7 Tips to Avoid Finance Report Errors

The Global Business Travel Association (GBTA) reported that 19% of expense reports contain errors or missing information. And that companies “spend, on average… nearly 3,000 hours correcting errors in expense reports annually.” Tired of finance report errors that eat up time and jeopardize reconciliation? Here are 7 ways TravelBank customers reduce the cost of processing expenses from $26/report to less than $7, and save 5-10 hours per month on accounting and reconciliation.

1. Don’t rely on paper receipts

Manual receipt entry yields a lot of accidental mistakes (if the employee doesn’t lose their receipt in the first place!)

Instead, use a mobile app so employees can capture IRS-compliant digital copies of their receipts in real-time. Employees just snap a photo and OCR (Optical Character Recognition) scans the receipt and categorizes expenses appropriately.

2. Don’t ask employees to hand create expense reports

If you’re waiting for a tidy expense spreadsheet, you’re going to be waiting forever!

Instead, allow employees to capture and submit receipts as they happen:

- Sync credit card transactions

- Accept forwarded email receipts

- Upload photos of receipts

- Automatically submit receipts when employees book flights, hotels, and rental cars via your company’s travel software

Good business expense tracking software can compile these receipts into a detailed expense report so submission is only one tap away.

3. Sync transactions to the ERP

If you still require the accounting/finance team to transfer documents manually, you’re more vulnerable to bottlenecks, delays, and errors.

Instead of keying data into the ERP, sync your expensing software and/or corporate cards with your general ledger (like Quickbooks, Bill.com, Xero, or Netsuite). You’ll:

- see all your spend, merchants, and transaction statuses in one place

- minimize data entry mistakes

- see real-time costs as money is spent

4. Create guardrails when employees book travel

Most expense and travel policies languish deep on the shared drive. Companies can’t proactively enforce policies. And employees ask for forgiveness after they’ve mis-spent funds.

Instead, use travel booking software with customized parameters and budgets, so employees can only book travel within policy.

5. Automatically route expense and travel approvals

Booking a trip or processing an expense report involves a lot of unnecessary back-and-forth between employees and supervisors. And approvals can fall through the cracks with busy approvers.

Instead of clogging inboxes, use software to route approvals, notify whomever needs to review and approve, and has fallbacks for forgotten requests.

>> Related: 71% of CFOs Say T&E Management Absorbs Too Much Time <<

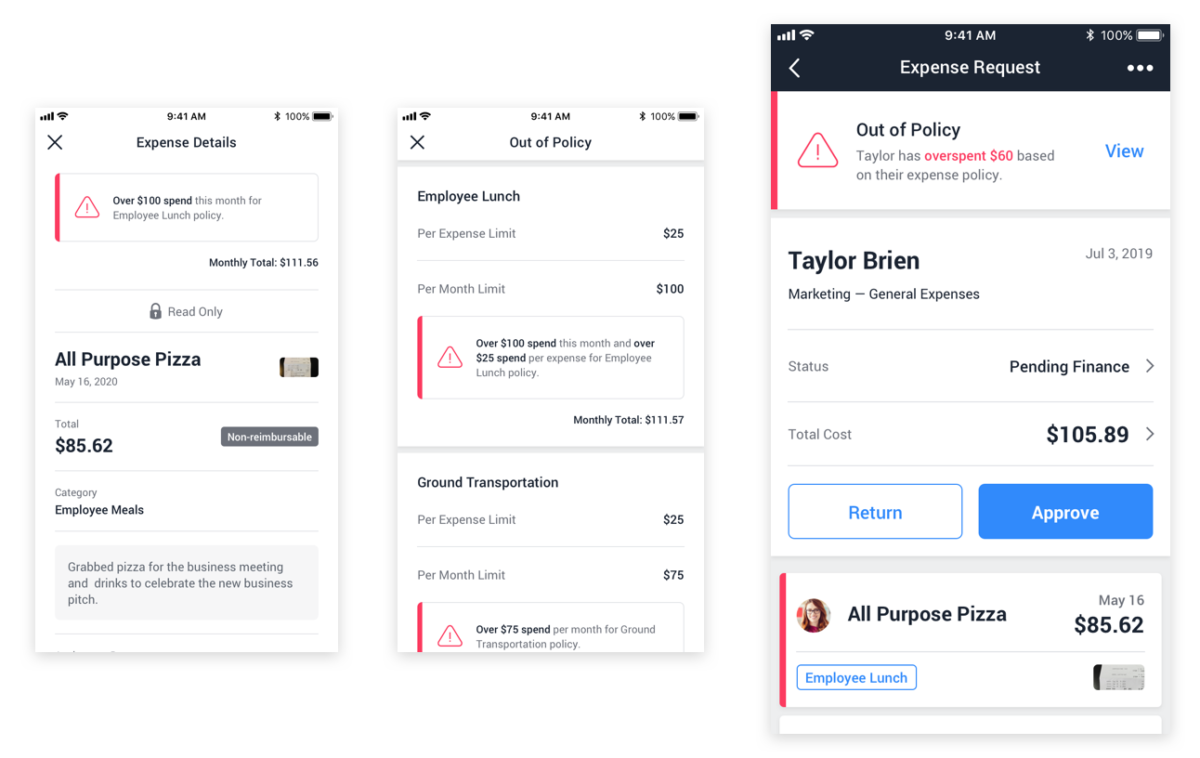

6. Set up alerts

Missed deadlines, forgotten receipts, over-budget spending, and non-compliant expenses waste a lot of time.

Instead, use automated alerts to flag problems so employees and their managers can intervene early.

7. Use real-time dashboards, not batched reports

Every month, most Finance teams hand-build spreadsheets across teams and departments to track costs.

Instead, use real-time dashboards to track spending habits, remaining budget, anomalies, and upcoming accruals: