A smart T&E policy should evolve with your company’s growth and the changing economy. We received dozens of questions from CFOs during a recent webcast with the CFO Leadership Council. Read on for our experts’ advice for crafting clear and consistently enforced T&E policies for 2025.

Table of Contents

Q: How often should a T&E policy be reviewed and updated?

A: If it’s a brand-new policy, revisit it quarterly to fine-tune it, similar to adjusting a thermostat until it feels “just right.”

For long-established policies, annual reviews are typically sufficient unless your company experiences major changes like a shift in headcount or new spending categories. (And for what it’s worth, we’ve seen enormous shifts in spending patterns).

Q: Travel prices fluctuate constantly—how do you set realistic spending guidelines?

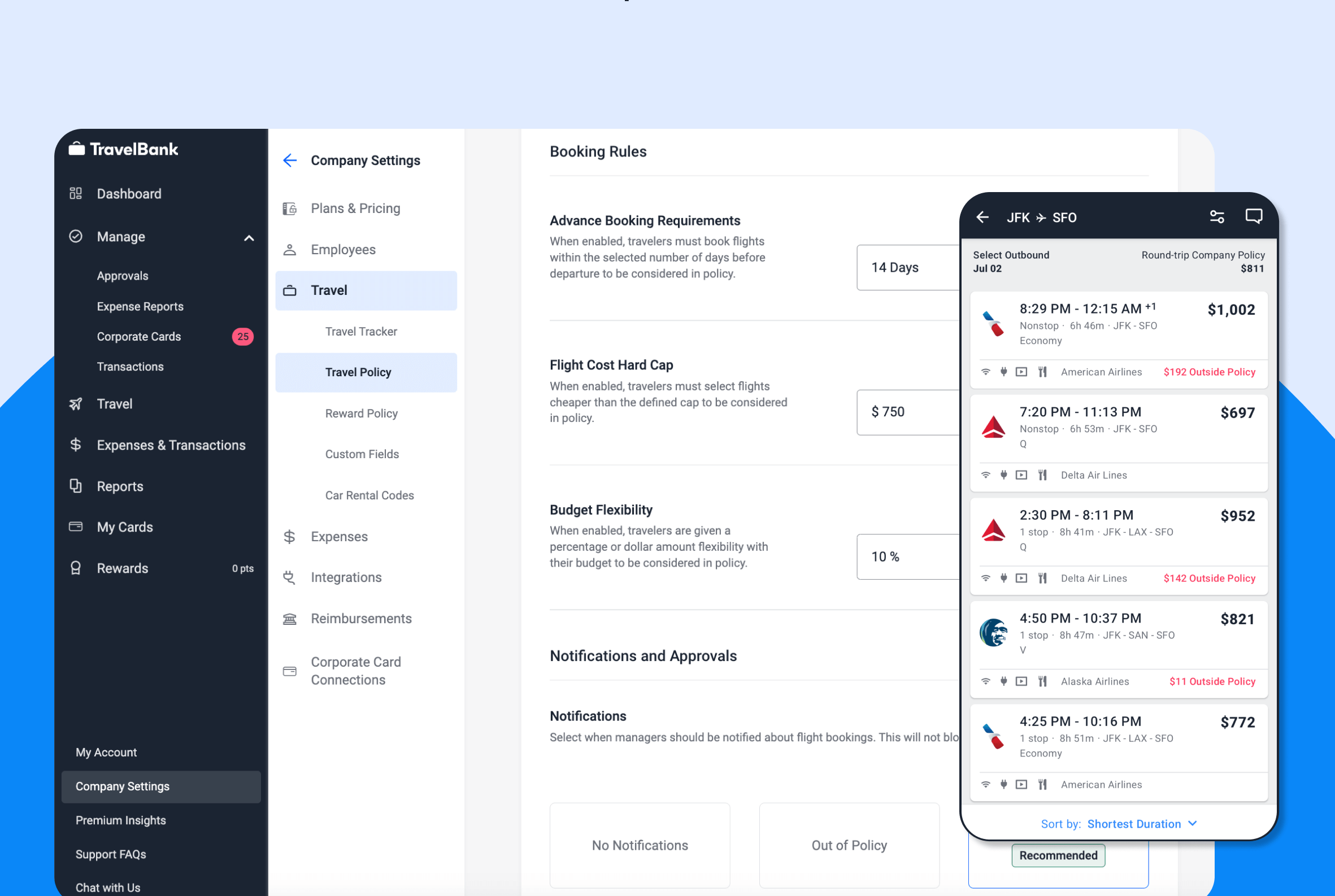

A: Pricing is dynamic! We all know how expensive hotel rooms are during Dreamforce, holidays, even concerts. Make sure your travel booking platform uses dynamic trip budgets. These use algorithms to create realistic price caps based on your parameters—such as economy class and nonstop flights. That means there are no arbitrary spending caps, and employees have flexibility, without straying too far from budget.

Q: How do you avoid price jumps during the time lag between searching for a flight and getting approval?

A: Many travel platforms won’t finalize a booking until it’s approved. To minimize price jumps, set a rule that managers must approve bookings within 24 hours. This creates accountability and reduces the chance of missed savings due to delays.

>> Related: Automation Is Taking Over the Expense Report and That’s Okay <<

Q: How do you encourage employees to book earlier to save money?

A: Early booking almost always saves money. A good rule of thumb is to require bookings at least 14 days in advance. While 30 days is even better, it’s often impractical due to last-minute business needs. By setting a 14-day minimum where possible, you strike a balance between planning and flexibility.

Your travel booking platform should report on these metrics, too, so you can see which employees or teams book last minute.

Q: How do we hold employees accountable for violating the travel policy? Should there be consequences?

A: Think accountability, not punishment. One useful strategy is creating a “naughty list”. You track who regularly books outside of policy, and have real, data-driven conversations with repeat offenders: “You booked 7 trips last quarter; 6 were out of policy. Why?”

If the behavior continues, some companies restrict that employee’s ability to travel. Or to stop reimbursing noncompliant spending. But most of the time, just having the (admittedly uncomfortable) conversation works.

Q: If we have a company credit card for travel, how do we enforce its use over personal cards?

A: First, clearly state in your policy that all travel must be booked using the company card. If you’re using a travel booking platform, make the card the default option. And yes—it’s okay to take a tough stance: if an employee uses their personal card against policy, don’t reimburse them. Many companies follow this approach and see quick compliance. Plus, centralizing spend on a company card earns you perks, rebates, and better visibility.