5 Ways FinTech Reduces Fraud

For many companies, travel and expense management is a ripe area for fraud. Sixty-one percent of finance executives report that their travel and expense policies are frequently or sometimes violated — and 73% agree that employee violations will grow over the next 5 years. Deliberate and unintentional fraudulent activity costs companies $125,000 on average. Interested in protecting your business from fraud? Here are 5 ways FinTech reduces fraud.

>> Related: 2023 Is the Year of Replacing Legacy FinTech <<

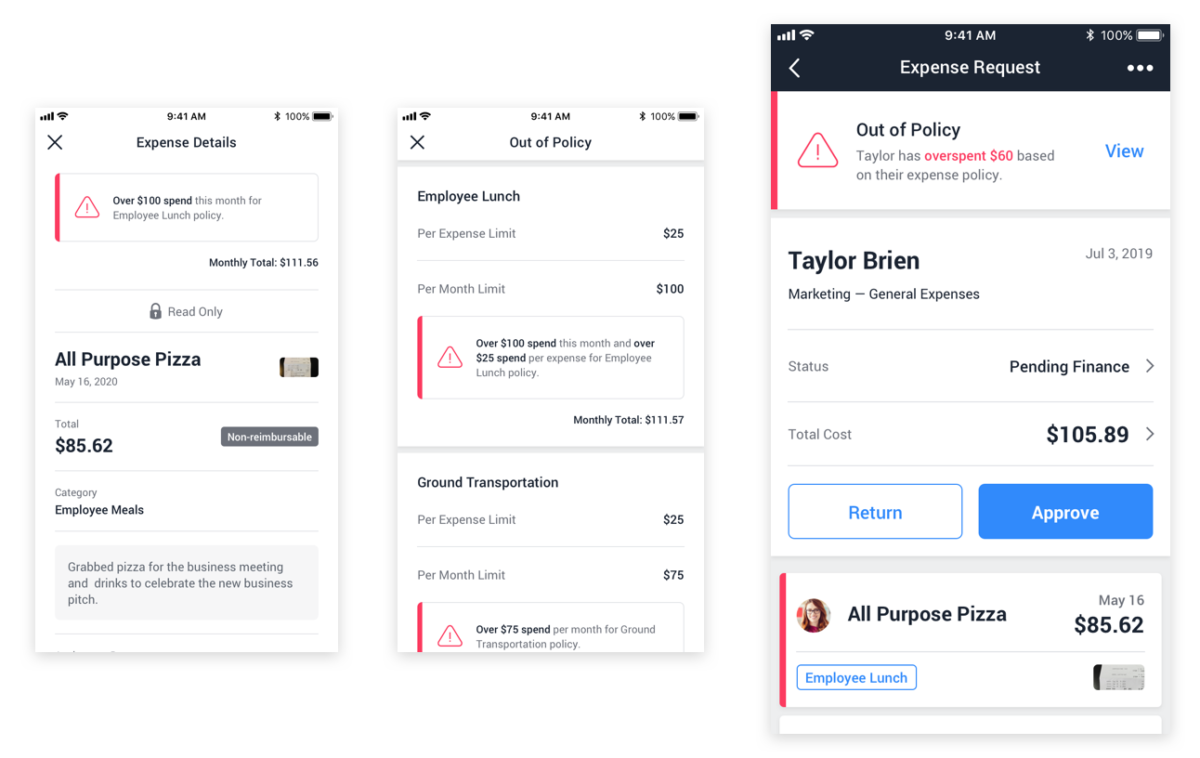

Prevent unintentional fraud

Violations aren’t always fraudulent. Outdated policy documentation, such as PDFs that employees must track down and read on company intranets, inadvertently increases the likelihood of violations. Static policies and manual checkpoints open up a lot of slack between the employer, manager, and employee.

When companies apply controls directly in their travel booking platform or expense management platform, violations can be prevented. And users immediately see what is out of policy, and why their flights or expense reports can’t be submitted.

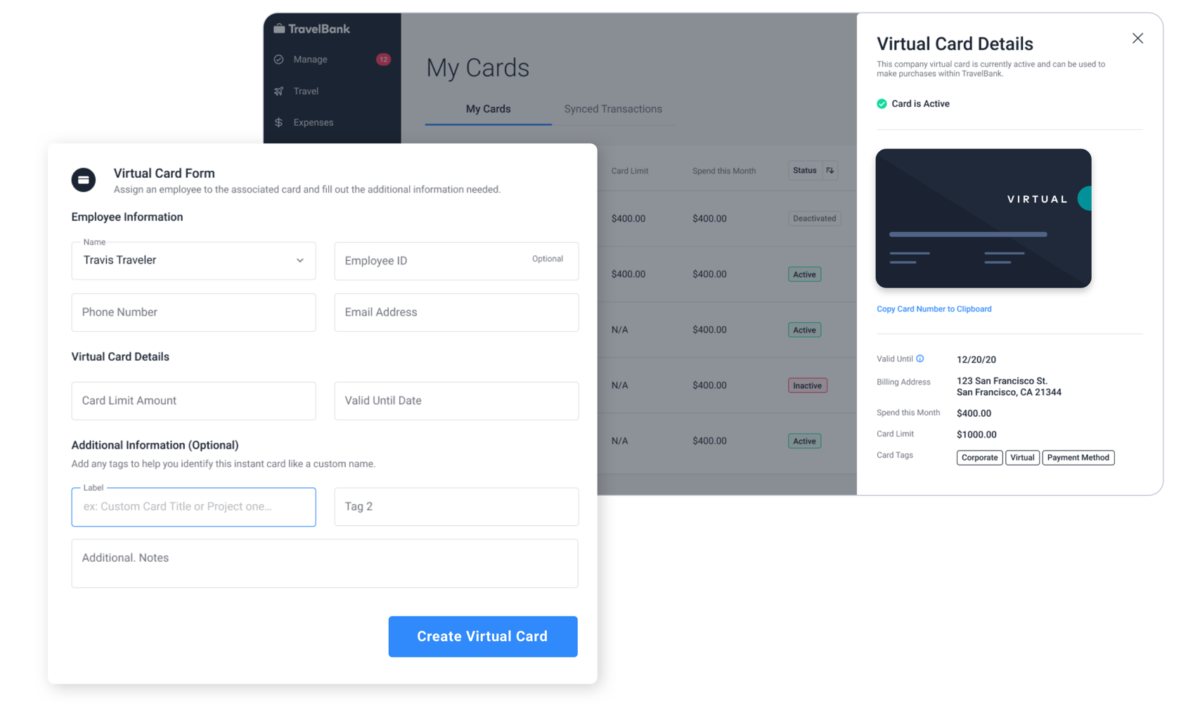

Replace corporate cards with virtual cards

Another way FinTech reduces fraud is by increasing the finance team’s control of budgets. When you give someone a traditional corporate card, you’re just giving them an allowance and trusting them to spend within policy. Instead, with virtual cards, the policies are written into the software. For example:

- You can limit the merchant category codes allowed to be charged to the card.

- You can let someone spend up to $1,000 on restaurants, but each dinner can only be up to $50.

- Transactions can only happen in Atlanta.

- When the trip is over, you can pull back what they don’t use and close the virtual card.

Automatically enter receipts

When companies rely on busy humans to manually check if (submitted and itemized!) receipts match itineraries, inappropriate or suspicious expenses often go unnoticed.

Manual receipt entry yields a lot of accidental mistakes. According to the Global Business Travel Association, fixing incorrect expense reports eats up 3,000 hours per year on average. That’s more than a full time job! And these false positives drown out true fraud. On average, it takes between 18 – 24 months to detect fraud.

>> Related: How to Adapt to the Surge of Expenses from Amazon, Walmart & Target <<

Instead, with an integrated mobile expense app, employees can snap a photo of their receipt and send details digitally. OCR (Optical Character Recognition) pre-scans receipts and categorizes expenses appropriately.

- This helps reduce the potential for lost receipts that hold up reimbursements.

- It also reduces the risk of fraud and abuse in the travel and expense process.

- And it significantly reduces the risk of human errors and omissions during expense reporting.

FinTech reduces fraud by reducing errors, and with fewer innocuous mistakes, the Finance team can focus on spot checking and deeply investigating suspicious data.

>> Related: What Is Impeding FinTech Transformation? <<

Directly integrate expense data in the ERP

Similarly, the Finance team keying data into the ERP creates a very large margin for error. By automatically integrating approved reports, Finance saves time and prevents time-consuming errors.

Visualize outliers or patterns of behavior

With consolidated and reliable data, you can identify:

- top spenders (by individual and department)

- high spend items, merchants, or categories

- airfare and hotel booking leakage

- how often employees are booking over budget

- if employee compliance is changing over time