Effortless Business Travel Expense Reporting: A Step-by-Step Template

Looking to overhaul your business expense template or standardizing one for the first time? This post explains business and travel expense tracking and provides a starter business travel expense report template.

First, what is a business expense report?

Expense reports record costs incurred by employees. It may sound trivial, but expense data empowers employers to minimize fraud, track spending patterns, identify cost savings, create realistic budgets, comply with regulations, and reconcile payments with vendors or credit card companies. Expense reports are most common for travel, where employees itemize money spent on transportation, lodging, meals, and incidentals. But as more employees work from home, business expense reports also record small, recurring service and supply costs, such as fast WIFI.

Key Elements of a Business Expense Report Template

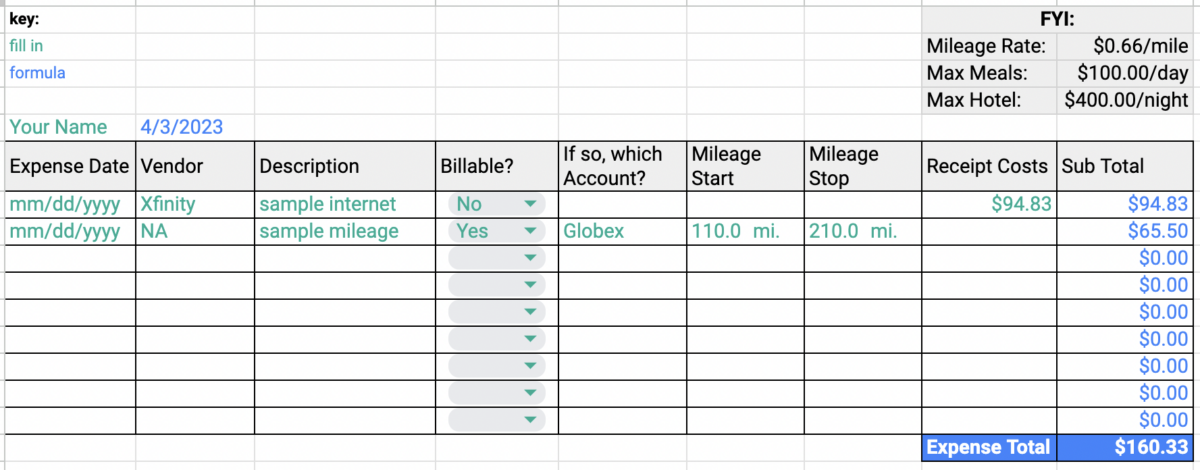

When creating an expense report template, include:

- Dates

- A detailed table of expenses

- Photos of receipts

- Common cost limits, such as per diems, mileage reimbursement, or maximum cost per meal.

- Expense policies, including how soon employees must file reports, and when they can expect reimbursement.

Steps for Creating a Template

If you’re creating a manual template, we recommend creating it on the cloud (i.e. Google Sheets or Microsoft 365) so it can easily be cloned and submitted by employees.

- In the first tab, explain your expense policies, expectations, how to submit the report, and how to escalate questions. You want anyone new to expensing (or the company) to clearly understand what is reimbursable.

- On the second tab, include a detailed table for expense tracking, including dates, itemized costs, and vendor/location details. If employees are incurring expenses on behalf of a customer or client, ensure they can track which costs are billable and to which account.

- On the third tab, create a “whiteboard” for employees to add photos of their itemized receipts.

Here is a sample template via Google Sheets that you can clone >

Common Business and Travel Expenses

Airfare

Airfare is one of the top expenses of a trip and booked far in advance. Define if employees should seek reimbursement after buying the ticket or after taking the flight. If the latter, employees may be financially strained if they use personal cards. Airfare has many incidental costs. Articulate clear policies for:

- TSA PreCheck or Global Entry – while they cost ~$100, they’re far cheaper than rebooking a missed flight

- Checked baggage

- Seat upgrades so that staff can pre-select seats or get a few extra inches of legroom

- Visas and passports for international travel

>> Related: The Most Common Challenges of T&E Management <<

Accommodation

Lodging is another top expense, with nightly rates and lodging fees adding up quickly. Accommodation covers hotel rooms and taxes, or short term rentals (i.e. Airbnb). Depending on the length of stay and your policies, it may also include laundry services or a gym membership.

Transportation and Mileage

Transportation expenses include rental cars, taxis, subway fares, or any other fees associated with getting around during the business trip. It also includes mileage reimbursements. Every year the IRS studies the costs of operating an automobile, including “the cost of gas, oil, tires, maintenance and repairs, as well as the fixed costs of operating the vehicle, such as insurance, registration and depreciation or lease payments.” In 2024, the IRS increased the Standard Mileage Rates to $0.67 per mile for business purposes. An employee who drives 200 miles to a business trip (and back) would be reimbursed $268, plus tolls and parking. Sometimes flights or trains are cheaper, so articulate an exact policy.

Meals

Many companies have a per diem allowance for un-billable meals during business trips. Many also create policies that prohibit expensing un-billable alcohol or entertainment. If employees are lodging at a short-term rental, expect them to expense groceries.

Software, Supplies, and Services

Remote expenses go beyond laptops and can include printers, monitors, basic office supplies, and headsets. Additionally, many organizations also offer a monthly stipend for internet and telecom bills, or the occasional coffee. Remote teams are also more likely to DIY software procurement, especially if the monthly costs are low.

Advantages and Disadvantages of Manual Expense Reporting

Advantages

If manually managing all of this sounds like… a lot, you’re not wrong. But manually creating and processing expense reports is familiar and it won’t be difficult to train employees to fill out a simple spreadsheet. It also bears no software costs – but beware thinking that manual = free. Research consistently shows manual expense reports cost $26 in person-power per report.

>> Related: 7 Tips to Avoid Finance Report Errors <<

Disadvantages

Why are manual expenses so pricey? Because they’re time consuming. Employees manually gather receipts and hand-enter details into spreadsheets. To many employees, it’s a dreadful task that snowballs the more they avoid it. Similarly, manually checking spreadsheets against photos of receipts is error-prone. Small discrepancies in the data have to be hand-researched by accounting. A study from GBTA several years ago found that companies spend more than 3,000 hours correcting expense report errors annually. Manual reports also rely on the honesty of the employee reporting the expenses, plus the attention-to-detail of approvers. They’re simply more susceptible to fraud or negligence.

Advantages and Disadvantages of Digital Travel Expense Reporting

Travel expense software offers numerous advantages over traditional spreadsheet-based methods. For starters, it streamlines workflows and reduces time spent collecting, reviewing and approving reimbursement requests. They’re also far more accurate and can automatically categorize entries or capture values from receipts. And most integrate directly with general ledgers in Quickbooks, Bill.com, Xero, or Netsuite. Accounting can tabulate most expenses automatically, without scrutinizing every receipt or hand entering sub-totals.

Disadvantages

Digital travel expense reporting does have a few drawbacks that should be considered. There are costs associated with purchasing and implementing the software or services necessary for digital reporting, as well as ongoing maintenance and support fees. Minimize costs by opting for software that tackles multiple components of your T&E program, such as digitizing expense reporting, streamlining trip bookings, and automating reimbursements. There is change management and training to consider. It is a new tool for a tool-weary workforce.

>> Related: 21 T&E KPIs We Track for Reporting <<

Tips for Training Employees to Track and Report Expenses

Expense report compliance is an evergreen concern for finance teams. To boost compliance:

- Record a short screen-share tutorial of creating and submitted an expense report. Link this everywhere, including within the template itself.

- Train supervisors first, so they can answer questions fluently.

- Then offer department-wide trainings to review policy changes. Offer context for why policies are so firm. Include tips from your company’s road warriors.

- Communicate an initial grace period as employees adapt to the new process. Be sure to cushion deadlines by a few days, so that stragglers can be chased down before threatening corporate policy.

- Create and communicate “office hours” where accounting is available to answer private questions (either in person, via email, or via chat software).

- Explicitly onboard new employees to the expense policies, timelines, and template.

- If you opted for a software solution, ask how they can help with implementation by providing things like communication templates or training sessions

>> Download TravelBank’s Travel Policy Template <<

FAQs

How do you write a travel expense report?

Writing a travel expense report is relatively straightforward, but it does require some organization and attention to detail. The first step is to compile all your receipts for the trip or month. These should include any transportation costs (including mileage reimbursement), lodging, meals, and other miscellaneous expenses. Once you have your itemized list of expenses compiled, add them in detail to your spreadsheet including date of purchase or service rendered, amount spent and details of what was purchased, or who provided the service. Include all applicable taxes as well as tips when applicable. If submitting electronically, save the document with an appropriate title such as “Travel Expense Report” followed by the date.

What is a sample of business expenses?

Business expenses include costs incurred while traveling for work. Examples of common travel expenses include hotel and lodging costs, laundry services, airfare and its fees, car rentals, taxis, subways, meals, or mileage. As more employees work from home, remote expense policies vary widely but often cover Internet service and AV equipment.

What should be included in an expense report?

An expense report should include all costs incurred during a period of time. This includes receipts and any other proof of purchase, such as credit card statements or invoices. Additionally, the report should include detailed descriptions of each expense item, including date, purpose, vendor or supplier name, and amount spent. Reports must be submitted in a timely manner with accurate data – inaccurate reports can result in issues with reimbursement or even potential legal action.