2023 Is the Year of Replacing Legacy FinTech

In a recent CFO Dive survey, 42% of finance executives reported their highest priorities for 2023 are adopting new technologies or replacing legacy fintech systems.

>> Related: 71% of CFOs Say T&E Management Absorbs Too Much Time <<

Across industries, CFOs and finance leaders are deploying financial software to bolster their organization’s growth. For the first time, there are new bespoke technologies for the finance function. Particularly organizations in the mid-market and small business segments are no longer forced to use big, incumbent solutions.

Here’s what we learned from the report:

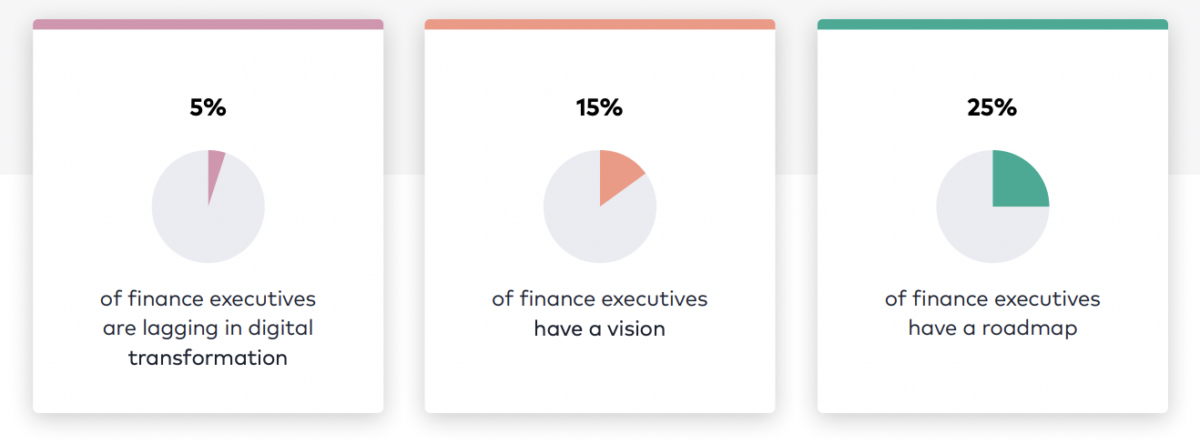

Big aspirations but limited roadmaps

While 88% of finance executives agree that fintech will be an important growth driver for companies over the next five years, 45% report their organizations remain in the early stages of digital transformation or deployment. Only 25% of finance executives have a roadmap.

>> Related: Why 70% of U.S. Companies Haven’t Automated Their Finance Processes <<

Tunnel vision on AP, AR, and reporting

When asked which finance tasks are currently benefitting from automation, more than half of the finance executives reported that their departments have adopted automation technologies to support Accounts Payable and Receivable (56%) and reporting and analytics (53%).

But with CFOs so focused on these core areas, they may overlook ways to modernize other finance-adjacent processes that weigh down their teams with manual work.

For example, only 21% of finance executives identified travel and expenses when asked to rank which finance tasks would benefit most from enhanced automation — even though it’s a huge time suck that could be cutting into time spent on more strategic initiatives. Companies process around 51,000 expense reports and spend on average 3,000 hours correcting errors each year, according to the Global Business Travel Association. That’s 3,000 hours of squandered overhead just within the finance and admin teams.

Embracing automation can help eliminate that overhead and make expense management easier, while at the same time providing more accuracy and real-time visibility into expenses and reimbursements.