How Much Is Increased Travel and Expense Policy Compliance Worth?

Travel and expense (T&E) spending is significant at many organizations, and difficult to rein in. Low employee awareness and poor compliance with corporate T&E policy have real costs. Here’s what we learned about travel and expense policy compliance from a recent Forrester study.

Hidden Policies

Organizations frequently set T&E policies but have no way to encourage or enforce adherence. And violations aren’t always intentional. Outdated policy documentation, such as PDFs that employees must track down and read on company intranets, increases the likelihood of violations. Static policies and manual checkpoints open up a lot of slack between the employer, manager, and employee.

>> Related: How to Reduce Business Travel Spending <<

Frustrating UX

When tools or processes are slow or cumbersome, employees simply forgo formal channels and book directly with vendors. And when booking on their own, employees frequently choose their preferred providers to maximize individual perks, such as airline miles or hotel points. On average, employees strictly following company T&E policies spend 20% less than nonadherent employees.

In the 2024 commissioned Forrester Consulting Total Economic Impact™ study, a director of ERP solutions at a healthcare organization described a common scenario: “Travel for us was a free-for-all situation… People booked at a premium and chose carriers based on their personal preference or personal rewards, not on price. We knew there was extra spending we were not catching.“

Catching Noncompliant Spending After It’s Too Late

Management also critically lacks visibility into spending and policy adherence, and struggles with manual and limited reporting capabilities. As organizations scale in complexity and headcount, it becomes increasingly difficult for finance teams to review every transaction for compliance against policy. When employees overspend, the feedback loop can take months, long after it’s too late. The same Forrester study interviewee said, “If someone booked out-of-policy we might find out, we might not. It might have taken me two or three months to catch.“

>> Related: 9 Easy T&E Policy Updates that Rein in Costs <<

Significant ROI

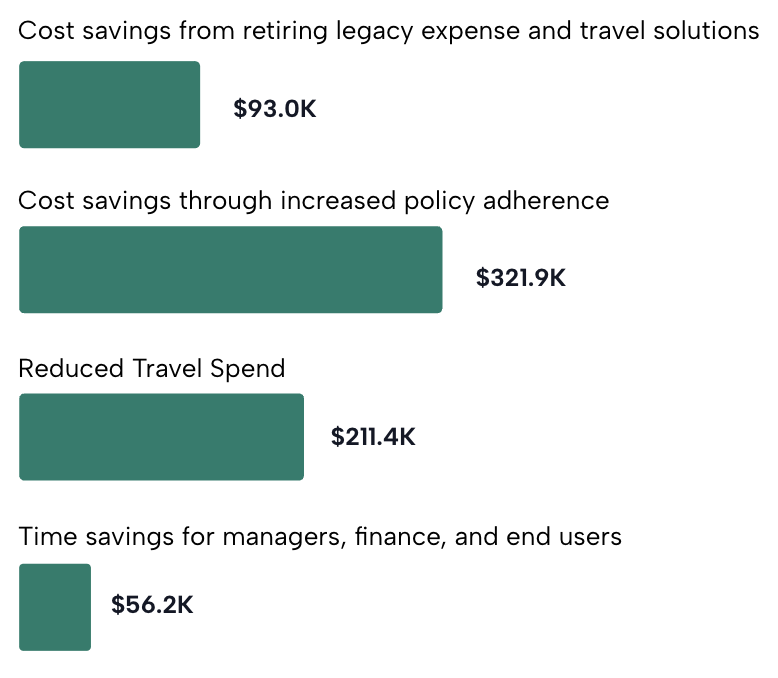

In the end, policy adherence is probably the most important part of T&E management. In Forrester’s study, they modeled that improving policy compliance nets the greatest financial benefit:

How TravelBank Boosts T&E Policy Compliance

During the study, Forrester found that switching to TravelBank improved employee adherence to T&E policies from 40% to 91%, saving $321,000 over 3 years. TravelBank’s ease of use encouraged more employees to book directly through the app, where they were guided by up-to-date and easy-to-follow policies.

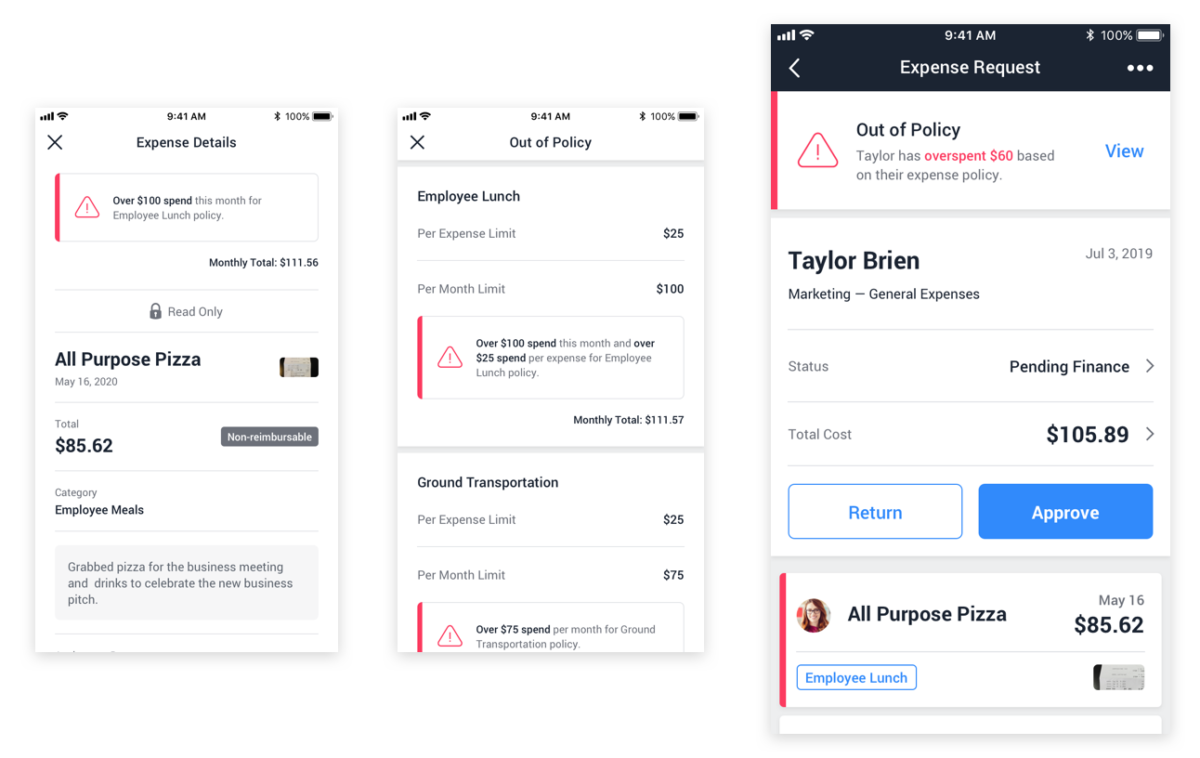

By applying controls directly in the travel booking and expense management platform, violations are prevented. And users immediately see why their flights or expense reports can’t be submitted.

With TravelBank, finance admins can set spend limits by expense category and/or duration, and propagate alerts for overspend when managers are reviewing expense reports:

- Transaction limits show a spend alert any time a transaction in that category exceeded a dollar threshold.

- Duration limits can be set on a daily, weekly, or monthly basis, and would display a spend alert if the employee has submitted more than the total set for that duration.

Expense Spend Alerts encourage compliance with company policy, and can be used as hard limits to enforce company wide, or loosely as a nudge for managers to remind employees of the company policy.

“With TravelBank, we’ve seen our compliance increase from 65% to between 95% and 99%. I don’t think people were intentionally doing wrong, I think they just didn’t have the guidance that we have now with TravelBank.”

– DIRECTOR OF PROCUREMENT, EDUCATION