TravelBank Adds Card Management, Searchable Expenses, Premium Insights & More

Businesses have faced unprecedented changes this year due to the global pandemic, economic instability, and looming national election. Company spend is under more scrutiny as every dollar is measured for ROI, so it’s our goal to help your team gain a clear understanding of your spend and how it can be optimized through accurate, high quality spend data.

We’ve been hard at work rolling out over a dozen new features to help your team control and manage spend more efficiently. Here’s a deep dive into what’s new on the TravelBank expense and travel management platform.

What’s New

Card Management

Integrate with the bank of your choice so spend and reconciliation occur in one seamless process, giving your team visibility of every transaction, before it’s even submitted.

Corporate Card Sync Gives You the Flexibility to Use Any Card

Lately, we’ve seen other travel or expense management providers require customers to adopt their corporate card, or charge you fees when you don’t. This is a profit play, and at TravelBank we know it’s unrealistic to expect all expenses to be charged through a single corporate card account.

Instead, we’ve built corporate card sync, making it easy to integrate with the banks of your choice so you have the ability to manage all of your spend from a single platform, and flexibility to use whatever cards work best for your team. We already support and import transactions from over 48,000 personal and corporate cards and banks.

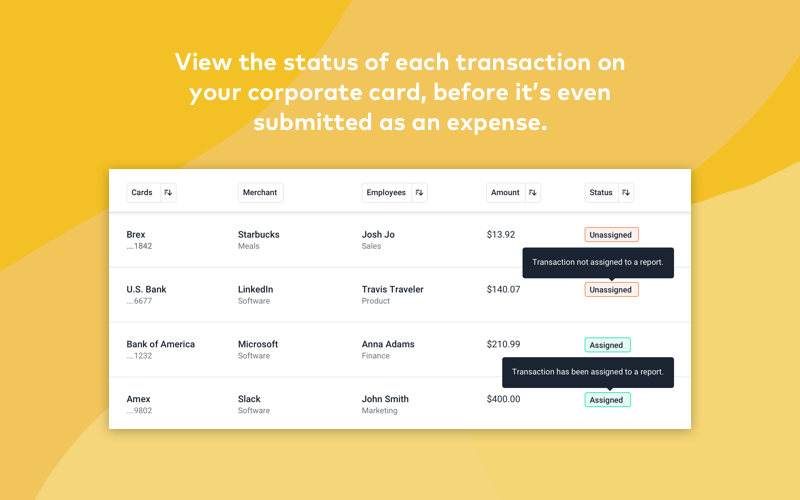

See Real-Time Transaction Statuses

TravelBank is now able to provide visibility into the real-time status of every transaction, whether or not they’ve been submitted as an expense. This will help your finance and accounting team anticipate spend before month’s close, track true costs proactively, and flag out-of-period unsubmitted expenses. Gone are the days of waiting for expense reports to be submitted by users.

Comprehensive View of Cards for Admin

Our new view gives your admin the ability to see all of the corporate cards they manage, and reconcile corporate card transactions with a click. See expiration dates, spending limits, and more in one comprehensive view.

My Cards for Employees to Manage Payment Methods

A new Cards tab on the desktop app makes it easy for your employees to manage their assigned corporate cards and personal cards, and view their transactions on one screen.

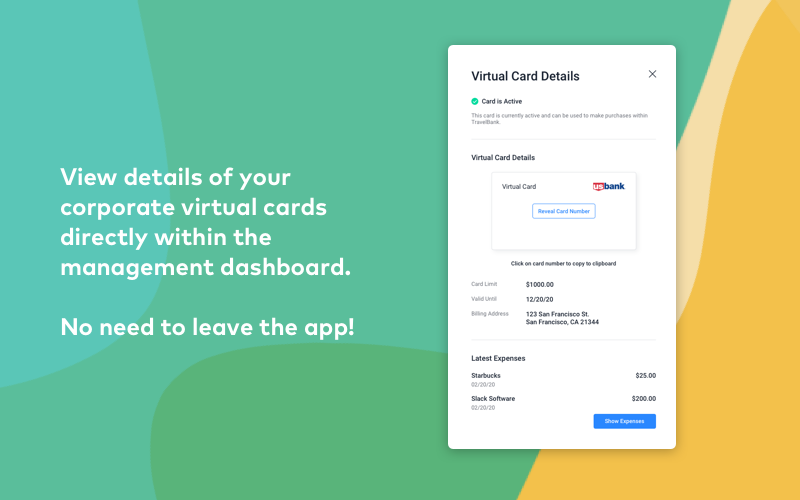

U.S. Bank Instant Card Integration

We’ve partnered with U.S. Bank and integrated the U.S. Bank Instant Card directly into the TravelBank travel and expense management application. This integration allows business admin to provision virtual corporate cards to employees from within the TravelBank app, while earning market-leading card spend rebates. The Instant Card provides employees with a safe and convenient contactless payment option that integrates with mobile wallets through a proprietary green path verification technology. As employees return to the road, Instant Card provides touch-less hotel check-in that doesn’t require faxed corporate card verification.

Premium Insights

Data integrity is imperative for the accounting team, while finance needs good reporting that enables visibility and forecasting.

Premium Insights is our new user-friendly and fully customizable dashboard that allows you to monitor all of your spend, leakage, and trends. It gives every decision maker in your company a one-stop dashboard for the travel and expense metrics that matter to your business.

The home dashboard displays summary items on your organization’s spend, top savers, approval compliance, high spend items, and even airfare and hotel booking leakage. Individual travel and expense dashboards give a more focused view into each area and allows admins to learn more about the state of their organization’s spend at a glance.

Your team can build configurable reports that answer more specific questions, like where your highest spenders are traveling to or whether they are submitting reports on time, and dig into top vendors your company gravitates to when purchasing for an expense category.

For new organizations ramping up on TravelBank, see how your company’s adoption and compliance with the booking platform changes over time.

Schedule hourly, daily, or weekly Insight reports to your inbox and view your data on the go. Set up trigger reports that are sent to your inbox anytime there’s an exception or a threshold is met.

Upgrade your analytics to Premium Insights today and track and report expenses and travel on every metric. Reach out to your success manager or support@travelbank.com to get started.

Expense Tracking & Management

With workforces going remote, more employees have expenses to submit. By making expense tracking intuitive and layering in automation, there’s less human error, which saves time and greatly reduces the accounting team’s end of month headache.

Updated User Interface

TravelBank’s user interface has been updated on desktop to allow employees to search and assign individual expenses into unique reports with ease.

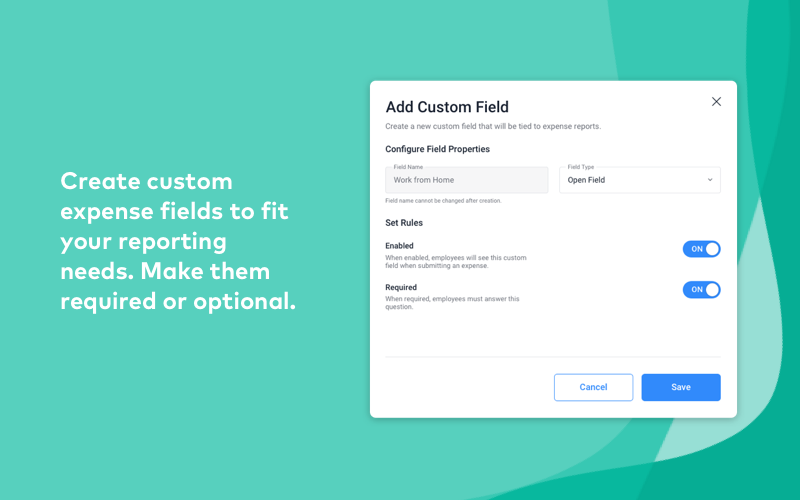

Custom Fields

Custom fields allow your team to track and report on specific company initiatives like work from home expenses or virtual conference fees. For admin, it’s easy to customize and update expense fields from the company settings in the app—no IT support required. Two-way sync with your general ledger ensures that any updates are reflected into your accounting platform

New Industry Solutions

Expense management is not one size fits all. To help our customers set up policies, customize expense categories, and follow best practices for expense management within their industry, we’re rolling out guides and specific expense features for various industries, beginning with computer software, healthcare, manufacturing, and construction.

Expense Spend Flags

Coming soon! Expense spend flags help managers identify out of policy spend. This makes it easier to understand why your team might be seeing trends in noncompliance, and use that information to enforce or update your organization’s policy as necessary.

And More!

Additional General Ledger Integrations

We’ve upgraded the technical side of our general ledger integration with NetSuite to be more advanced. Details for setting up the integration are here.

New integrations with FinancialForce and Intacct are scheduled next and coming soon.

Grey Labeled Edition

Our grey labeled edition allows our customers and partners customize the look, feel, and function of your TravelBank platform to fit with your business branding.

Rewards Store Expansion

We’ve added more redemption options to the Rewards Store, including Amazon, DoorDash, and Hulu, offering users more ways to use their rewards points now or later. Rewards points can also now be redeemed as charitable donations through our partner, Charity on Top.

New Marketplace Offers

We’ve crowdsourced over 150+ offers and deals in the TravelBank Marketplace, giving our customers exclusive access to savings and services with a focus on work from home supplies and software.

TravelBank has always been designed to make expense management intuitive and simple from our receipt scanning technology that captures everything on receipts, reducing human error, to the machine learning that helps categorize expenses properly for your business instance. With over a dozen new features, we aim to bring increased efficiency to your team in today’s business climate.