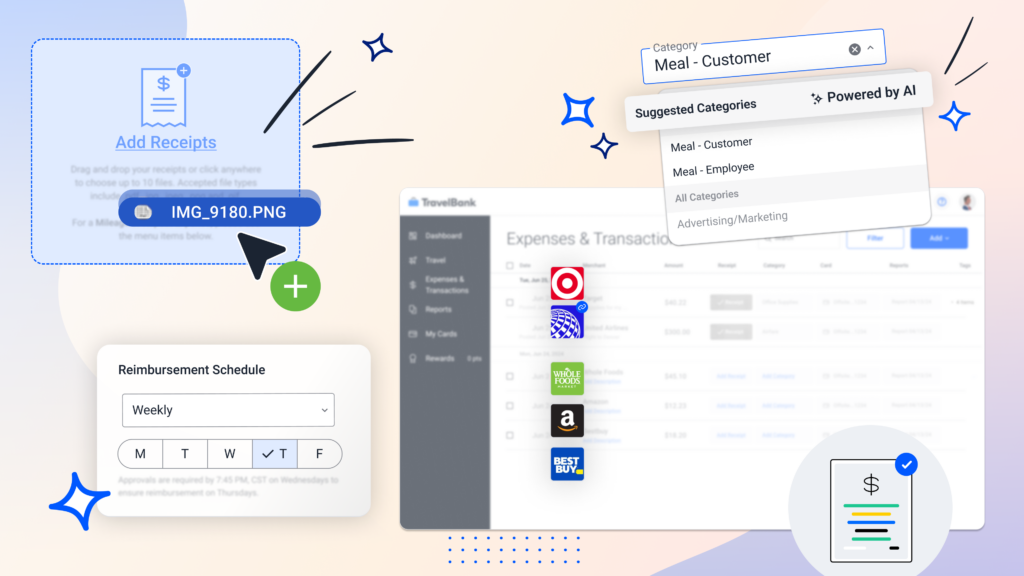

TravelBank has reimagined expense reporting with the release of QuickScan, which uses new Optical Character Recognition (OCR) technology. The process of capturing and organizing expenses is virtually seamless, as QuickScan automatically generates a new expense and populates it with critical data read from the receipt.

Employees can easily upload up to 10 receipts at once using the drag-and-drop functionality on the web app for maximum efficiency. For mobile app users, the process is even simpler—just snap a single photo containing up to three receipts, and the app will instantly generate expenses for you. With our OCR updates, TravelBank now supports multiple languages, currencies, and document types, making it a valuable tool for global teams operating across borders.

These enhancements not only improve usability but also ensure expense reporting is faster, more accurate, and more seamless than ever before.

Expense Reporting Simplified

In addition to the enhancements brought by OCR technology, TravelBank has introduced several features to reduce the effort required for expense reporting and offer more flexibility. Admins can set up weekly reimbursements on their preferred day, improving cash flow management and ensuring employees are reimbursed promptly. The addition of merchant logos alongside receipts makes it easier to identify expenses at a glance, saving time during the review process.

TravelBank is also wrapping up an AI-based Expense Categorization beta with 100+ customers that leverages a company’s historical data to automatically recommend the top five expense categories. This eliminates the need for manual categorization and ensures more accurate spend tracking.

Enhanced Card Management for Admins and Users

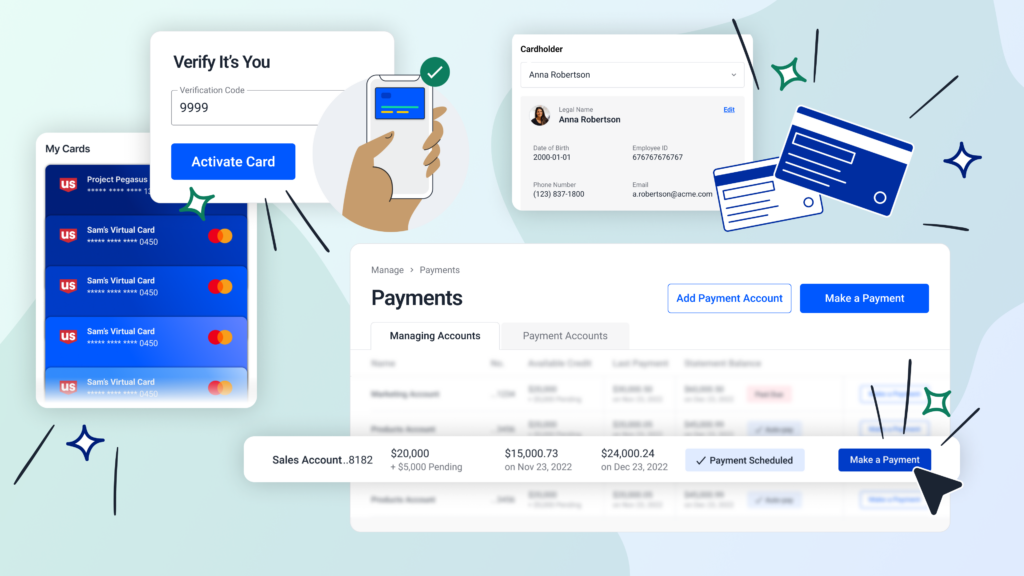

Recognized by CNBC as one of the best corporate card solutions for mid-sized companies, the U.S. Bank Commercial Rewards Card powered by TravelBank continues to deliver both employees and administrators time-saving enhancements.

For admins, the redesigned payment page provides an at-a-glance view of critical details, including credit availability, statement balance, and due date. To streamline card creation workflows further, admins can now add essential cardholder demographic information, such as phone numbers, organization names, and activation codes, directly to cardholder profiles.

Employees also benefit from these updates. Activating new cards is now a fast and straightforward process through online card activation or the My Cards dashboard, which pre-fills fields to save time. Usability enhancements, such as simplified scrolling and improved field entry descriptions, make managing credit cards smoother and more intuitive.

Expanding NDC Airline Partners for Cost Savings

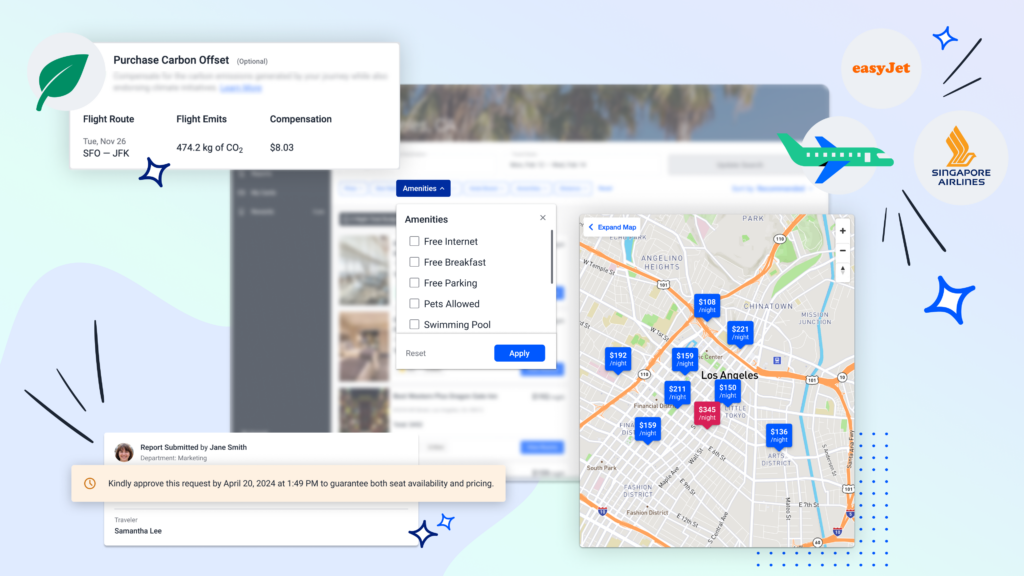

This year, TravelBank expanded its New Distribution Capability (NDC) connections, offering an even wider range of direct connect and cost-effective airline booking options. Singapore Airlines and EasyJet have joined our growing list of NDC-enabled carriers, which already includes American Airlines, United Airlines, and the Lufthansa Group.

Leveraging this technology in TravelBank has delivered significant savings for customers. This year, based on our customer data, NDC flight bookings cost an average of 10% less.

NDC has also allowed TravelBank to introduce Flight Hold Capabilities, enabling users

to secure their bookings temporarily while waiting for manager approval. This feature is available across iOS, Android, and web platforms, ensuring guaranteed seat availability and pricing while helping managers stay on top of expiration deadlines.

Travel Features for Every Step of the Journey

TravelBank introduced a variety of updates this year to make business travel smoother and more intuitive. One of the standout features is the new Hotel Map View, which lets travelers see both hotel lists and map locations simultaneously. Enhanced Hotel Filters also allow travelers to refine their search results at the room level using filters based on loyalty status, rewards program, cancellation policy, and rate types. This makes it easier to find accommodations that fit their needs and preferences.

For those looking to reduce their environmental footprint, TravelBank released Carbon Offset Data, which provides advanced CO2 metrics so travelers can compare the carbon emissions of flights, including connecting flights. This data factors in details such as aircraft type and routing impact, empowering users to make more sustainable booking decisions. Admins also have the option to allow travelers to purchase carbon offsets as they book flights.

Better Insights with Reporting Overhaul

This year, TravelBank made data insights a priority by rolling out a suite of enhanced reporting tools designed to help organizations make smarter financial decisions. Several new Premium Insights reports provide detailed data on areas such as approval times for expense reports, expense accruals, and carbon emission offsets, offering organizations greater transparency and actionable insights.

TravelBank enhanced Core Insights reporting by adding new filters and reports so admins can find data faster. The Flight Credit Report allows admins to easily track employee flight credits and plan future bookings more effectively. A new Negative Reimbursements Report highlights any outstanding balances and provides organizations with greater financial clarity.

To improve navigation and usability, TravelBank reorganized its reporting structure and introduced new filters, ensuring that users can quickly find the information they need. Admins and Finance users also benefit from more robust configurations for the Expense and Transactions Export, including the ability to include Account G/L, Unique Transaction ID, Current Approver Name, and Current Approver Email. These updates make it easier than ever for businesses to monitor spending trends, reconcile faster, and expedite follow-ups for pending approvals.

>> Related: Customer Service Matters More to Us than Ever <<

Security with the Strength of U.S. Bank

This year, we celebrate three years as part of the U.S. Bank family, benefitting from the unparalleled security and support that comes with it. With advanced safeguards such as password complexity requirements, advanced encryption for digital receipts, and enhanced mobile app security, our customers can rest assured that their information is well-protected.

TravelBank also gave Admins the ability to set specific delegate permissions for expense and travel approvals, reducing the audit and compliance challenges previously encountered with unrestricted access.

Looking Ahead to 2025

2024 brought tremendous growth, innovation, and success to TravelBank’s platform—but we’re just another year through this amazing journey.

Stay tuned as we continue to redefine how businesses manage travel and expenses. Whether it’s through innovative AI tools, expanded partnerships, or new sustainability features, TravelBank is committed to making your processes smarter and easier every step of the way.

Discover the TravelBank difference—request a demo today!