Is Your T&E Policy Sabotaging Compliance? CFOs Weigh In

T&E policy violations are more than a nuisance — they’re a growing source of financial risk. Research shows that employees who don’t follow policy spend up to 20% more than those who do. And 78% of CFOs say their policies are often ignored. What’s going wrong?

Today employees choose convenience over cost, often ejecting from inefficient processes to quickly book travel on sites like Kayak and Google Flights, or source supplies from eCommerce giants like Amazon. Meanwhile most T&E policies are written, delivered, and enforced like it’s still 2001, with long legalistic guidelines buried in an onboarding PDF.

We recently hosted a deep dive on the topic with the CFO Leadership Council and polled CFOs to see if their T&E policies are helping or hurting. These are the results.

Table of Contents

Travel and Expense Policies Are Violated. A Lot.

Across companies, T&E compliance is worrisome, with only 16% of CFOs reporting their policies are rarely or never violated. Those companies are dwarfed by the 78% of CFOs who say their policies are sometimes or frequently violated:

As T&E spending becomes even less centralized, risk of abuse is also growing. The Association of Certified Fraud Examiners (ACFE) reports that expense reimbursement fraud appears in 13% of cases, and takes an average of 18 months to detect. And the cost? A median of $50,000, up from $40,000 in 2022.

>> Related: 10 Questions to Audit and Update Your Business Travel Policy <<

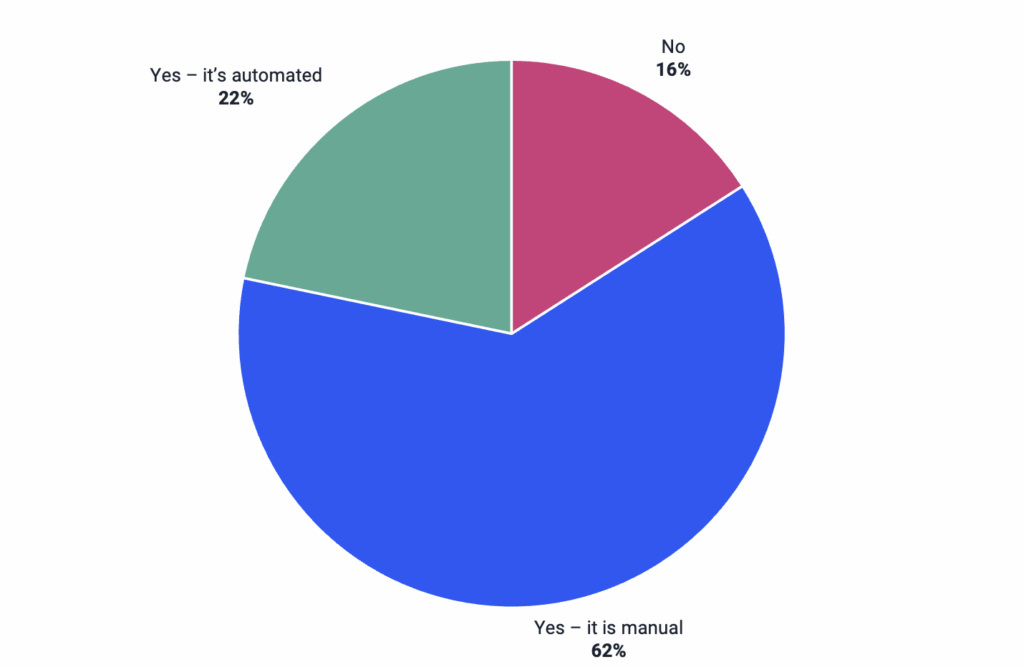

Policy Enforcement Is Mostly Manual

A major contributor is that most companies are still using spreadsheets, inboxes, and manual processes to catch and enforce compliance, all vulnerable to bottlenecks, delays, and errors.

When we polled the CFO Leadership Council, 16% of CFOs admitted they had no way to encourage or enforce policy adherence, and 62% did it manually, despite finance teams often being the leanest part of an organization:

We are not surprised that these ratios are so tightly aligned to violation rates in the previous poll.

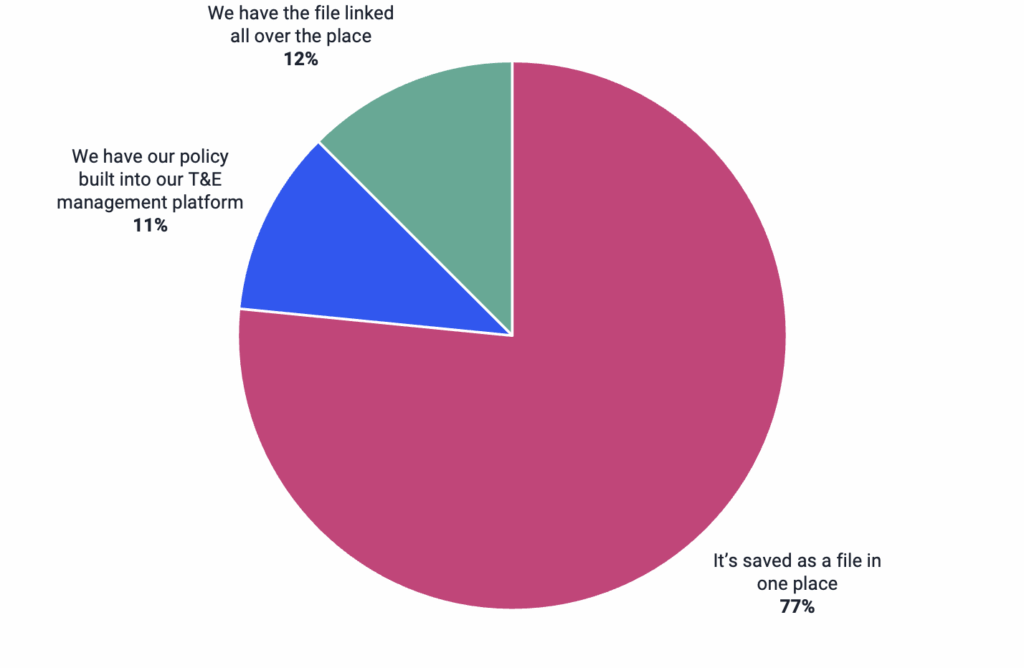

Policies are Buried

Even the most well-crafted policies don’t matter if no one follows them. Remember the average American reads at the 7th- to 8th-grade level. But we’ve seen 10-, 20-, even 80-page policies stuffed with legalese! No wonder employees skip the fine print and just run the company card, especially when under pressure to book last minute travel, or rebook a delayed or canceled flight at the airport.

>> Related: The Importance of Well-Defined Travel and Expense Policies <<

When we asked CFOs how they distributed their T&E policies, only 11% had integrated it into a T&E management platform, and 77% had it saved in a single file in a single location:

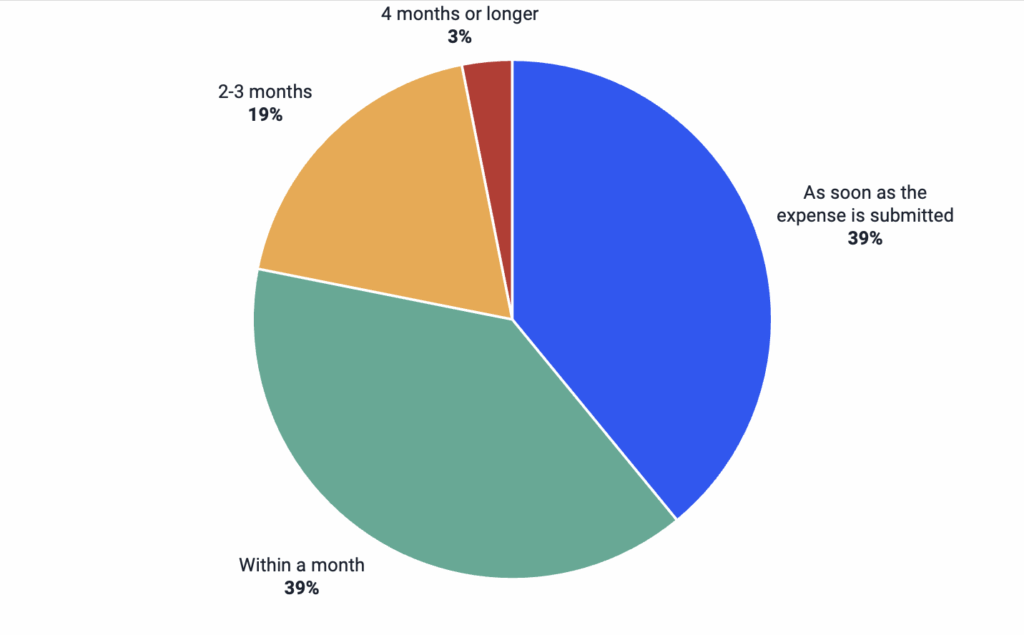

The Money Is Gone Even if You Catch Noncompliant Spending

The lone bright spot from our CFO polling? Seventy-eight percent of companies are catching noncompliant spending within a month:

But rather than waiting to flag violations after employees overspend, consider what controls would prevent money from being squandered.

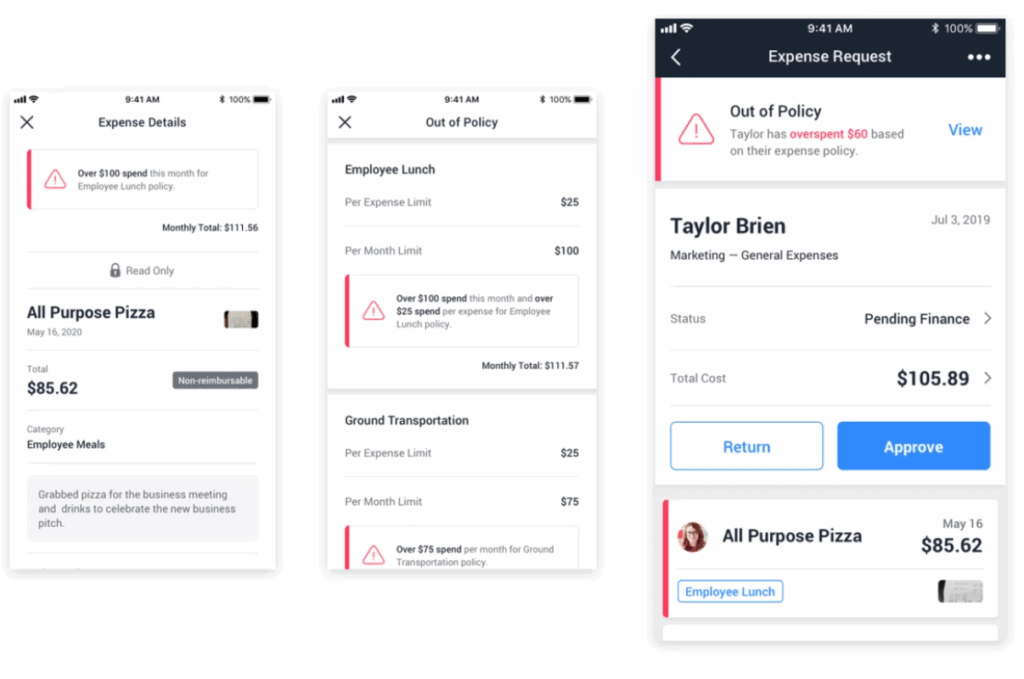

TravelBank was founded with these behavioral guardrails: our software takes your policies and embeds them in T&E workflows. Employees are automatically guided towards options they’re allowed to book, and blocked from things that aren’t allowed.

Admins can limit employees by setting thresholds by expense category and/or duration. And machine learning can identify risky anomalies, such as when an expense is out of range in terms of the location, the vendor, the time, and/or the person. (If this sounds familiar to the fraud detection you enjoy at your personal bank, you’re not wrong.)

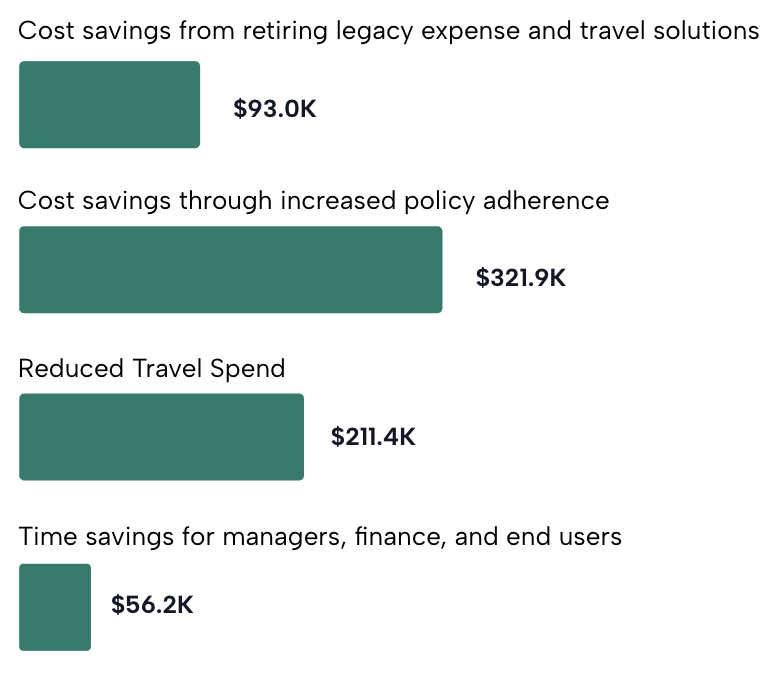

The ROI of a Good T&E Policy

In the end, policy adherence is probably the most important part of T&E management. In our recent study with Forrester, they modeled that improving policy compliance nets the greatest financial benefit: