70% of U.S. Companies Haven’t Automated Their Finance Processes

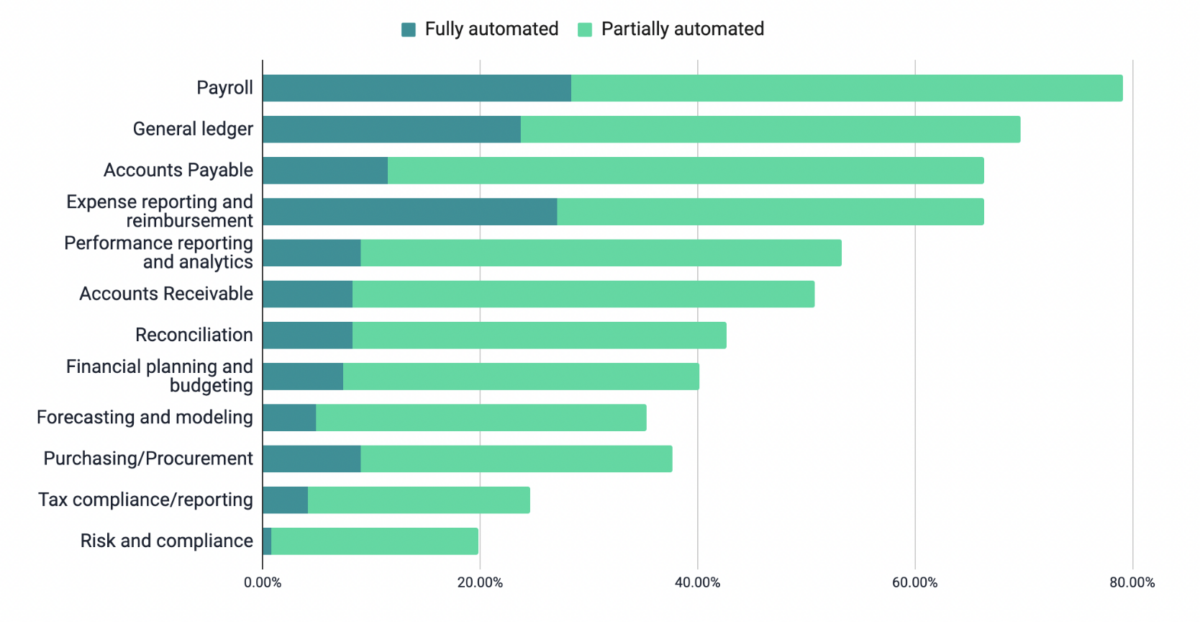

Whether it’s used for reducing human error, boosting productivity or driving down costs, automation is redefining how finance teams perform. Yet, according to a recent survey with Chief Executive Group, fewer than 30% of U.S. companies have fully automated their finance processes.

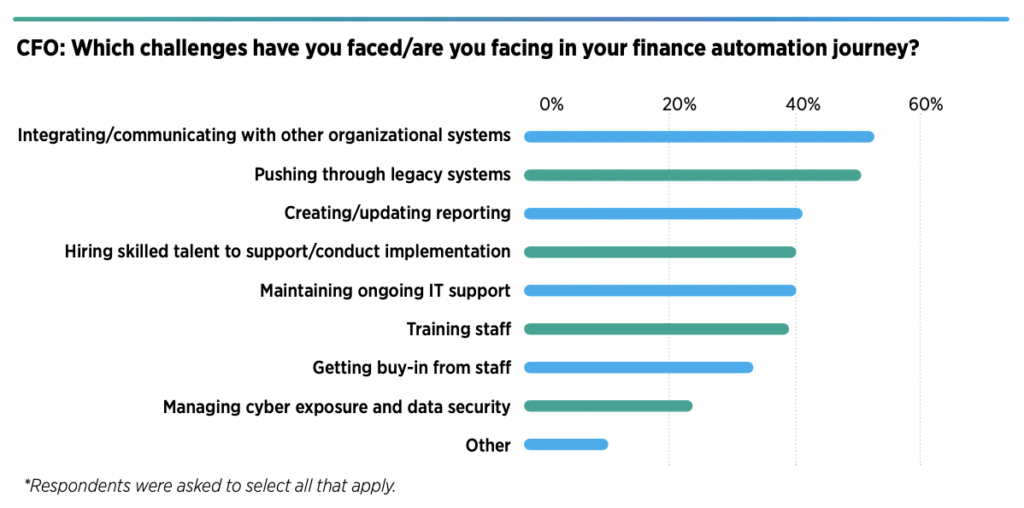

The same CFOs said their biggest challenges with automating finance has been integrating/communicating with other organizational systems and pushing through legacy systems.

The burden of legacy systems on finance automation

Interestingly, when Chief Executive Group asked CIOs the same question, as part of StrategicCIO360’s quarterly CIO Confidence Index, less than a third listed cybersecurity as a challenge to automation, despite their focus and the sensitivity of finance data, cloud hosting and system integrations. Instead, CIOs listed the same top concerns as CFOs: integration (51%) and pushing through legacy systems (49%).

>> Related: Automation Is Now the Foundation of Corporate Travel, Payment, and Expense Software <<

It’s no surprise since legacy systems didn’t have much competition before, and didn’t have to be efficient, automated or easy to use. Most were built for compliance or heavily nuanced programs. And while that makes for very robust technology, it’s also clunky and inefficient.

Delayed adoption of automation is also due to a lack of an enterprise-wide digital transformation strategy and reluctance and resistance to change, as found in U.S. Bank’s 2022 CFO Insights Report. Getting over these hurdles is most feasible when improvements can be quantified to help justify the time and monetary investments. But currently CFOs seem to lack the benchmarks needed to measure success.

Forecast ROI to accelerate finance automation projects

Being able to demonstrate not just the effect of an automated process but also its ROI can be a game-changer for companies looking to automate. According to the StrategicCFO360 / TravelBank April 2023 survey, 30% of CFOs believe they have achieved positive ROI on their finance automation projects but don’t have an estimate of what that really is.

Starting small with a pilot is often better, so you can build a case for dramatic changes. Creating and updating reporting may feel like a heavy lift, but the benefits are readily quatifiable. Consider weighing the time spent on conducting reporting now, versus the time and money saved by automated reporting and increased visibility.

The road ahead

The road to automation is certainly fraught with risks for companies that approach such projects without a thought-out plan. Here are some tips to help you along the way:

- When selecting an automation project, start with small but meaningful wins. What tedious process is absorbing too much of your team’s time?

- Strategically involve cross-functional stakeholders. What issues are we forgetting that may later detract our progress?

- Roll out a basic implementation first, then make improvements in future iterations so you don’t make inaccurate and costly assumptions.

- Look to your vendors to help you measure improvements and key results. Measuring ROI on initial automation projects will guide your decision to invest in further automation.