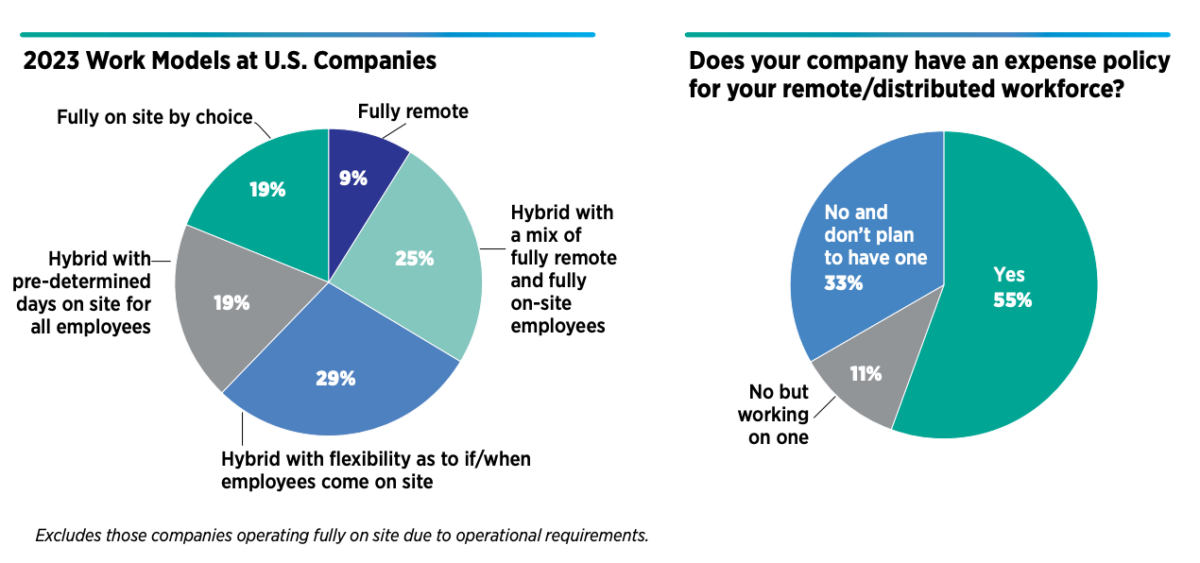

In the Chief Executive Group’s April 2023 CEO Confidence Index survey, 81% of U.S. companies reported that they’re currently operating either fully remote or in a hybrid capacity. And no wonder. Research from Global Workplace Analytics showed a typical U.S. employer is realizing cost savings—to the tune of $11,000 per hybrid/remote worker each year—by scaling back their physical footprint. Yet, despite most companies adopting remote workforces, our recent survey of CFOs found that only 55% of CFOs have an expense policy for remote workers.

The companies without an expense policy for their remote workers are missing a chance to support their employees and maximize productivity, at best, and leaving a gap for noncompliant spending, at worst.

Skyrocketing expense violations

Remote employees and their managers are still expensing, of course. In fact, transitioning to remote workforces usually contributes to an increase in expense reports being submitted. One year into the pandemic, Oversight found expense violation rates increased 292%, driven by risky and opaque out-of-pocket employee spending.

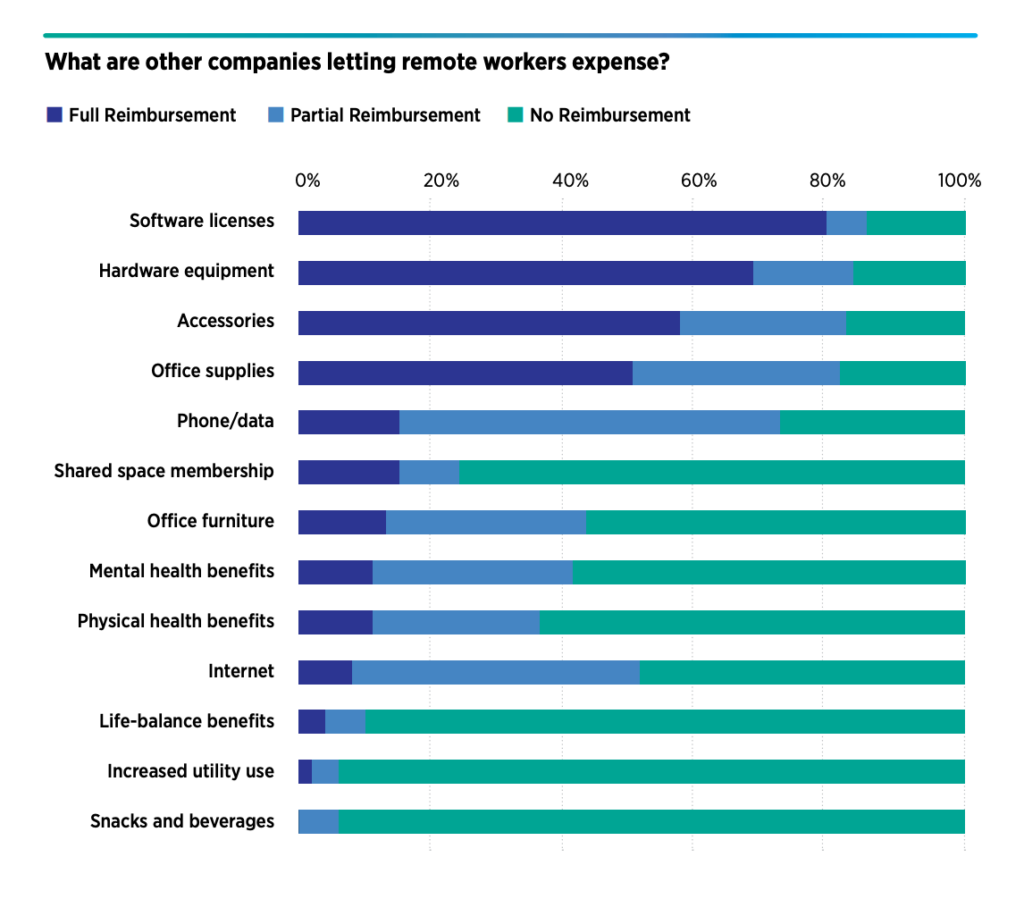

Without clear remote or work-from-home expense policies, remote supplies and perks are left to the discretion of individual managers:

And companies tend to only reimburse a fraction of the cost of remote work. Our survey found that only 43% of companies reimburse their employees for office furniture, and only half (51%) provide financial support for the internet connectivity workers need to accomplish their work.

>> Related: T&E Policy Failures Are Costing You—Fix Them Fast <<

A missed opportunity

If companies save $11,000 for every employee working remotely, more generous expense policies would boost morale, attract applicants, and help employees feel productive, valued, and healthy. Among TravelBank’s 20,000 company accounts, we’ve seen creative work-from-home policies that reimburse strong WIFI, monthly house cleaning, snacks, even therapy, or give employees the option to donate their monthly stipend to charity.

Such small perks enhance overall employee experience and culture, and can be a strategy to attract and retain skilled talent in a tight labor market. Overlooking these benefits is a missed opportunity to differentiate yourself beyond the usual incentives competitors offer, particularly in larger metropolitan hubs where in-office perks were common before the pandemic.

Interestingly, reimbursing employees for remote expenses appears to be more prevalent at smaller companies. The same is true when looking at mental health, physical health and work-life balance benefits—most likely as a way to compete with larger peers who offer higher compensation and more robust health care packages.

>> Q&A: Create T&E Policies for 2025’s Fluctuating Market <<

For instance, 35% of companies with less than $25M in annual revenues reported fully or partially reimbursing shared space membership/usage, versus none of the larger companies over $100M in revenues. Even office furniture tipped the scales, with 65% of small companies offering reimbursement to employees, versus 30% of large companies.

Guide employees with an explicit remote workforce expense policy

Simply put, if you’re one of the 45% of companies without remote workforce expense policy, it’s time to draft one:

- What savings are we realizing from a distributed work model that can be reinvested into our workforce?

- What expensable items can best support our talent strategy?

- What are our competitors offering—and how can we go a step further to stand out and differentiate ourselves?

- Who within the organization should be entitled to these benefits (e.g., fully remote, hybrid, managers, etc.)?

- How do we make the expense reporting process user-friendly—for both finance and employees?

- How do we calculate the ROI on these items, and how often should we reassess the policy?

>> Related: 10 Questions to Audit and Update Your Business Travel Policy <<