TravelBank powers the expense and travel solution for more than 45,000 companies with automated workflows for easier and more accurate expense tracking, real-time insights into spend data, customizable expense categories tailored to your business needs, and the only end-to-end solution for managing all of your travel and business spend in one place.

Fast Implementation

Start controlling cost in minutes, not months. Getting set up is simple with HRIS sync, general ledger integrations, and recommended policies.

Best ROI

Increase visibility and streamline spend, at half the price. Additionally, reduce errors, improve data accuracy, and speed up reconcilliation.

Users Love Us

Employees enjoy a user-friendly design for capturing expenses on the go and get their money back faster with rapid reimbursements.

Virtual Cards

Enable Contactless Payment

Control Spend

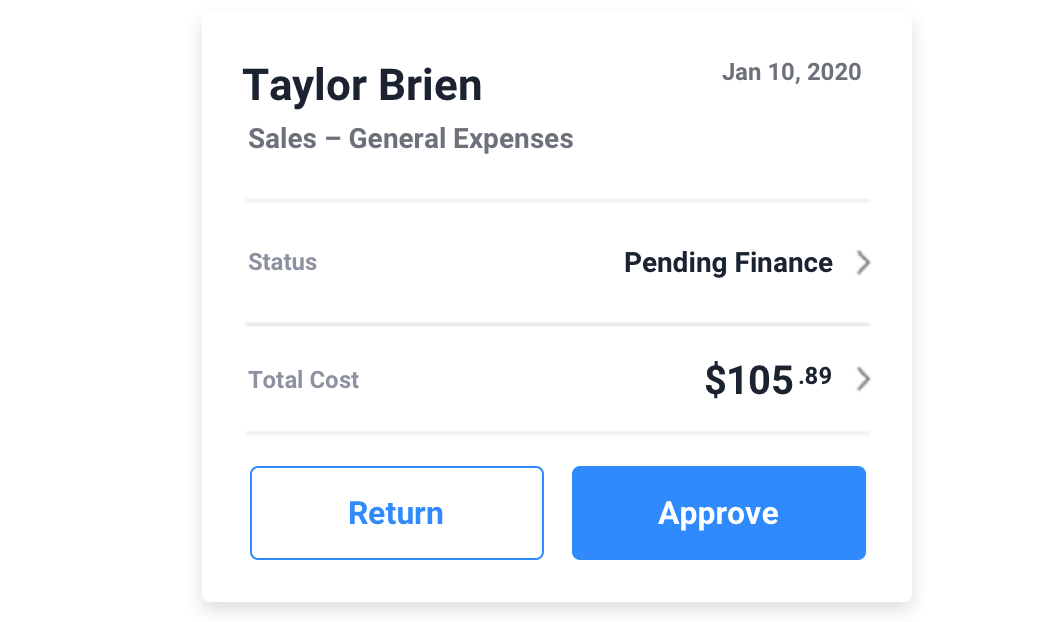

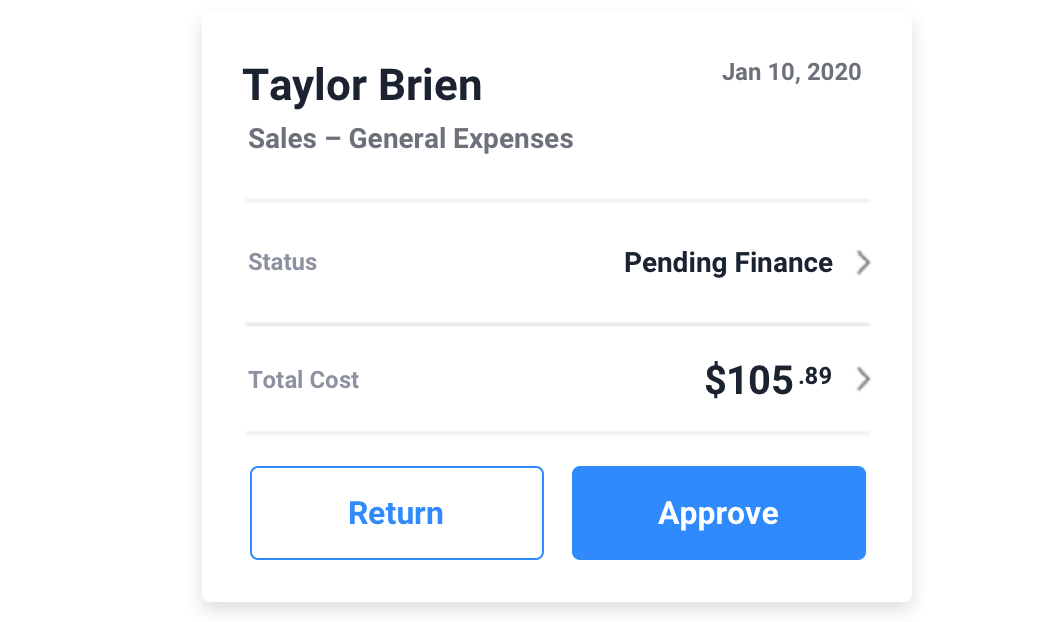

Review and approve expense reports from any device. We’ll notify employees when you’ve taken action. Once approved, auto reimburse your employees via direct deposit.

Increase Compliance

Identify patterns in spend, flag potentially fraudulent spend, and eliminate wasteful expenses more quickly for a greater impact. Use customizable expense categories and required fields to ensure compliance with industry regulations like PPSA.

Automate Your Accounting

Map expense categories and synchronize expense reports, reimbursements, and corporate card data between your current accounting products and TravelBank for a seamless accounting workflow.

Save company money when you manage spend in one place

Accurately Tracking Expenses Under the Physician Payments Sunshine Act (PPSA)

The Buyer’s Guide to Evaluating Expense Management Solutions

Healthcare Expense Tracking Made Easy