Are You Ready for These 2025 T&E Trends? CFOs Weigh In

Every year, TravelBank samples and analyzes hundreds of thousands of travel bookings and expense reports submitted on our platform. In our latest report, we saw three major shifts in 2025 T&E trends:

- General merchandise retailers like Amazon are now expensed more often than meals, hotel stays, and air travel.

- Food delivery apps (and their fees) are now more common than in-restaurant meals.

- And when it comes to ground travel, most business travelers use their own cars and expense gas and mileage.

If that sounds risky or inefficient, you’re not wrong. We hosted a deep dive on these T&E trends with the CFO Leadership Council and polled CFOs to see if their travel teams, H&R departments, and T&E policies are ready. In short, they aren’t.

Table of Contents

The Rise of Retailers

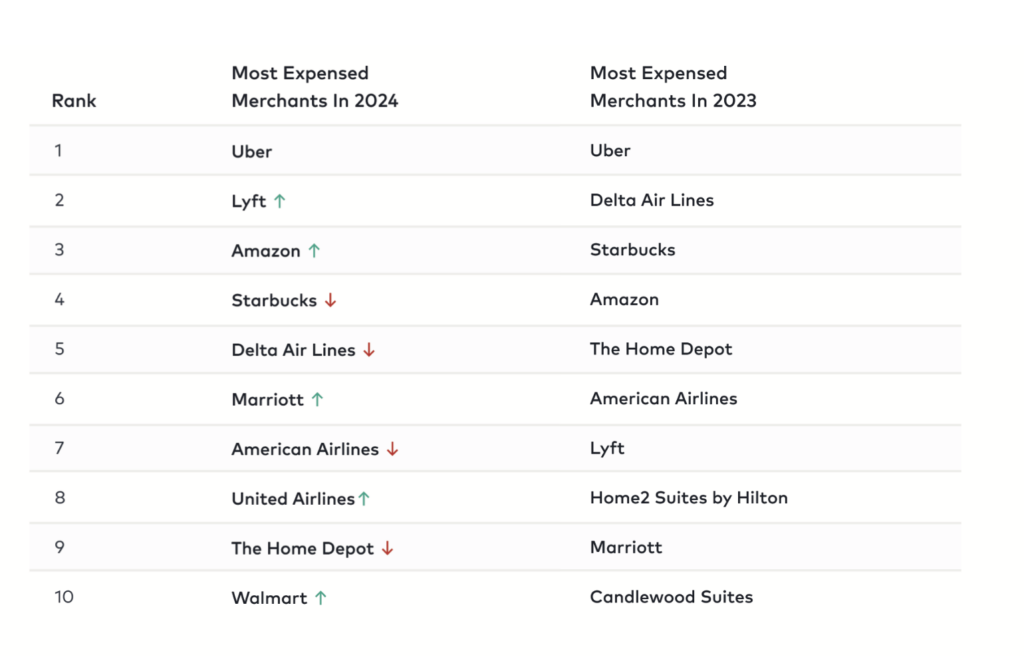

By far, the biggest of the 2025 T&E trends is the rise of business expenses from retailers like Amazon, Walmart, and Target. Retailers are now the most commonly expensed merchants – surpassing meals, hotel stays, and flights. And among retailers, Amazon was expensed more than 2x any other.

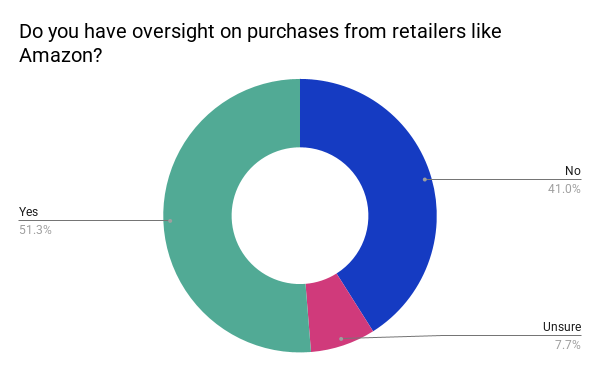

And yet, most companies have not adapted to the surge of business expenses from Amazon, Walmart, and Target. When we polled the CFO Leadership Council, almost 90% of organizations did not have a clear policy for general retailers like Amazon.

And unless companies used expense report automation software, they had to manually review receipts to see what was actually purchased.

Runaway Food Delivery Fees for Business Meals

Last year, UberEats surged to the second most popular merchant for business meals. Food delivery apps (and their fees) are now more common than in-restaurant business meals.

But food delivery app fees dramatically inflate costs – we’re talking 92% more expensive than the pickup price (source). And among the apps, UberEats has some of the highest and most unpredictable fees (source).

>> Related: How to Control Runaway Food Delivery Fees for Business Meals <<

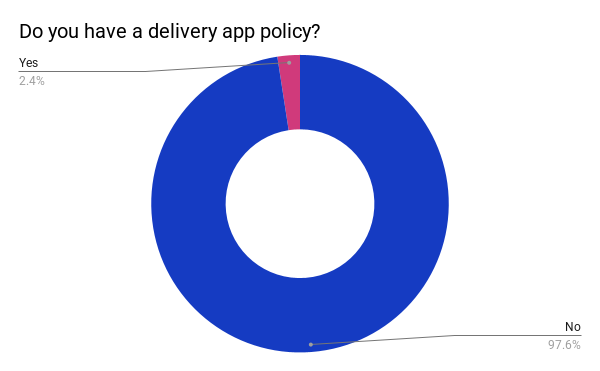

But when we asked CFOs if they’d clarified a delivery app policy to reflect 2025 T&E trends, more than 97% said no.

Paying a Parking Premium

In 2019, personal vehicles were used in just 25% of trips. But since the pandemic, the share of personal vehicle has grown to 63%. Most business travelers now use their own cars and expense mileage (at $0.67/mile, plus parking).

But daily parking rates are increasing. The average cost of day parking in Manhattan is now $69/day (source). And it’s cheaper to ride share to/from the airport than to park for a long weekend at 14 of the 50 largest U.S. airports (source).

>> Related: Is It Cheaper for Employees to Expense Mileage? <<

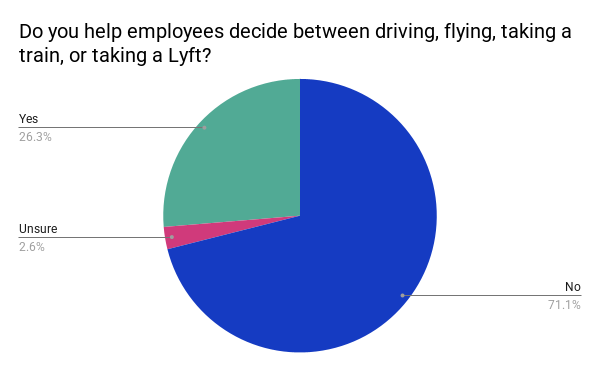

Yet when we asked if organizations are helping employees decide when to drive, fly, take a train, or use a ride share, 71% of CFOs said no.

The ROI of a Good T&E Policy

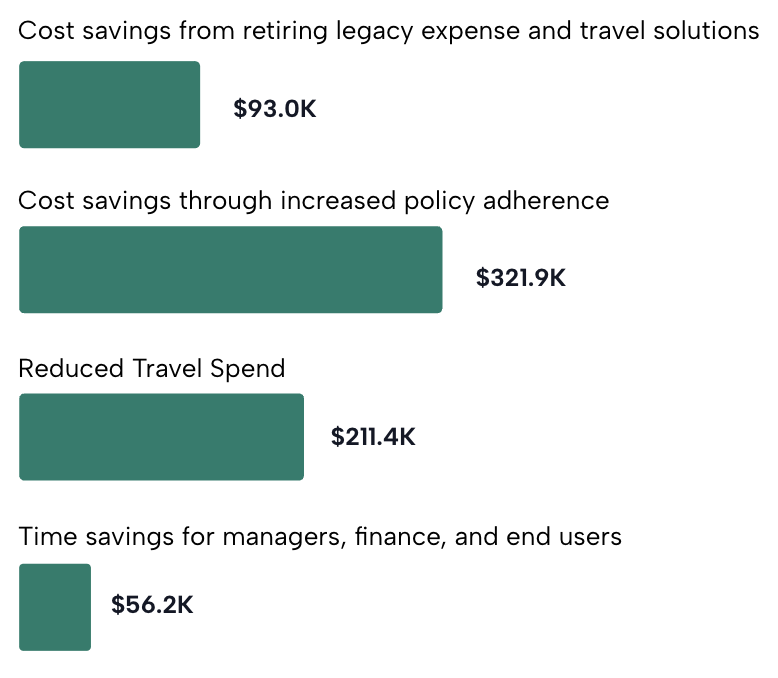

In the end, policy adherence is probably the most important part of T&E management. In our recent study with Forrester, they modeled that improving policy compliance nets the greatest financial benefit:

>> Related: What Does T&E Look Like in 2025? <<

Having a clear policy that reflects how employees spend T&E budget today will help minimize confusion and errors, and ultimately save time and money.

©2024 TravelBank. All rights reserved. The content above includes data and information from the 2024 State of Business T&E Report that is the proprietary property of TravelBank. Reproduction, distribution or use of the study, in whole or in part, without the express written permission of TravelBank is strictly prohibited. All trademarks are the property of their respective owners.