Guide to Finance Automation

Finance managers are focused on budgets, account reconciliation, payment dates, and the bottom line. But finance processes are deeply rooted in spreadsheets, mountains of receipts, and chasing down managers.

Whether it’s used for reducing human error, boosting productivity or driving down costs, automation is redefining how finance teams perform.

For example, the Global Business Travel Association (GBTA) reported that 19% of expense reports contain errors or missing information. And “companies process an average of 51,000 expense reports each year, meaning companies spend, on average, half a million dollars and nearly 3,000 hours correcting errors in expense reports annually.”

That’s more than a full headcount! Automation can help eliminate that overhead and make finance management easier and more strategic. According to Accenture’s CFO Now 2021 report, “60% of traditional finance tasks are now automated, up from 34% in 2018, facilitating tactical benefits around cost efficiencies and improved accuracy of historical reporting.” When scut work becomes automated, the accounting team can provide more strategic analysis and business value.

This introductory guide to finance automation defines automation, gives real world examples, and helps companies pilot automation projects.

Table of Contents

Defining Finance Automation

Finance automation refers to the use of digital tools and software to automate routine financial tasks and processes. Automation reduces the need for manual invoice processing, budget management, and expense tracking, to name a few.

This technology is particularly vital for CFOs – it not only boosts operational efficiency, but also enhances accuracy, compliance, and real-time visibility into financial data.

And the automation of these tasks allows finance teams to shift their focus from mundane transactional activities to high-value strategic planning, thereby playing a pivotal role in driving business growth and innovation.

Sample Automation Process

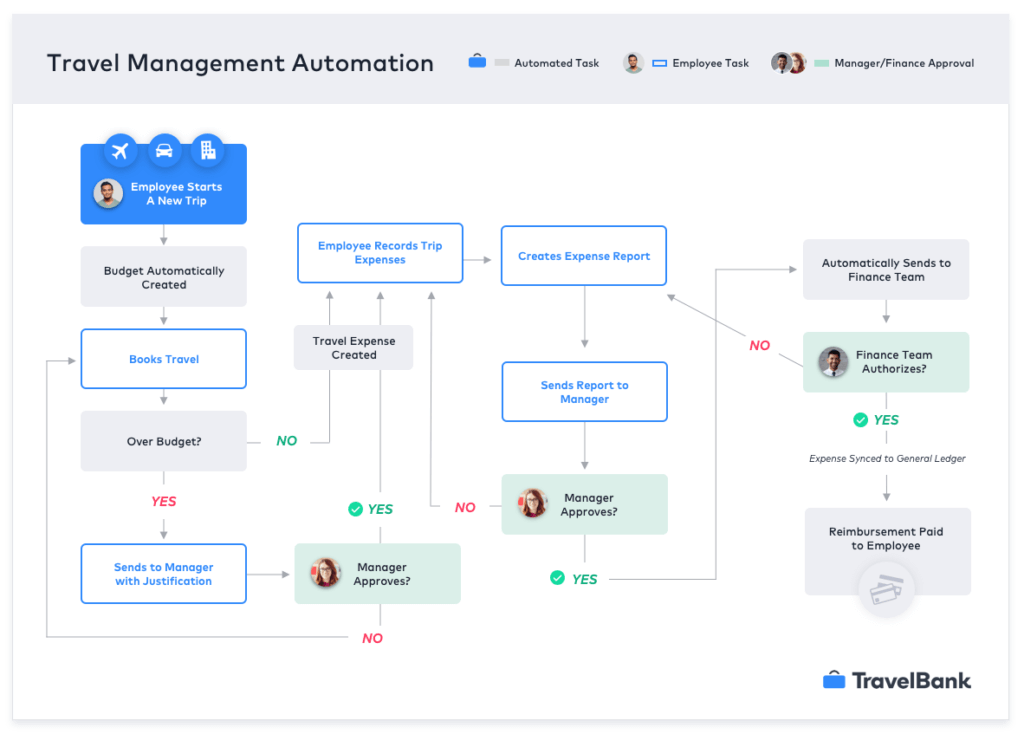

Here’s a sample automated workflow:

- When an employee starts a new business trip, software automatically calculates a personalized and compliant budget based on the destination, dates of travel, and real-time market rates. The employee knows exactly how much they have to spend.

- Automated travel policies then guide the employee through the entire booking experience, encouraging them to book within policy, but allowing them the flexibility to request exceptions when needed.

- The request process for “over budget bookings” is also automated, so managers are alerted to review, and the requested travel is booked automatically for the employee upon approval.

- When employees submit expenses, they are automatically synced with the general ledger.

- And the entire reimbursement approval process is automated with email or in-app notifications, so each stakeholder doesn’t have to remember to check expense report statuses, and the employee gets reimbursed more quickly.

The workflow above does a great job illustrating that automated management does not have to be complex to save exponential time and (let’s be candid) misery tracking the moving pieces.

Automation Opportunities

Prevent Data Entry Errors

When companies rely on busy humans to manually check if (submitted and itemized!) receipts match itineraries, inappropriate or suspicious expenses often go unnoticed.

Manual receipt entry yields a lot of accidental mistakes. And these false positives drown out true fraud. On average, it takes between 18-24 months to detect fraud.

Instead, with an integrated mobile app, employees can snap a photo of their receipt and upload it directly. OCR (Optical Character Recognition) pre-scans receipts and categorizes expenses appropriately.

- This helps reduce the potential for lost receipts that hold up reimbursements.

- It also reduces the risk of fraud and abuse in the travel and expense process.

- And it significantly reduces the risk of human errors and omissions during expense reporting.

Similarly, the Finance team keying data into the ERP creates bottlenecks, delays, and opportunities for error. By automatically integrating approved expense reports, Finance saves time and prevents time-consuming errors.

With fewer innocuous mistakes, the Finance team can focus on spot checking and deeply investigating suspicious data. Manually processing expenses reports costs $26 in person-power, per report. Automating expense management can reduce that cost to less than $7.

Prevent Unintentional Fraud

Violations aren’t always fraudulent. Outdated policy documentation, such as PDFs that employees must track down and read on company intranets, inadvertently increases the likelihood of violations. Static policies and manual checkpoints open up a lot of slack between the employer, manager, and employee.

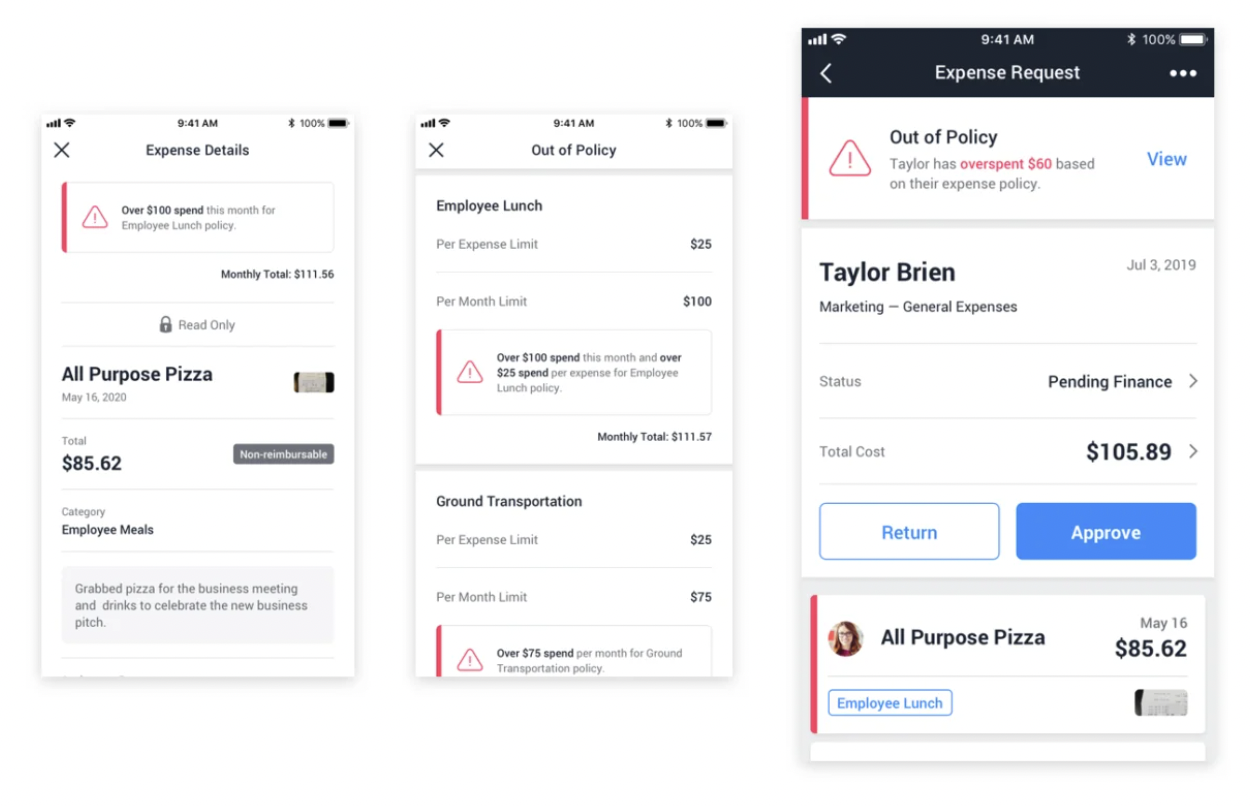

When companies apply controls directly in their travel booking platform or expense management platform, violations are prevented. And users immediately see what is out of policy, and why their flights or expense reports can’t be submitted.

Replace Corporate Cards with Virtual Cards

When you give someone a traditional corporate card, you’re just giving them an allowance and trusting them to spend within policy. Instead, with virtual cards, the policies are written into the software. For example:

- You can limit the merchant category codes allowed to be charged to the card.

- You can let someone spend up to $1,000 on restaurants, but each dinner can only be up to $50.

- Transactions can only happen in Atlanta.

- When the trip is over, you can pull back what they don’t use and close the virtual card.

Visualize Outliers or Patterns of Behavior

With consolidated and reliable data, you can identify:

- top spenders (by individual and department)

- high spend items, merchants, categories

- airfare and hotel booking leakage

- how often employees are booking over budget

- if employee compliance is changing over time

What Is Impeding FinTech Transformation?

CFOs see automating manual tasks as a top priority, but these projects are often hampered by their sweeping scale and complexity.

>> Related: Why 70% of U.S. Companies Haven’t Automated Their Finance Processes <<

During a recent survey with Chief Executive Group, CFOs reported 7 primary challenges that impede their org’s finance automation journey:

1. Integrating and Communicating with Other Systems

At almost 52%, the number one impediment is integrating and communicating with other organizational systems. For example, connecting your HRIS system to your ERP, or connecting your ERP to your travel and expense management software.

2. Pushing through Antiquated Systems

At 47%, the runner up challenge is pushing through legacy systems, like working with antiquated or outdated processes or softwares, or creating and updating reporting.

3. Hiring Skilled Talent to Support Implementation

The third largest challenge is hiring skilled workers who can do implementations and integrations. This is a twofold challenge:

- Ensuring you have the right implementation team to spearhead a FinTech project.

- Despite the finance team being strapped for time, a successful implementation team needs to include them. Without their hands-on feedback, the solution won’t fully capture your process.

Press potential vendors about their implementation process and resources. Are there workbooks, step-by-step guides, etc. to help you translate your manual or previous processes to the new system?

4. Maintaining Ongoing IT Support

Beyond implementation, maintaining ongoing IT support plagues FinTech transformation projects, especially when it comes to output files or API integrations.

5/6. Training Staff and Getting Their Buy-in

End users have to apply new processes/systems for FinTech projects to achieve ROI. Press potential vendors about their help centers and online resources. Do they have trainers available for customized workshops and Q&A? How do they recommend training staff early-and-often? How can the finance team be equipped to answer broader employee questions?

Then communicate early with your teams. Set clear expectations about how (and when) the manual process will transition to a new/automated process. And communicate the benefits of time or money saved.

7. Managing Cyber Exposure and Data Security

You can never be too safe. Liaise immediately with IT or SecOps to understand the overall data security of partner platforms and/or consultants.

How to Pilot Finance Automation

The best strategy for overcoming the barriers to adoption is piloting a small automation project, and gaining at least some efficiency on the finance team. Here are six practical tips and considerations on how to pilot finance automation:

Identify Opportunities for “Only Finance” Automation

First, focus on what you can control. Automating tasks or processes that are wholly owned by the finance team are a much easier lift.

Gather a list of the mind-numbing tasks your team dreads doing, then evaluate:

- The frequency at which they occur

- The manual effort required to complete them

- The benefits that could be gained from automating them

- The costs associated with automation

Get Started with a Basic Model

The implementation phase can launch your initiative forward or really drag it down. Keep initial implementations simple. For example, if you want to streamline your expense report process, begin by automating reimbursement.

Layer on Customizations

As tempting as it is to plan for every “what if” scenario in the beginning, it’s a lot easier to identify gaps and layer on customizations after your initial implementation is complete. Get feedback from your team, and start to address the nuances that will take your automated task from basic to bespoke.

Measure Improvements

Has your team freed up to spend 10 more hours a month on more strategic initiatives?

To determine the success of your finance automation initiative, it is important to measure your return on investment (ROI). This involves calculating cost/time savings and comparing them to the costs associated with implementing the automation.

Some key metrics to consider when measuring ROI include:

- Increased productivity

- Reduced errors and improved accuracy

- Faster processing times

- Cost savings related to travel and expense management

- Software costs

- Time spent on the implementation

Find New Stakeholders

Ultimately finance is a cross-functional responsibility. Consider how the ROI of your automation could be increased by pulling in additional stakeholders.

For example, managers field expense reports before they land with Accounting and Finance. Automation that could flag overspend earlier in the process (or even prevent it!) would provide incredible fallback benefits to the finance team.

Expand Your Pilot

After successfully launching small automations with your finance automation pilot, and tracking/achieving ROI, there will be more appetite for larger projects. Automated reimbursement may lead you to expense management approval flows.

About TravelBank

TravelBank simplifes all aspects of corporate travel and expense management. By integrating flights, hotels, and expense reports, TravelBank significantly reduces the risk of human errors and omissions during expense reporting. Our customers report saving 5-10 hours/month on reconciliation alone.

“Beforehand, there was so much stress involved in trying to get the AmEx bill reconciled each month. Now, with TravelBank, I’m able to get monthly reporting done in less than a day. TravelBank saves us a ton of time and paperwork and chaos.” – Joel Martin, OnRamp