How to Evaluate Expense Management Software

Is your company wasting time manually processing expense reports? Or maybe your employees are avoiding their expense reports due to frustrating, outdated software? According to Forrester research, business travel expenses are one of the most difficult operating expenses to control due to the tedious details and lack of visibility. Here are 5 recommendations – plus 31 detailed use cases – to help businesses evaluate expense management software.

Table of Contents

The Challenges of Manual Expense Management

Have you ever manually filed an expense report? Let’s walk through the process:

- After employees collect their pile of receipts from a recent trip or this month’s business related expenses, they type up all of these expenses manually.

- Next, they dutifully scan in each receipt—at its worst, this step involves a lot of tape and maybe even snail mailing the hard copies back to the office.

- The manually entered expenses and digital copies of the receipts then must be combined into an expense report that is submitted to their manager, and later the finance team, for review. With the potential for human error, it’s no wonder a lengthy auditing period and a few costly corrections are usually required.

- When the reimbursement finally comes through, the employee has already been floating the cost of these business expenses for far too long.

This tedious process creates numerous challenges: wasted time, inconvenience and confusion for employees, noncompliance, and a lack of visibility.

>> Related: How Better UX Saves 15% of Time Managing T&E Reports <<

On top of all of that wasted time, when expense reports are processed manually they can cost over $26 per report. If your company has 50 employees who submit the average 1.5 expense reports per month, it would cost your company $23,967 per year simply to process those reports.

Outdated Software is Also Costly

Many antiquated business expense apps claim to automate the process, when in actuality they are only improving a portion of the experience. There is also expense management software available that was built to support the expense management needs of large enterprise companies. These systems are extremely nuanced and end up creating a frustrating user experience for most businesses who don’t need such heavy, complicated software.

How to Choose the Expense Management Software Your Business Needs

So what is the solution? Modern, streamlined expense management software that is comprehensive, automated, and intuitive. Here’s how to evaluate expense management software by:

- The type of system that best suits your needs

- The integration capabilities of the system

- The cost and complexity of implementation

- The level of customization and support available

1. Balance the needs of your stakeholders.

- For your finance team, controlling costs, predictability, and visibility are all top of mind. Compliance and real-time insights into spend are a huge help with forecasting and provide the team with timely and accurate data for reporting.

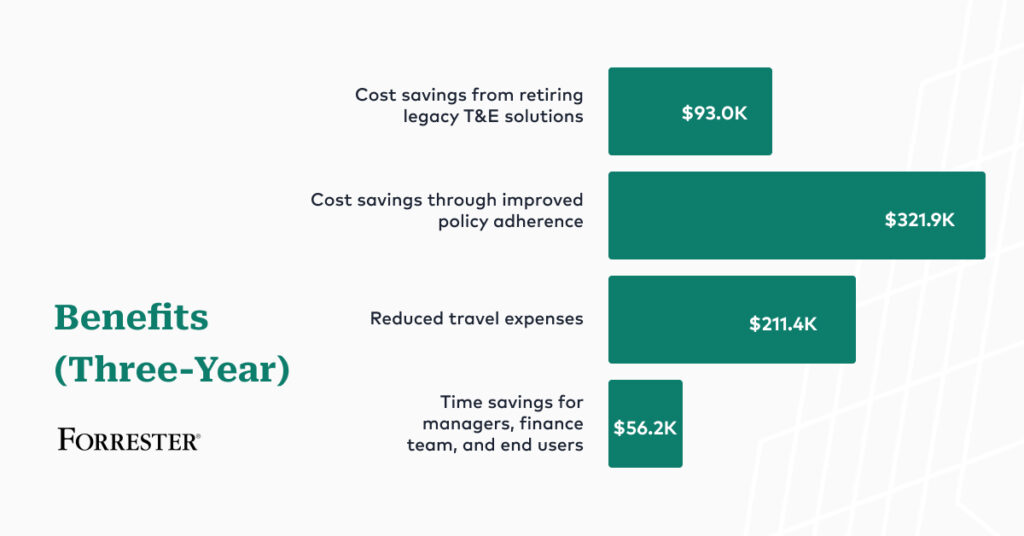

- Policy adherence is probably the most important part of T&E management. In a Forrester Consulting study, they modeled that improving policy compliance nets significant financial benefit:

When tools or processes are slow or cumbersome, employees simply forgo formal channels. On average, employees strictly following company T&E policies spend 20% less than nonadherent employees. Convenience for employees is the X factor to improving compliance. When creating an expense report is simple and there’s the incentive of timely reimbursements, employees are motivated to get them done.

>> Related: Why Orgs Consistently Struggle with T&E Policy Adherence <<

2. Automate as much as possible.

Automated expense management saves time, minimizes human error, creates a better approval flow, and gets money back to your employees faster.

- Integrations with your human resources information system allow you to quickly invite employees to your new business expense app, and a built-in onboarding flow guides your employees to sign up, which only takes a few seconds, and they are automatically linked to your organization.

- With automated expanse management, employees can simply capture expenses as they happen, let OCR technology fill in the details, and submit them as an expense report when they’re ready with one simple tap.

- When the employee submits their expense report, the manager receives notifications so they know there is a report pending their review and approval.

- The manager can reject the expense report, sending it back to the employee to adjust any errors, or approve it, routing it to the finance team.

- When a report is approved by the finance team, the expenses are synced to the general ledger, for simplified processing and better reporting accuracy, and the reimbursement is processed and disbursed in as little as 24 hours.

3. Increase compliance with intuitive and mobile-friendly expense capture.

For successful adoption and use of business expense software, it’s really important to select one that supports both mobile and desktop devices.

- Mobile apps allow employees to capture IRS-compliant digital copies of their receipts in real time as spend happens. This could be done by syncing credit card transactions, forwarding email receipts, snapping photos of a receipt with a mobile device, or even uploading an image.

- Simple expense capture removes barriers to tracking spend, minimizing forgotten expenses and lost receipts. It also allows your employees to begin their expense report on a mobile device and finish on their desktop without the worry of losing the data.

4. Incentivize employees with faster reimbursements.

In addition to providing employees with a simple process for capturing and submitting expenses, it’s important to process reimbursements quickly.

- Modern business expense apps can disburse reimbursements to employees via options such as direct deposit as quickly as 24 hours after the report has been approved. Knowing they will get paid back quickly incentivizes employees to finish and submit their expense report, rather than leave the task on the back burner.

- Automated expense management also reduces the potential for human error, and thus the need for corrections, and decreases the time needed to audit expense reports. Overall, this can drastically speed up processing time leading to faster reimbursements.

5. Get real-time visibility into expenses.

Your expense management software should provide more accurate and timely expense data, which in turn makes it easier to control costs and achieve compliance.

- As a finance manager you need to see where your company’s money is going. You should also have enough insight to forecast spend and take action before the money is spent.

- With earlier access to spend data through a centralized analytics dashboard, your finance team can identify patterns in spend, flag potentially fraudulent spend, and eliminate wasteful expenses more quickly for a greater impact.

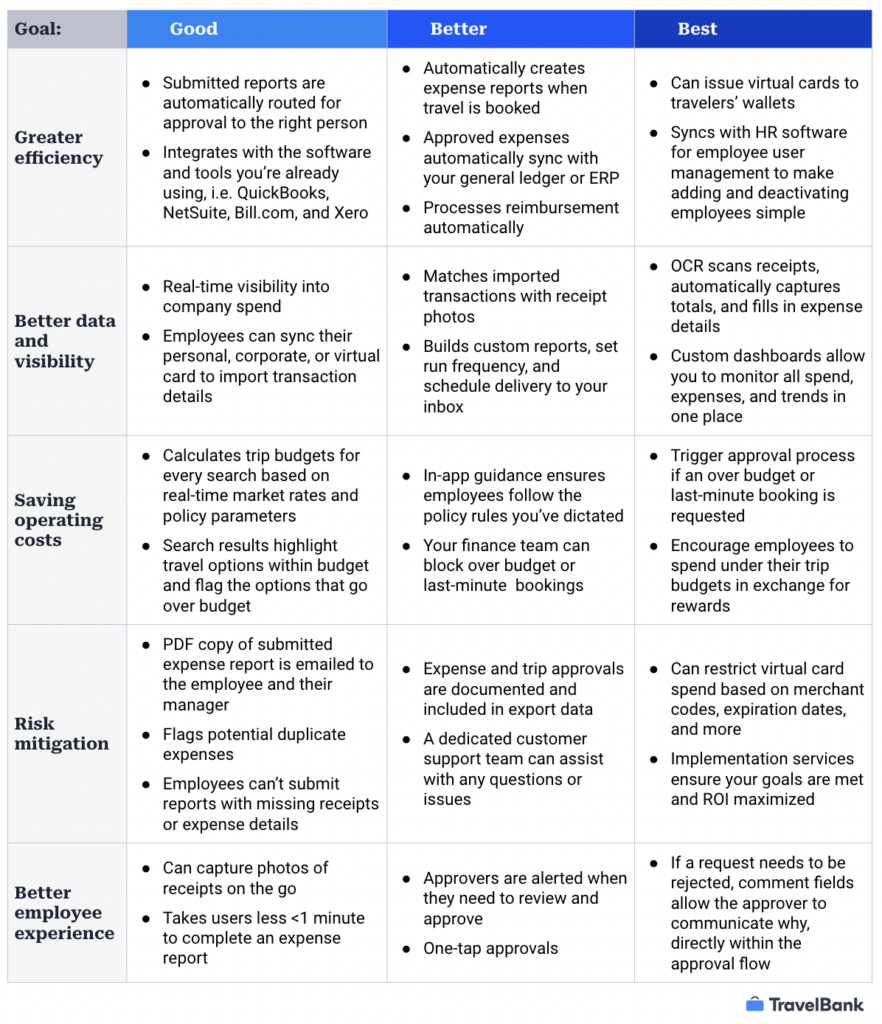

31 Use Cases to Help Evaluate Expense Management Software

How 3 Companies Transformed Their Expense Management with TravelBank

Replacing Excel saved major time and created a process that could scale with their team.

Prior to using TravelBank, the then 65-person FiscalNote team was using Microsoft Excel as their main expense reporting tool. “With Excel, there’s a ton of manual effort to reach out for approvals to department heads and add the expenses to payroll,” says Marshall Thomason, FiscalNote’s Controller. “Our main goal was to automate a lot of these redundant tasks that we were doing by hand with prior inefficient processes. It took us six times longer to work with Excel than TravelBank,” says Marshall.

Read the full FiscalNote story >

Employees who used to rather skip reimbursements than file their reports, no longer have to waste time.

Jumpcut employees previously used Expensify to keep track of travel expenses and submit for reimbursements. “We found it to be a very poor user experience and multiple employees were complaining about Expensify. Many people hated the clunky platform, specifically how time consuming it was, and the complicated UI/UX. Some employees even chose to skip receiving reimbursements, and just lose the money, in order to avoid using the platform altogether,” explained Jennifer Leshkevich, former director of people and culture at Jumpcut.

Reconciling the AMEX used to take three days. Now monthly reporting is done in less than a day.

OnRamp was looking for a better way to handle expense reporting. “At the time, we were using Excel spreadsheets and paper receipts, and it was definitely not worth it,” says Joel Martin, Senior Manager of Customer Operations. In fact, their analog approach to tracking and reporting was a pain point for the entire team. “It was really time consuming for me,” adds Sherrie Atkinson, OnRamp’s Accounts Payable Lead. “Sometimes it took up to three days to handle monthly reporting. I kept thinking, ‘There has to be a better way of doing this.’”

TravelBank helped streamline work for Accounts Payable. “Beforehand, there was so much stress involved in trying to get the American Express bill reconciled each month and get expense descriptions clear enough for auditors,” says Sherrie. “TravelBank has sped things up so much that I’m able to get monthly reporting done in less than a day now. Plus, a lot of our staff are saying it’s made their life a lot easier. It’s been a great tool for us.”