Highlights

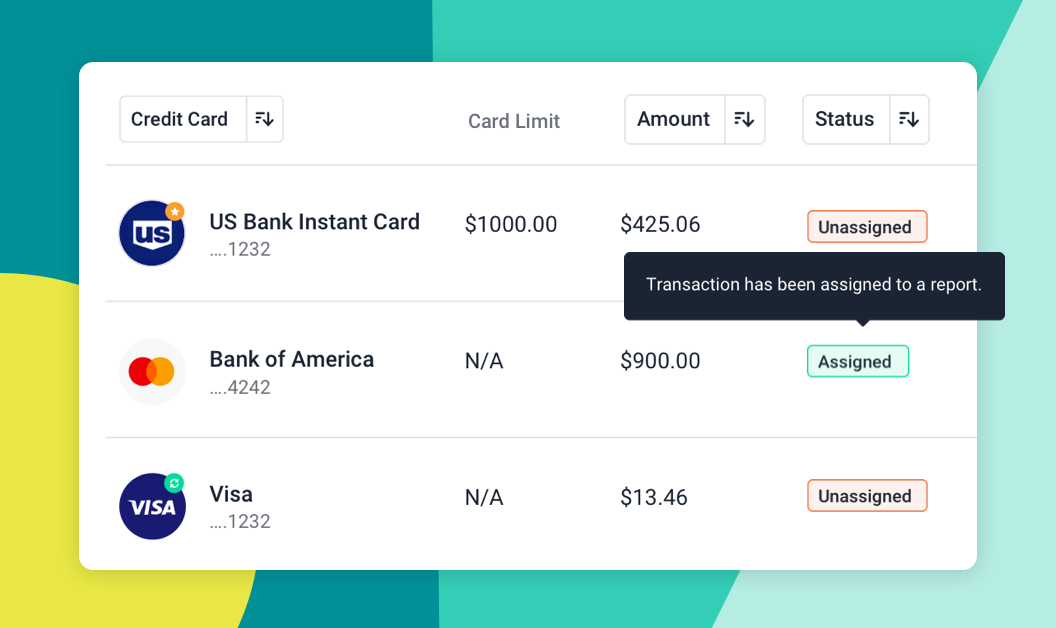

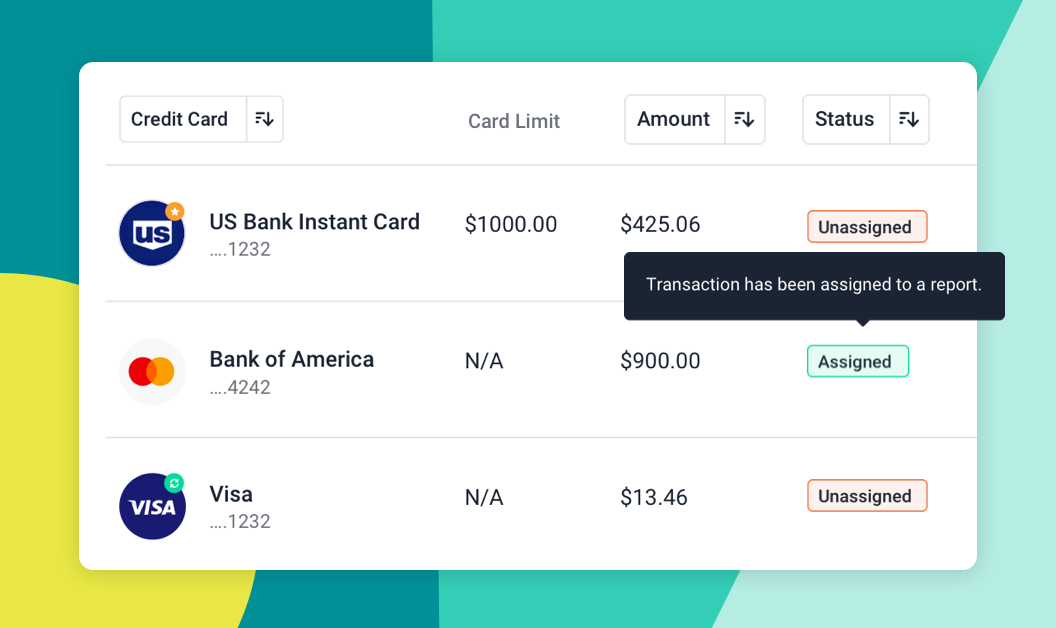

Looking for an expense solution that allows you to automatically sync transactions and card information? Reconcile your corporate card transactions with statuses that allow you to see exactly which transactions have and have not been submitted.

Optimized Costs

Guide your teams to stay on budget with one intuitive platform for tracking all card spend.

Maximized Productivity

Eliminate the headache at month’s close with a reconciliation process that takes seconds.

Improved Experience

Easily extend purchasing by issuing virtual cards, or sync any personal or corporate card for real-time tracking.

Features

Virtual Cards

Enable Contactless Payment

With TravelBank +

U.S. Bank Instant Card® create virtual cards, track transactions, and manage budgets on one platform.

Expense Management In One Place

Our travel and expense system allows you to sync any card, virtual or plastic, and track each transaction and compliance status within the management dashboard.

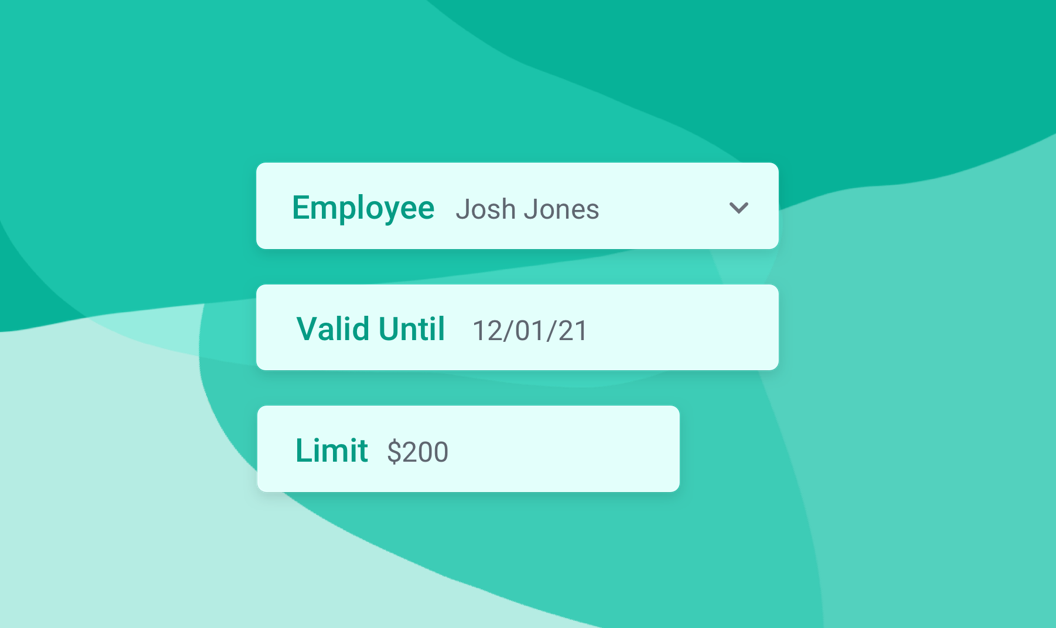

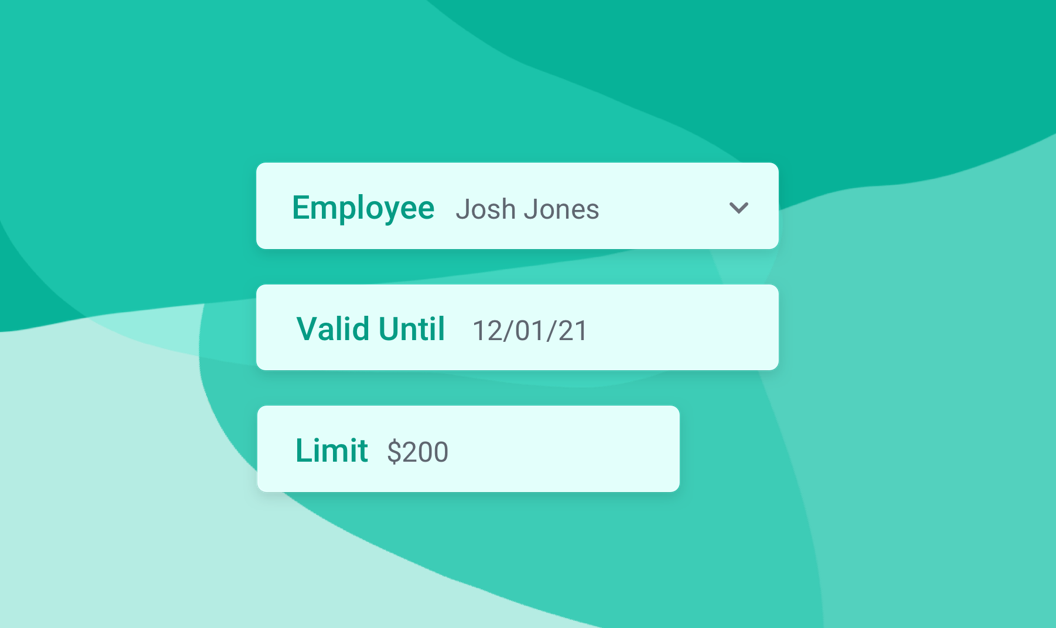

Send Cards Virtually

Issue unlimited virtual corporate cards with our U.S. Bank integration. Set budgets and expiration dates then assign to anyone who needs it, all within the TravelBank app. With instantaneous purchasing power, individuals (contractors, consultants, job candidates, etc) get what they need while you track transactions and compliance in real-time.

More about virtual cards

Sync with Any Card

Other providers may require you to switch your current card to theirs, or charge you fees when you don’t. With TravelBank, use the card that works best for your company. TravelBank supports and imports transactions from over 48,000 personal and corporate cards and banks.

![]()

Quickly Pair Transactions

See synced transactions and manually created expenses in one view and easily merge expenses and your receipts with card transactions.

Integrations

Seamless Integrations

Map expense categories and synchronize expense reports, reimbursements, and corporate card data between your current products and TravelBank.

Save company money when you manage spend in one place

The Business Guide to Adopting a Virtual Card Setup

Your employees need a fast and efficient way to make purchases and keep operations moving.

Checklist: 7 Ways to Maximize Virtual Card Value

In this checklist, you'll learn seven strategies to grow, optimize, and protect the value of your virtual card program.

Best Practices for Corporate Credit Card Management

With smart corporate credit card management, Finance teams can ensure budgets are followed.

Answers to your questions.

How does it work?

![Collapse Arrow]()

The TravelBank card management tool syncs with all major corporate credit cards, both plastic and virtual. All transactions are available in the TravelBank expense reporting solution. The reconciliation tool provides your finance team with visibility into the real-time status of every expense, anytime and anywhere – gone are the days of waiting for expense reports to be submitted by users.

How do I sync my corporate card with TravelBank?

![Collapse Arrow]()

First, you'll need to identify your corporate card to see if it’s supported within the app. If your card is provided by one of the 48k bank vendors we already sync with, set up takes seconds. Your transactions will immediately start syncing. If your card is with a bank we don’t yet connect with, our team will work with you and your bank of choice to enable a seamless transaction sync.

How do I assign corporate cards to my employees?

![Collapse Arrow]()

Once your corporate card is set up, you can assign cards to employees within TravelBank. Expenses are synced to your employee’s credit card feed, allowing your employees to easily submit expenses reports with transaction data ready to go. Admins have access to a dashboard, enabling them to view all credit card transactions throughout the company.

What is corporate credit card management?

![Collapse Arrow]()

Corporate credit card management refers to the processes and systems implemented by an organization to effectively manage and control the usage, expenses, and reconciliation of corporate credit cards.

How can corporate credit card management help my company?

![Collapse Arrow]()

Implementing an efficient corporate credit card management system can help your company streamline expense tracking, automate reconciliation processes, ensure compliance with expense policies, and simplify the overall management of employee expenses.

What are the benefits of using corporate credit card management software?

![Collapse Arrow]()

Corporate credit card management software provides real-time visibility into card expenses, automates approval and reconciliation processes, and allows for better expense tracking and reporting. It helps save time and money, improves accuracy, and enhances overall expense management efficiency.

How does corporate credit card management software work?

![Collapse Arrow]()

Corporate credit card management software automates the entire expense management process. It integrates with corporate credit card providers and accounting software like QuickBooks or NetSuite, pulls transaction data in real-time, streamlines reconciliation, enables employee expense tracking, and simplifies expense report creation.

Can corporate credit card management software handle multiple cardholders?

![Collapse Arrow]()

Yes, most corporate credit card management software can handle multiple cardholders. It allows for centralized management and provides individual card feeds for each cardholder, ensuring that all transactions are captured accurately for their respective expense reports.

What is the card reconciliation process in corporate credit card management?

![Collapse Arrow]()

Card reconciliation is the process of matching credit card statements with related receipts and expense reports to ensure accuracy and identify any discrepancies. Corporate credit card management software simplifies this process by automatically reconciling transactions and flagging any potential issues.

How can I make expense reimbursement easier for employees?

![Collapse Arrow]()

Implementing a corporate credit card management system can help make expense reimbursement easier for employees. These systems allow employees to easily capture receipts, create expense reports, and submit them for reimbursement, reducing the administrative burden.

Is it possible to manage personal credit card expenses through corporate credit card management software?

![Collapse Arrow]()

While corporate credit card management software primarily focuses on managing corporate credit card expenses, some solutions offer the option to integrate personal credit card expenses as well. This allows for a comprehensive expense management system that covers both corporate and personal expenses.