Products

All-In-One

Expense, travel, card reconciliation, and insights to control spend and unify reporting.

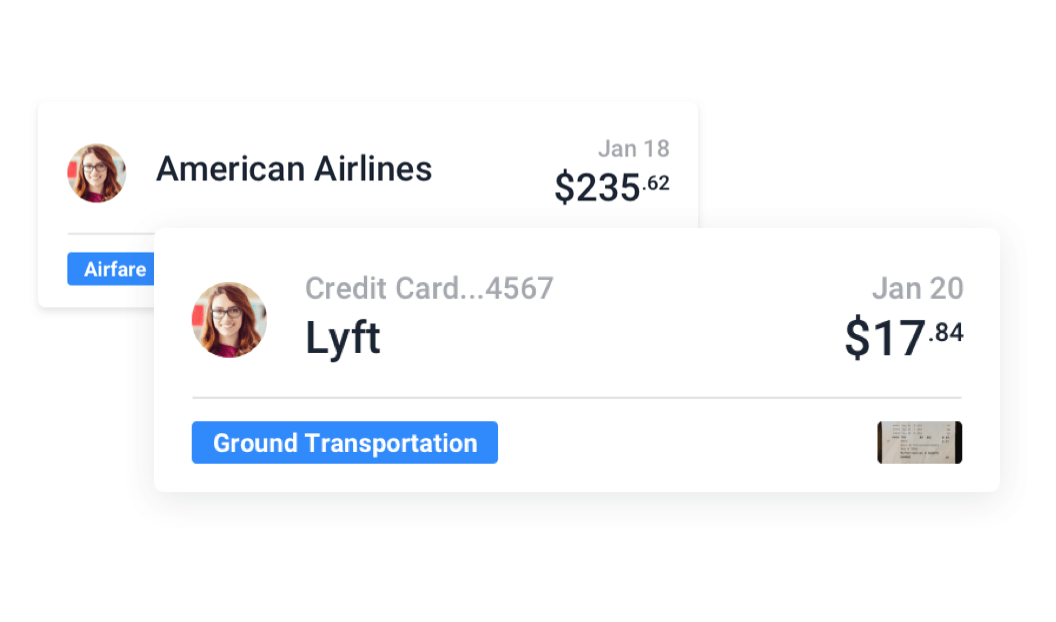

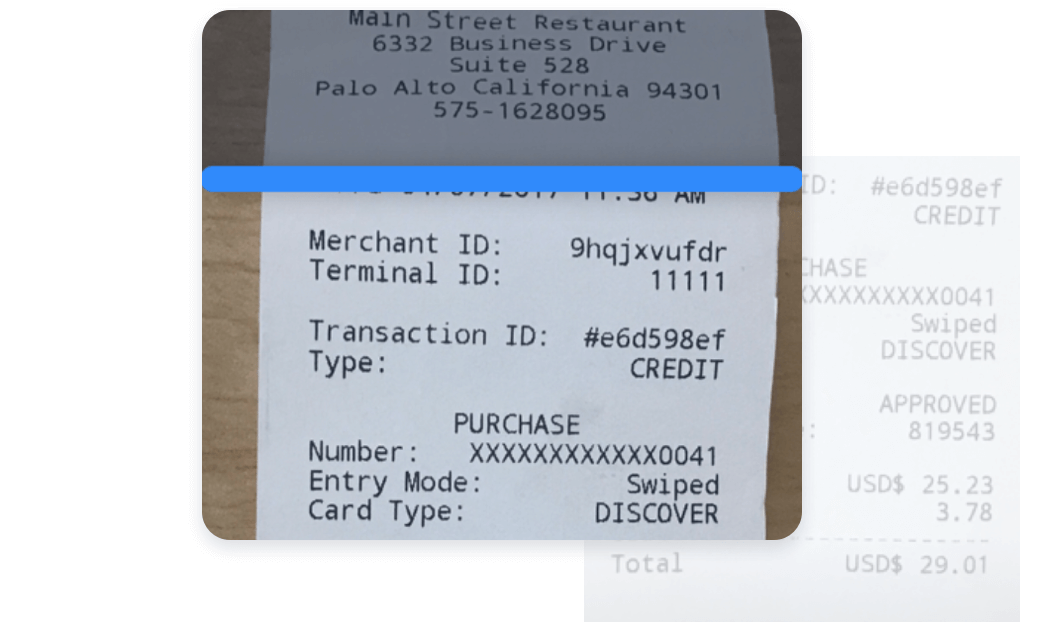

Card Management

We sync with all corporate cards! Reconcile your transactions and create virtual cards instantly.

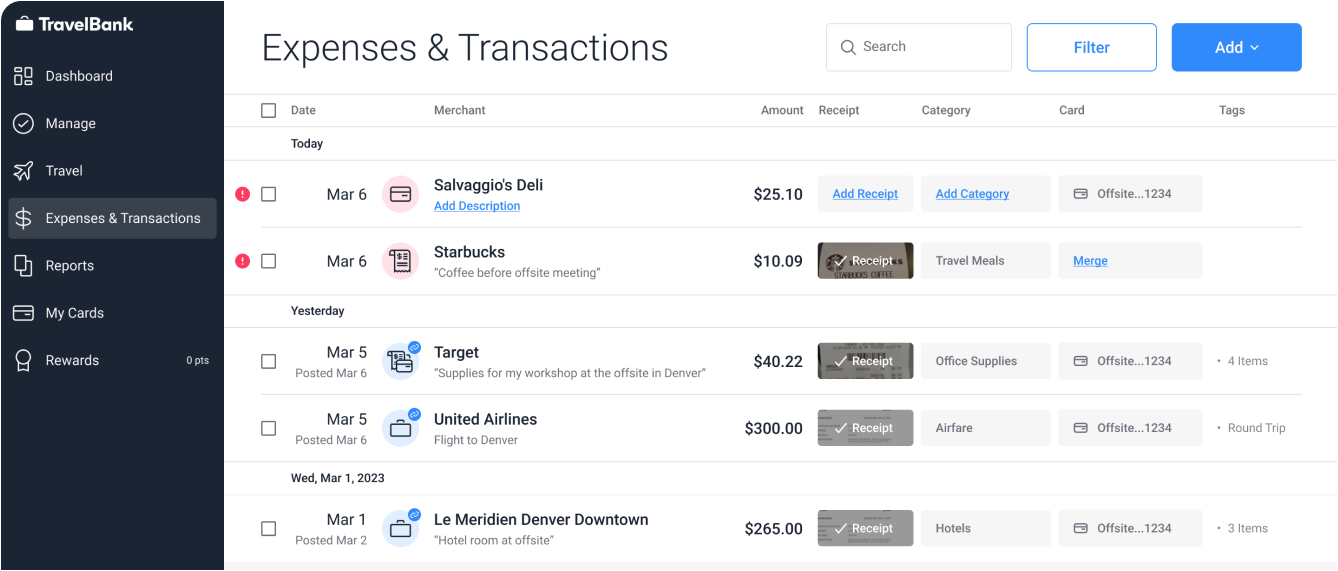

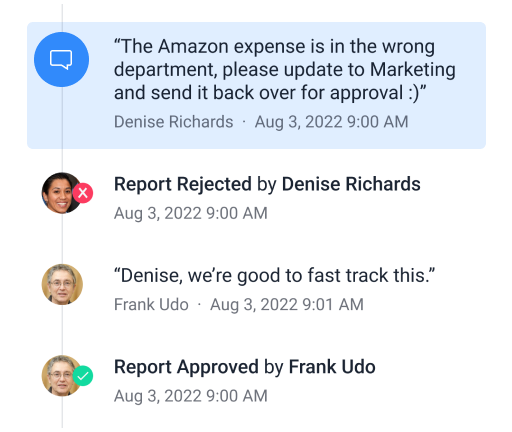

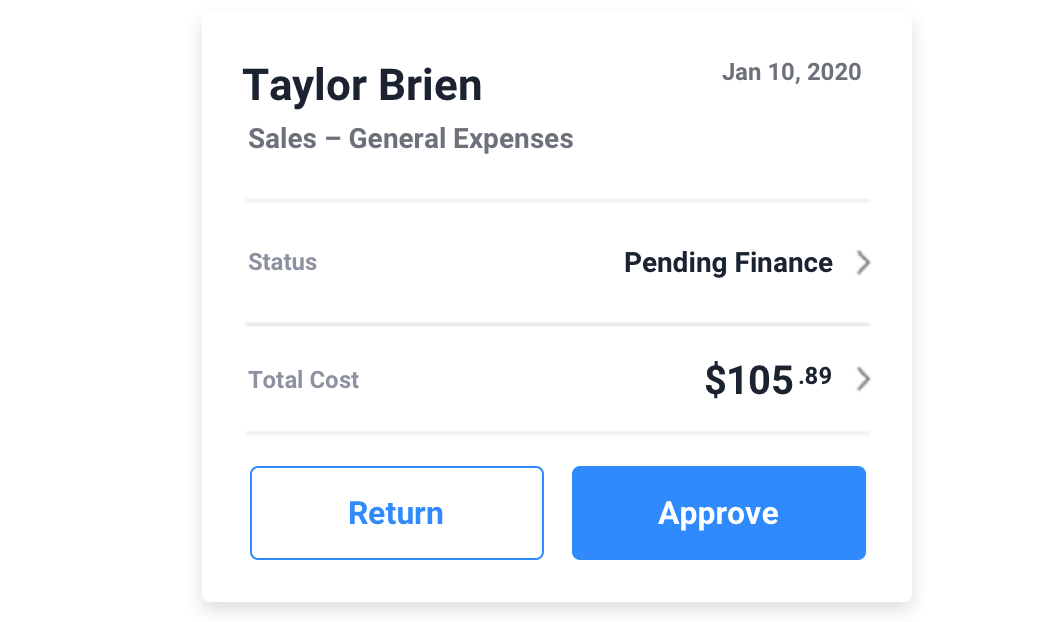

Expense Tracking

Streamline expenses and improve visibility into business spend.

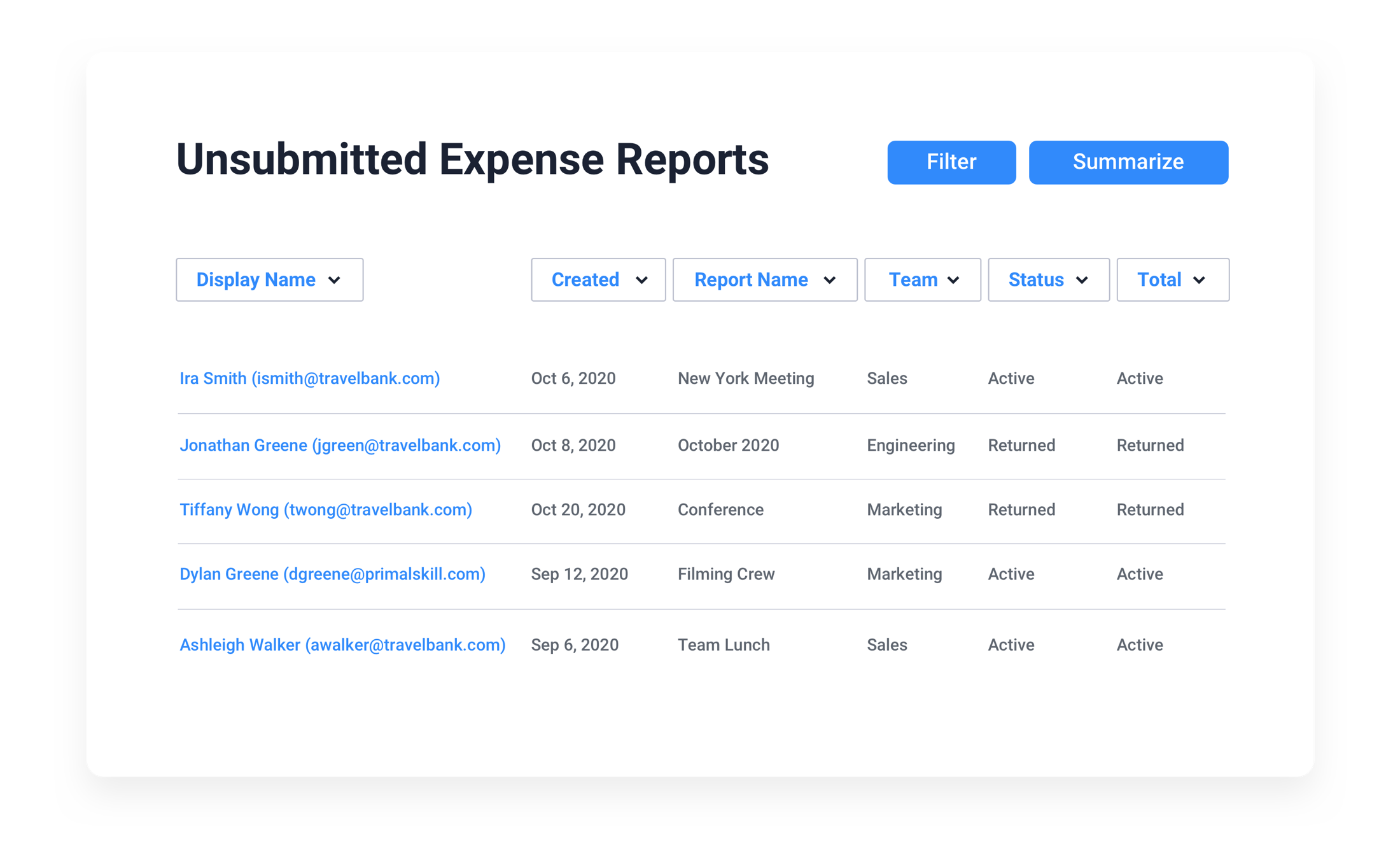

Premium Insights

Report on any metric. Customize and export data to monitor spend and compliance.

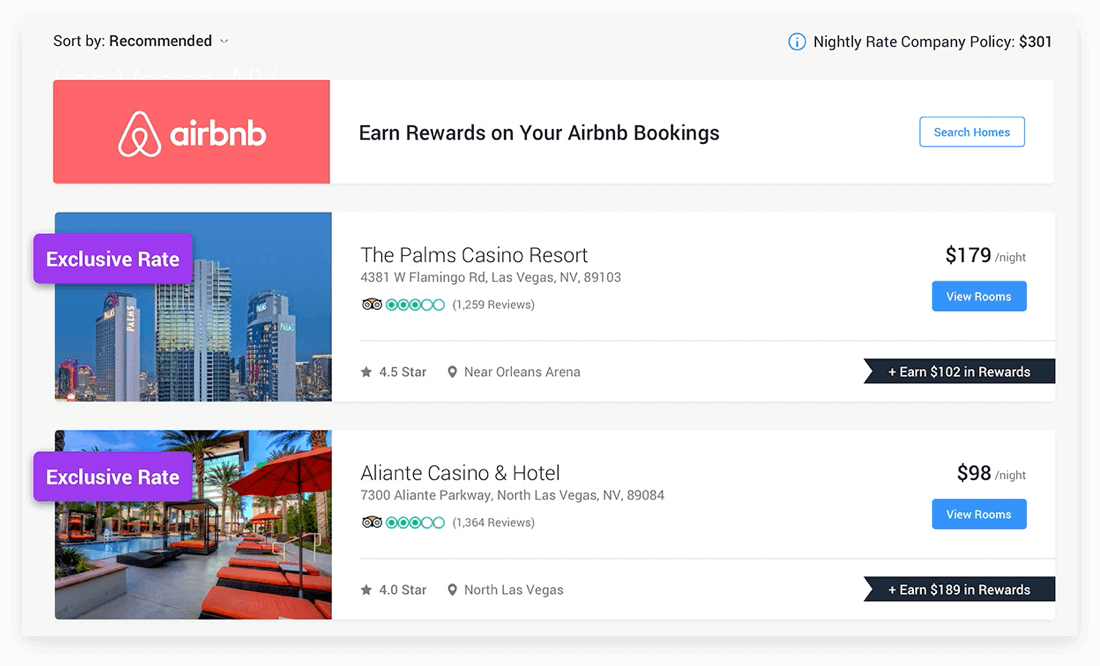

Travel Management

Book flights, hotels, and cars with custom budgets and approvals.

Integrations

Sync your current software with our products for a seamless experience.

Solutions

Solutions for every business user.

By Roles

By Industry

Hear from companies who utilize TravelBank to power their travel and expenses.

CUSTOMER STORIEs

Resources

What’s new in the app

LEARN MORE

Company

Pricing

Unlock your potential with a career at TravelBank.

CHECK OUT CAREERS