How to Adapt to the Surge of Business Expenses from Amazon, Walmart, and Target

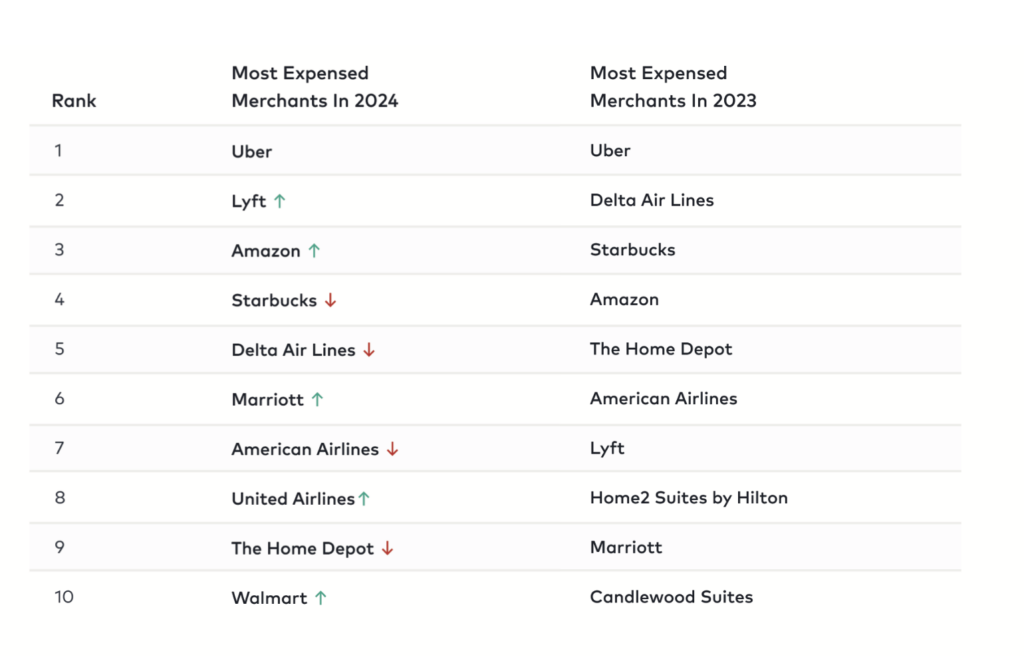

Every year TravelBank selects and analyzes travel bookings and over 300,000 random expense reports submitted on our platform. And by far, the biggest spending trend last year was the rise of business expenses from Amazon, Walmart, and Target. Despite corporate fixation on negotiated hotel rates and in-compliance meals, these general merchandise retailers are now the most commonly expensed merchants.

Table of Contents

The Rise of Burdensome Autonomy

Across all the spending data in 2024, we consistently saw a shift towards autonomy. Business travelers and employees are supplying their own needs without the hassles or delays (or bulk discounts) of official procurement.

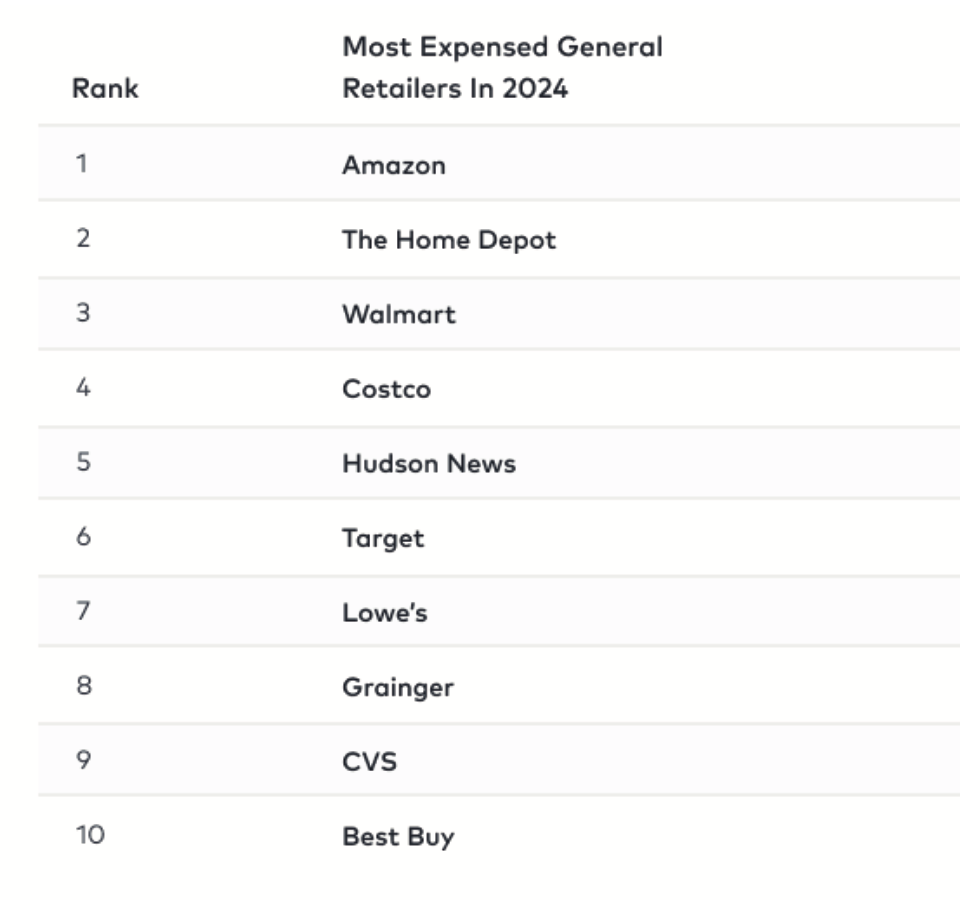

General merchandise retailers like Amazon are now expensed far more than meals, hotel stays and flights. And among general merchants, Amazon was expensed more than 2x any other retailer. We were interested to also see CVS (#9) and Walgreens (#11) so high on the list.

As employees self-supply from consumer sites and stores, it begs the question: is your organization wasting money by having employees source piecemeal supplies without oversight?

A Policy Gap

Companies need to urgently review general merchandise costs and spending patterns, and ask if “autonomy” has gone too far. Especially because your travel and/or HR team aren’t as focused on these vendors compared to meal policies, hotel stays, airfare policies, and ground transportation policies.

One self-sabotaging policy from our customer base? Giving all remote or hybrid employees a $150/month stipend for supplies. In this case study, employees couldn’t buy higher quality WFH supplies (or didn’t bother to check reviews), and had to replace broken equipment throughout the year. The annoyance and waste was constant, and the customer quickly shifted their policy to a large January stipend, and limited purchases to select brands.

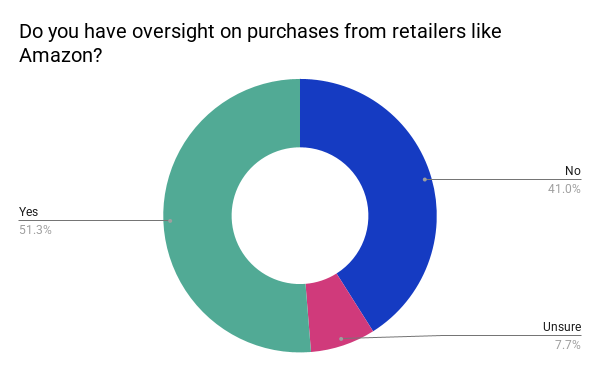

When we polled the CFO Leadership Council, most attendees did not have a clear policy for general retailers like Amazon.

And unless companies used expense report automation software, they had to manually review receipts to see what was actually purchased.

If that sounds wasteful and burdensome, you’re not wrong. All of the administrative time “saved” by not sourcing and managing official procurement vendors was then squandered on AP audits (and, of course, this doesn’t account for dollars lost to actual fraud).

>> Related: Automation Is Taking Over the Expense Report and That’s Okay <<

How to Improve Oversight for Amazon Business Expenses

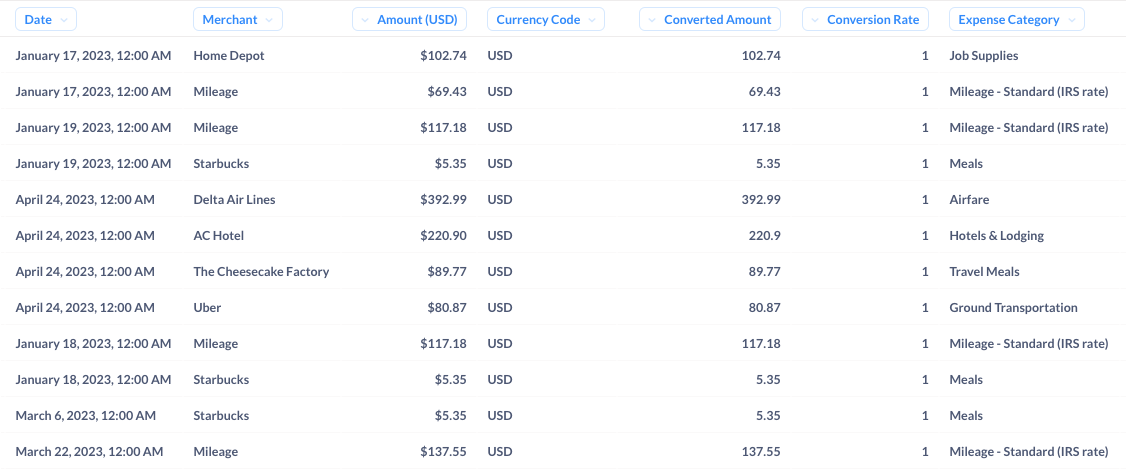

Without a doubt, the most efficient oversight is to use an expense management platform that mandates categories, automatically captures merchants, and requires accompanying receipts before submission. With that data, it’s far easier and faster to pull reports and dig into this risky spend category.

If you’re not ready, and still want employees to self-supply from Amazon, consider having one central person collect requests and order through Amazon. And be sure to create a new expense category – such as “work from home expenses” – to begin tracking exactly what people are spending. Visibility is the first step to oversight.