The Importance of Well-Defined Travel and Expense Policies for Businesses

Well-defined and organized travel and expense policies are crucial for any small business. A recent Capterra report reported 90% of SMB managers expect a surge in opaque credit card payments. Having a clear policy helps guide employees, streamline processes, minimize confusion and errors, and ultimately save time and money.

Table of Contents

What is a Travel Expense Policy?

A travel and expense policy is a formal document that provides guidelines for business-related travel and expenses. It outlines the types of expenditures that the company will reimburse, such as transportation, meals, entertainment, remote expenses, lodging, and specifies the procedures for submitting expense reports.

Policies are vital tools for businesses to foster a culture of financial responsibility. The policy ensures fair treatment of all employees, maintains financial control, and reduces the potential for fraud.

Why Travel and Expense Policies are Important for Small Businesses

For small businesses, where budgeting is especially tight, having a well-defined travel and expense policy helps with cost management, transparency, fairness, and overall operational efficiency. Here’s why:

- Cost Management: These policies give clear guidelines on what’s acceptable, so you can prevent overspending and make the most of your limited resources.

- Transparency: With these policies, you can keep track of employee spending, avoiding any financial issues or misuse that could hurt small businesses.

- Fraud Prevention: Detailed policies act as a deterrent to fraudulent claims, which could seriously impact a small business’s finances.

- Efficient Processes: Having a travel and expense policy in place standardizes the process for claiming and reimbursing expenses. That saves time for everyone involved.

Minimizing the Cost of Travel for Company Employees

Travel and expense policies play a crucial role in cutting down travel costs for businesses. These policies give clear guidelines on what expenses are acceptable and set limits to prevent overspending. For example, policies might say to use economy class travel, share accommodations, or limit meal allowances, all to control excessive spending. And policies often include procedures for booking cost-effective travel through pre-negotiated suppliers.

>> Related: How to Control Runaway Food Delivery Fees for Business Meals <<

Be sure to clarify:

- Airfare

- Where do employees book flights?

- How far in advance should airfare be booked?

- What classes of airfare are acceptable?

- Can employees use frequent flyer benefits?

- What additional flight expenses are acceptable, including flight change fees, WIFI, upgrades, and baggage fees?

- Lodging

- What hotels have negotiated rates with your company?

- Can employees use an AirBnb?

- What room types and upgrades are acceptable?

- What is the maximum nightly rate?

- Which additional lodging expenses are acceptable, including WIFI, mini-bar, tipping, and parking?

- Ground Transportation

- When should employees use rail, their personal cars, rental cars, taxis, or rideshares?

- What is the maximum daily rate for rental cars?

- What happens if a rental car incurs damage, tickets, fines and traffic violations?

- Which transportation fees are acceptable, including parking, airport parking, and tolls?

Protecting Your Company’s Bottom Line

Travel and expense policies are important in protecting a company’s bottom line. Deliberate and unintentional fraudulent activity costs companies $125,000 a year on average!

- They help avoid unnecessary spending by setting clear guidelines for valid business expenses.

- T&E policies also prevent fraud and misuse of funds through strict procedures for claims and reimbursements, like needing itemized receipts and mandatory reviews.

- Plus, they streamline expense reports and reimbursements, saving time and reducing administrative costs.

- T&E policies promote transparency and accountability, creating a culture of fiscal responsibility that boosts the company’s financial health.

>> Related: Corporate Travel Policy Best Practices <<

Preventing Employee Ignorance by Clearly Stating the Company’s Expectations

When building your policy, remember it exists to keep spending at a level that’s right for your business. To eliminate confusion, provide examples of allowable and non-allowable expenses.

Setting these clear guidelines is the first part of creating a (nearly) foolproof policy. But more complicated policy isn’t necessarily going to save you more money or increase compliance. Instead, focus on aligning your policy to your employees travel needs, incentivizing better behavior, and keeping employees happy and productive.

>> Related: How to Adapt to the Surge of Expenses from Amazon, Walmart & Target <<

A few tips for a successful policy:

- Involve stakeholders in the process — striking a balance across their varying needs increases your chances of adoption and better serves your business as a whole

- Keep it updated — if you haven’t updated your policy in two years, it’s probably outdated

- Don’t be too vague — employees’ varied backgrounds and values can lead to drastically different interpretations of a vague policy

- But still keep it simple —the longer and more nuanced your document, the more likely employees are to skim over it or ignore it all together

>> Q&A: Create T&E Policies for 2025’s Fluctuating Market <<

Keeping Your Business Audit-Ready

Having clear travel and expense policies is especially important when preparing for audits. These policies make it easy to keep accurate records of all business expenses. And when it’s audit time, having everything organized helps speed up the review process and saves time and effort.

Plus, detailed T&E policies ensure compliance with tax regulations and prevent fraudulent practices, both of which are key areas of focus in an audit.

Establishing Dynamic Policies Around Travel Expenses

When creating policies, it’s temping to simply adopt black-and-white compliance: You’re over the daily rate. ❌ You didn’t book the cheapest flight. ❌

But this kind of inflexibility is often at odds with commonsense (and employee morale): an employee is presenting at Dreamforce, and hotel rates in San Francisco tripled. The cheapest flight was a red eye with two layovers. A VIP client demanded an emergency meeting tomorrow. A new mom needs a hotel room with a fridge for her breast milk.

Instead, embrace dynamic policies and budgeting with software. Tools like TravelBank ingest real-time data to create reasonable budgets based on market rates, travel dates, your policies, and destination. With dynamic budgets and policies, you’re shaping travel policies and budget expectations around the real world of travel, instead of squeezing trips into the mold of the spend max you set. The result is often more accountability and more appropriate budget guidelines for a wider range of destinations.

Common Challenges that Overwhelm Companies Without Policy Controls

Without travel and expense controls in place, companies will be challenged by:

- Overspending: Without clear guidelines on acceptable expenses and spending limits, employees may overspend on business trips, resulting in higher costs for the company.

- Lack of transparency: Without strict procedures for documenting expenses, it can be challenging for companies to track employee spending and identify any potential misuse of funds.

- Inefficient processes: Without standardized procedures for claiming and reimbursing expenses, the process can become time-consuming and costly for both employees and the company.

- Fraudulent claims: Without proper checks and balances, there is a higher risk of fraudulent expense claims that could result in financial loss for the company.

- Compliance issues: Without detailed policies, employees may not realize they aren’t complying with your travel and expense policies. Further, companies may struggle to comply with tax regulations and may face state or federal penalties for non-compliance.

Enforcing a Travel and Expense Policy

Your well-crafted new (or newly updated) travel and expenses policy promises to control spend and improve compliance. It only works, though, if you can get all employees on board to follow the procedures correctly.

>> Related: Why Employees are Unhappy with Your Travel Policy <<

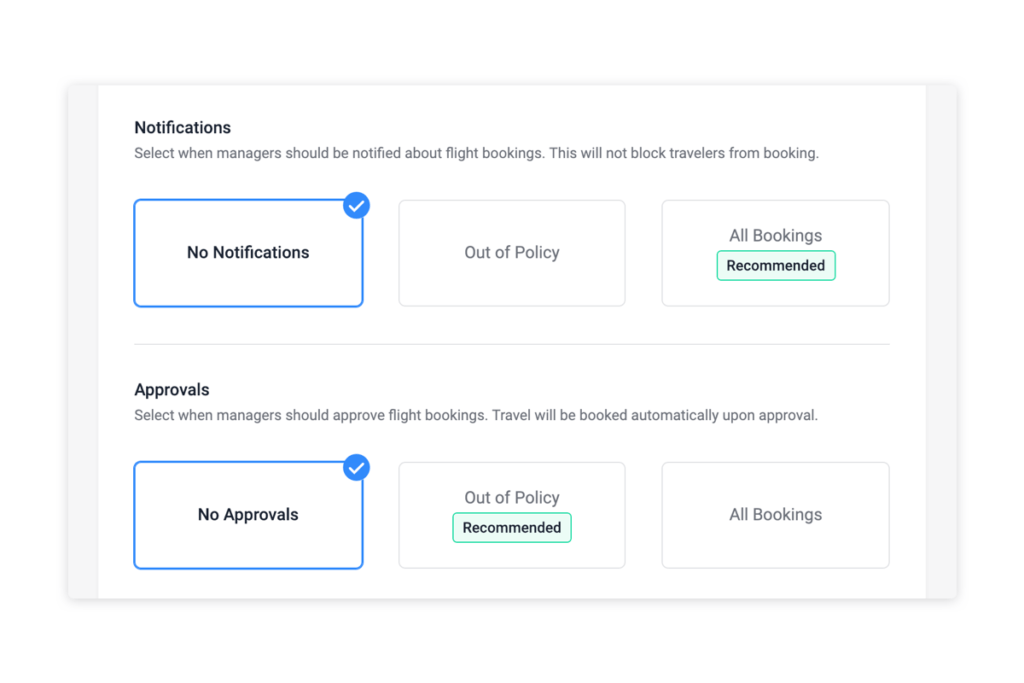

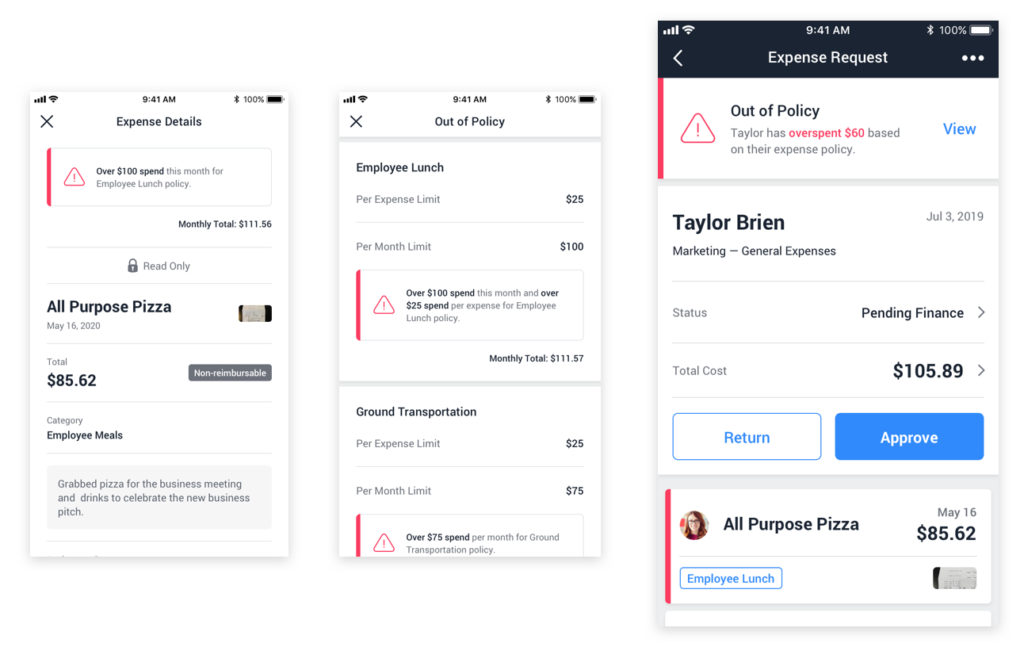

Carefully consider how you’ll document the policy, communicate policy changes, and answer personal questions. And, better yet, adopt T&E software that integrates your policy limits, so employees simply can’t book or submit non-compliant T&E.

Frequently Asked Questions

Why is it important for businesses to have well-defined travel and expense policies?

Having well-defined travel and expense policies promotes financial accuracy and accountability. Travel expense policies help curb extravagant spending or fraudulent expense claims, help employees understand what the company will reimburse, and clarifies what procedures they need to follow to receive reimbursement.

How do well-defined travel and expense policies benefit employees?

Well-defined travel and expense policies eliminate guesswork about what costs are appropriate, and what processes and timelines must be followed. Business travel expenses policies also help employees avoid out-of-pocket expenses that won’t be reimbursed later.

Do travel and expense policies apply to all employees?

Travel and expense policies usually apply to all employees in an organization. These policies act as a universal guide for managing travel expenses and ensure fair and consistent treatment across different levels of the company. So, whether you’re just starting out or a top-tier executive, you’re expected to follow the policy’s guidelines when traveling for work or incurring expenses. Of course, it’s important to note some positions might require more frequent travel or have higher expenditure limits. But the main goal of these policies remains the same: to maintain financial control and accountability for everyone.

If your business requires unique travel and expense policies for various departments, it may be time to invest in a travel and expense management platform like TravelBank that can help automate nuanced travel and expense policies and keep compliance high.

How often should travel and expense policies be reviewed and updated?

It’s a good idea for companies to review and update their travel and expense policies every year. However, if there are big changes in business operations, shifts in the economy, or updates in tax laws, more frequent reviews might be necessary. Regular updates make sure the policy stays relevant, fair, and aligned with the company’s financial goals and regulatory requirements. This process is important, but it’s also important to balance the company’s interests with employee adoption.