Itemized Receipts in Corporate Travel Expense Management

Table of Contents

The small, detailed receipts provided by vendors after every purchase, can hold tremendous power when it comes to corporate travel expense management. If you’re keen to detail, such receipts provide a detailed summary of the purchase, including:

- The individual cost of each item

- Applicable taxes

- Mode of payment

- Date and time of purchase

In general, a receipt that provides all this information is called an itemized receipt. The name stems from the fact that they break down every transaction. And this makes them a vital tool for tracking your expenses.

In this article, we will explore what an itemized receipt is and how business travel managers can leverage it to better manage their business travel resources.

What is an Itemized Receipt?

An itemized receipt, unlike a simple receipt, is more than just proof of purchase. On top of listing the total amount billed in the transaction, an itemized receipt further provides more details about every item (product or service) purchased along with the corresponding prices and taxes.

Itemized receipts can be used by accounting and finance departments for:

- Accounting and bookkeeping

- Expense tracking

- Tax purposes

- Employee reimbursement

Itemized receipts can also be used to pinpoint errors in a transaction.

Information that Should Be Included in an Itemized Receipt

There is no one specific way to create an all-inclusive itemized receipt. Merchants in most cases retain the freedom to choose what details they can put in their itemized receipts.

Despite this, certain details must be present to qualify as an itemized receipt:

- The name of the business/merchant and their contact information

- Items or services purchased

- Date and time of the transaction

- Individual prices for each item

- Total billed amount

- Method of payment

Some businesses can add more information depending on their internal policies. Such information may include the transaction number, return policies, business location, and more.

Difference Between a Simple Receipt and an Itemized Receipt

On the surface, a simple receipt resembles an itemized receipt. Key differences between both receipts truly manifest in their contents.

A simple receipt typically serves as proof of payment. In most cases, it shows only the total amount paid to the merchant or business. On the other hand, an itemized receipt provides a more detailed list of the items purchased.

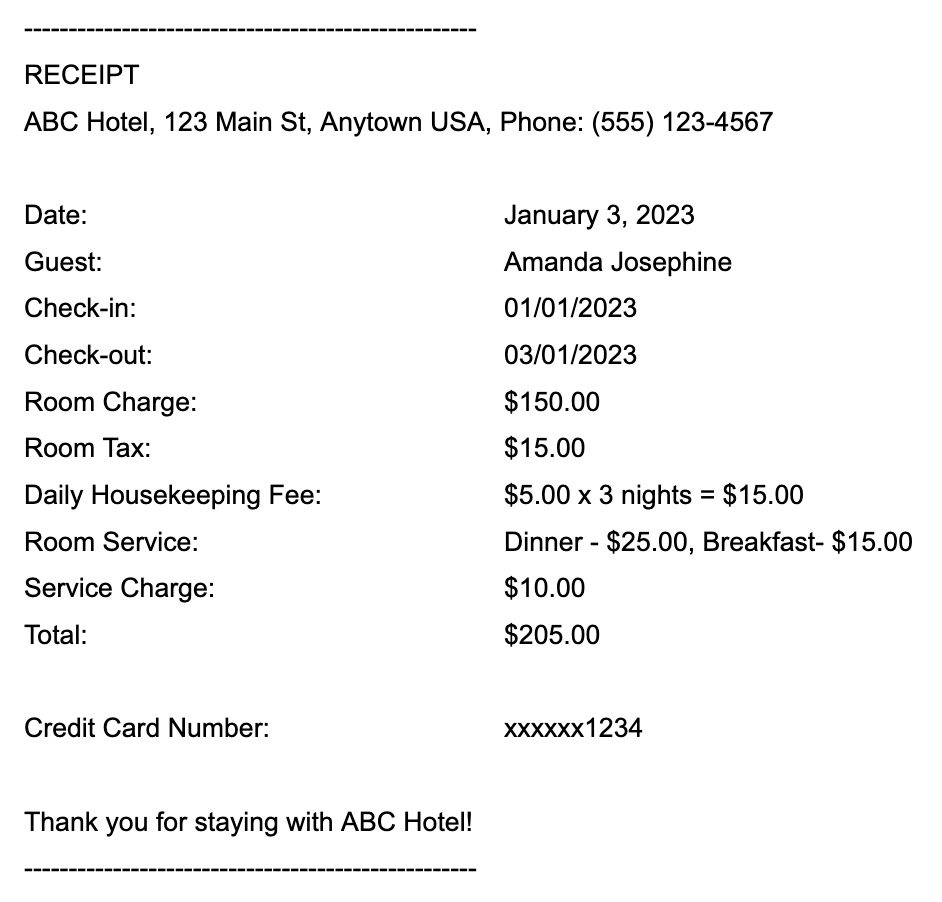

That said, what does an itemized receipt look like?

Itemized Receipt Example

Here’s an example of itemized receipt and its contents:

While a simple receipt may be sufficient for basic one-time transactions, itemized receipts are essential for more complicated businesses that need to track and report expenses accurately.

The Role of Itemized Receipts in Accounting and Expense Reporting

Unfortunately, 61% of businesses around the world struggle with their cash flow. Part of the problem stems from poor oversight over the company’s expenses and revenue.

Like simple receipts, itemized receipts can play a pivotal role in accounting and expense reporting. By clearly detailing every transaction, an itemized receipt helps business expense managers better understand how employees use company financial resources.

Itemized receipts can further aid in:

Fraud Prevention

Inappropriate or suspicious expenses often go unnoticed in corporate travel. It is difficult to accurately verify the legitimacy of the expenses accrued on the company’s credit card without an accurate backlog.

On average, it takes between 18 – 24 months to detect fraud. By that time, the business may have lost about $26,000. From these numbers, it’s easy to see why fraudulent expenses can be detrimental to the company.

Here, itemized receipts can help curb fraud. By requiring employees to obtain and submit original itemized receipts for their travel expenses, companies can deter their employees from making out-of-policy purchases. Doing this can also discourage employees from hiding personal expenses within their receipts.

>> Related: 5 Ways FinTech Reduces Fraud <<

Expense Tracking

As the company’s accountant manager, it is your duty to keep a constant watch on employee travel expenses. However, tracking business expenses can be difficult. Most travel documents provide broad summaries of the employee’s transactions.

Itemized receipts provide a more detailed summary of items, prices, quantities, and any applicable taxes or fees. This helps ensure that all expenses are accounted for and reported accurately. Additionally, expense tracking with itemized receipts helps in more efficient budgeting and waste minimization.

>> Related: Finding the Best Expense Tracking App for Your Business <<

Budget Planning

Itemized receipts are a good place to start for the 54% of businesses that lack a formally documented budget. With itemized receipts, businesses can better plan their budgets. This is achieved by periodically reviewing employee expenses for business-related purposes.

With itemized receipts, businesses can track expenses over time. They can identify common spending areas, price fluctuations for certain items, and more. This information helps the business manager adjust their budget accordingly and make more informed decisions about future spending.

Settling Employees Reimbursements

If an employee has incurred personal expenses while on business travel, they should be reimbursed. To do this, they can submit an itemized receipt to the accounting department for review. An itemized receipt justifies the employee’s claim for reimbursement.

The detailed information contained on the receipt clears any ambiguity around what was purchased or the amount that should be reimbursed, leading to quicker processing times and fewer disputes.

Tax Deductions

Businesses can leverage itemized receipts to lower their taxable income. By capturing detailed information about every transaction, you can clearly categorize employee travel expenses and claim tax deductions on these expenses.

Lastly, itemized receipts serve as an audit trail for businesses. In the event of an audit, itemized receipts help support the legitimacy of expenses and provide evidence of financial transactions. They demonstrate that expenses are valid and were incurred during the normal course of business.

>> Related: How to Manage Expense Reports More Effectively <<

How to Make an Itemized Receipt for Your Business

Corporate customers may at times request a detailed summary of the transactions conducted with your business. As such, it helps to understand the basic steps on how to create one for your business.

Here is a brief step-by-step process for creating an itemized receipt for your business:

Step 1: Choose a Template

You can find many pre-built itemized receipt templates that suit your business. If custom templates don’t cut it, you may opt to have a professionally designed template that captures all the fundamental details.

Step 2: Include Your Business Information

Summarize the most vital data fields, including your business name, address, and phone number on the receipt template. Should your customers face challenges e.g. disputes with the charges, they can easily reach out to you.

Step 3: Add a Transaction Number or ID

Every receipt generated by your accounting system should have a unique ID. A unique ID distinguishes each sale from the other. Essentially, this separates every transaction so accountants and auditors can easily distinguish between them.

Additionally, unique transaction IDs can help customer service teams in responding to customer complaints by providing relevant details about the transaction.

Step 4: List the Items or Services Purchased

While creating your itemized receipt, list down each item and provide a clear and concise description. Each item should be accompanied by other relevant details such as individual costs or prices.

Step 5: Calculate the Subtotal, and Totals After Adding Taxes and Fees

It’s also important to include any applicable taxes or fees or any discounts applied. Calculate the subtotal of the items or services purchased before adding in any taxes or other fees.

If there are any taxes or additional fees that need to be added, include these amounts in the appropriate section. Lastly, add up all the costs to calculate the total transaction amount, including any taxes and fees.

Step 6: Provide Payment Information

Lastly, don’t forget to include the customer’s chosen method of payment. This may include cash, credit card, or check. Transactions conducted through credit cards can be itemized by providing the last four digits of the card used.

By following these steps, you can ensure that you provide your customers with an accurate and complete itemized receipt that can serve as a record of the transaction as well as proof of payment.

>> Related: A Step-by-Step Business Expense Template <<

When is an Itemized Receipt Important?

Normally, a simple receipt will suffice as proof of payment. In a corporate setting, itemized receipts will provide a more accurate picture of what company money is spent on.

Here are the most common situations when itemized receipts are required:

- When settling reimbursement – Providing an itemized receipt helps simplify the reimbursement process, as employees can provide the finance and accounting department with proof of purchase for each expense incurred during their trip.

- When complying with tax laws – Tax deductions can be calculated more accurately with an itemized receipt. As such, this protects the business from issues related to tax fraud, tax evasion, and other related issues.

- When identifying instances of fraudulent transactions – Using company money for alcohol, leisure, personal travel, and other unauthorized expenses stated in the company travel policy can be considered fraudulent. Itemized receipts help business managers identify misuse of company resources by providing a detailed list of every transaction.

Overall, itemized receipts provide businesses with greater control over their spending, help reduce expenses, and facilitate compliance with tax law. As a result, businesses can save money on unnecessary expenses while improving their bottom line.

>> Record-Keeping Requirements for Expense Report Receipts <<

Conclusion

In summary, itemized receipts are essential tools to enable businesses to better track and manage their shopping expenses. In turn, this enables them to better track their spending trends, implement cost-saving measures, and effectively manage their budget for financial stability.

FAQs

Here are some common questions people have about itemized receipts:

What is an itemized receipt?

An itemized receipt is a document listing all the details of a transaction. It breaks down individual items and their prices, taxes, discounts, payment method, and total amount paid, among other details.

Why do I need an itemized receipt?

Itemized receipts can help you track expenses, manage your budget, prevent fraud, reimburse employees, etc.

Can I get an itemized receipt after the transaction is complete?

You can request an itemized receipt at the time of purchase, or contact the merchant later to ask for one. However, keep in mind that some merchants do not automatically issue itemized receipts unless you ask for one.

What information should be included in an itemized receipt

An itemized receipt should include the date and time of the transaction, the name and address of the merchant, particular items purchased and their associated prices, etc.