In 2019, personal vehicles were used in just 25% of business trips. But since the pandemic, the share of personal vehicle usage burgeoned to 64%, and continues to hold firm at 63% in 2024. This trend is cementing: most business travelers now drive their own cars and expense mileage.

We hosted a deep dive on these T&E trends with the CFO Leadership Council and polled CFOs to see if their T&E policies guide employees on when to drive their own cars. In short, they don’t. In this post, we dig into why you may want to rethink personal car use.

Table of Contents

Paying a Parking Premium

Most of us assume employees driving their own cars for business trips is cheaper and simpler, but it’s worth modeling the costs:

- The 2025 IRS mileage reimbursement rate is now $.70/mile.

- Road tolls, of course, cost more.

- And, most volatile, they’ll also need to park.

Daily parking rates at airports, hotels, and garages are dramatically increasing. The average cost of day parking in Manhattan is now $69/day (source). And it’s cheaper to ride share to/from the airport than to park for a long weekend at 14 of the 50 largest U.S. airports:

(source)

For many trips, a ride share, train, or commuter flight is actually cheaper. Consider a roundtrip from Portland, Oregon to Seattle, Washington. It’s about a 3-hour drive, and would cost $234 in mileage alone. Or you can fly roundtrip on Alaska Air for $137.

>> Related: What Does T&E Look Like in 2025? <<

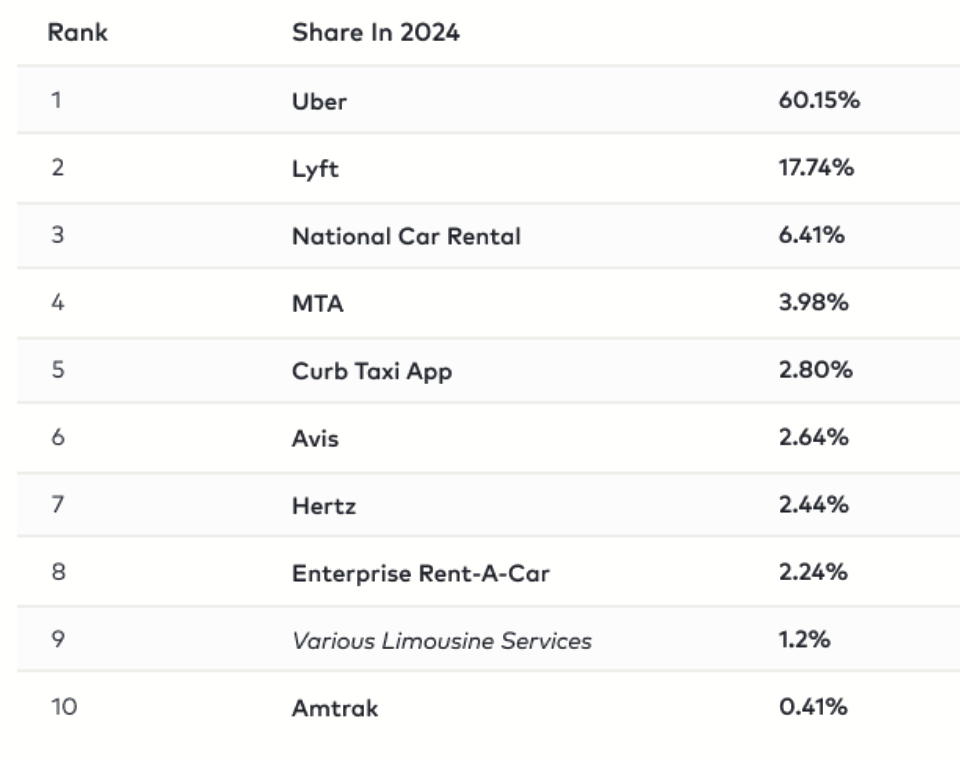

Train travel can be even cheaper, especially since it brings travelers to city centers and reduces taxi or ride share costs. Yet in 2024, limousines were more common than trains!

Don’t Overlook Risk

The Bureau of Transportation Statistics reports there are ~13 car accidents every 60 seconds in the United States, adding up to ~6.75 million accidents each year across the country, and costing ~$340 billion (source).

Given how common they are, there’s a possibility employees will be in accidents when they use their own cars for business trips. Your policy needs to address whether the employee’s insurance will be used as the first line of coverage, and what happens if/when the claim exceeds the employee’s policy.

It simply may be cheaper to forego personal car use, negotiate with a car rental company, and build-in the necessary insurance coverage. (The thresholds for these negotiated rates are lower than you may think. Spending just $5,000-10,000 a year in rental cars is enough to secure a good rate.)

A Policy Gap when Employees Expense Mileage

It’s worth unraveling “ground” costs and looking individually at mileage, parking, and tolls. Similarly, you may have common routes that are more wasteful than others. If you have an expense tracking platform, it’s even easier to find these spending categories, and then scrutinize them. Do certain regions or teams expense mileage more often? Who are your big spenders? And does that information align with your business goals?

>> Related: The Importance of Well-Defined T&E Policies <<

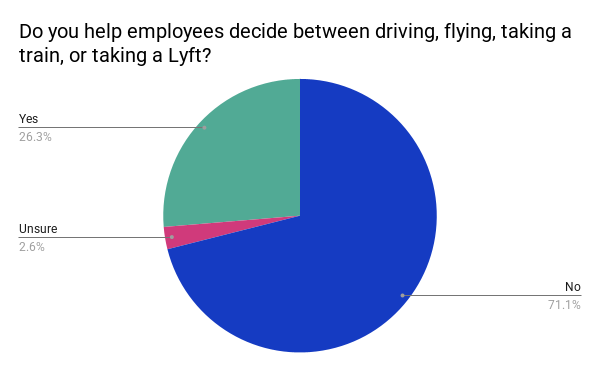

No doubt it’s nuanced and relies on employees and their managers accurately forecasting costs. Yet when we asked if organizations are helping employees decide when to drive, fly, take a train, or use a ride share, 71% of CFOs said no.

The ROI of a Good T&E Policy

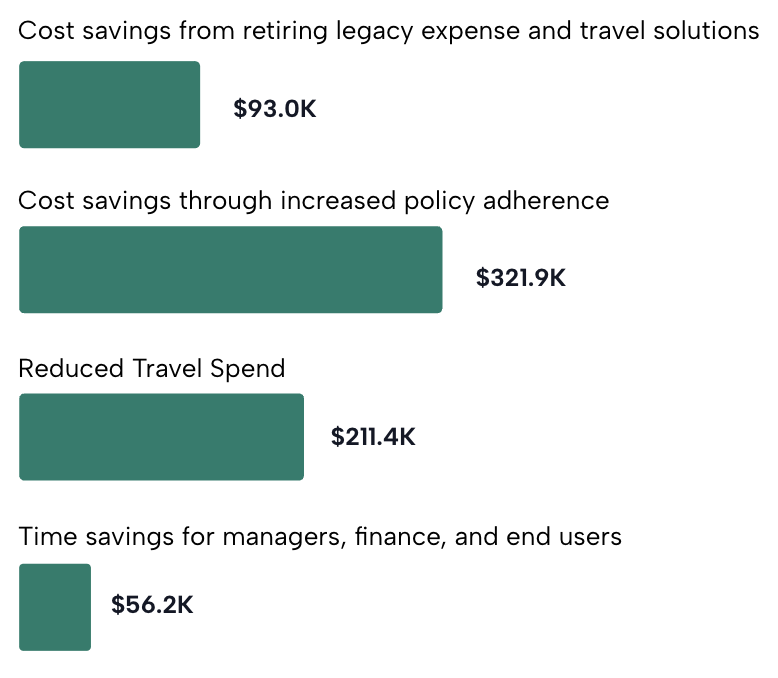

In the end, no matter the policy, adherence is the most important part of T&E management. In a recent study conducted by Forrester Consulting, they modeled that improving policy compliance netted the greatest financial benefit:

Companies simply have to create modern T&E policies that reflect how employees travel and work in 2025, not in 2019.

©2024 TravelBank. All rights reserved. The content above includes data and information from the 2024 State of Business T&E Report that is the proprietary property of TravelBank. Reproduction, distribution or use of the study, in whole or in part, without the express written permission of TravelBank is strictly prohibited. All trademarks are the property of their respective owners.