4 Best Business Expense Tracker Apps in 2023

Staying on top of expenses and having visibility into corporate spend can be one of the biggest challenges to your business. While far from a walk in the park, making sure your team keeps track of receipts and expenditures, files expense reports in a timely manner, and properly allocates purchases is essential for accurate operations and budget forecasting. Fortunately, business expense tracking apps are available to not only make it easier for your employees, but also help improve visibility into company spend and can help reduce costs.

>> Related: Automation Is Now the Foundation of Corporate Travel, Payment, and Expense Software <<

However, finding a good business expense tracking app is hard! You need to consider what features are essential for your company, pricing, implementation, and ease of adoption across your organization.

What is a Business Expense Tracker App?

Let’s start with the basics. Business expense tracking apps are reporting tools that assist in streamlining finances by simplifying expense documentation, receipt capture process, reporting, and approvals.

How Does an Expense Tracking App Work?

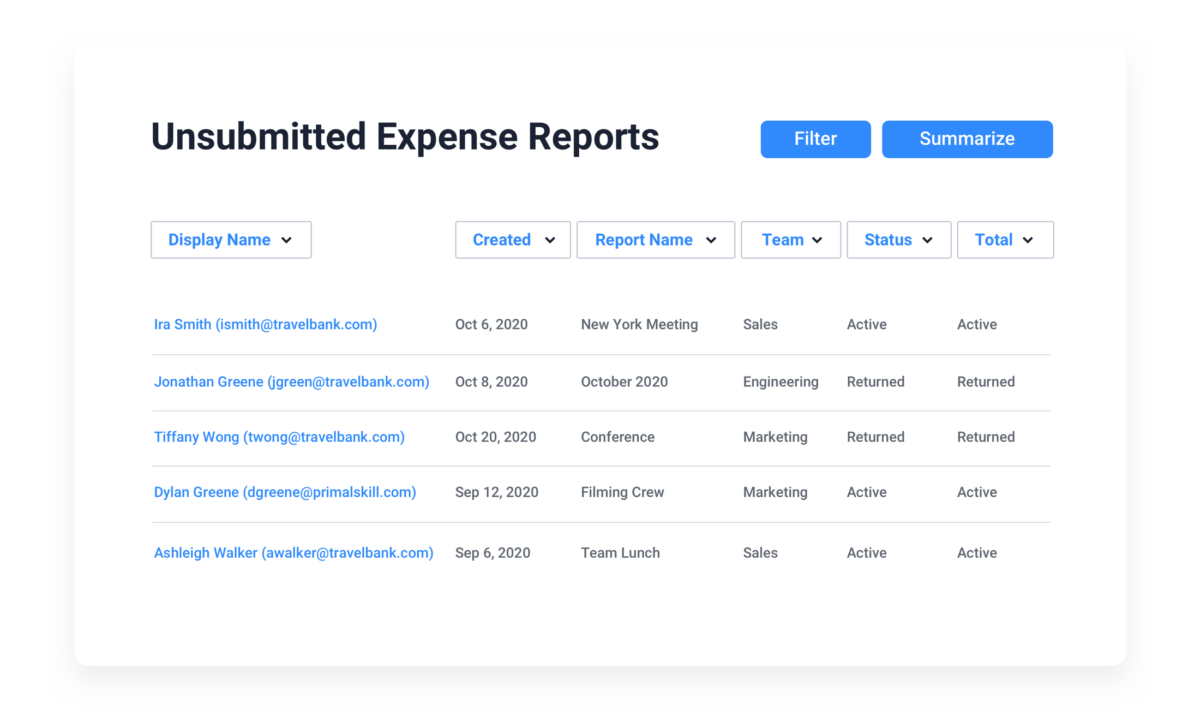

A business expense tracking app allows for the upload of receipts, as well as expense and mileage recording. Typically the tracking technology is available in both mobile and desktop versions, and enables employees to capture receipts and track expenses on-the-go. The technology then organizes the data and transforms it into reports that can be saved, sent for approvals, or analyzed by finance teams.

TravelBank, for instance, offers an intuitive app that manages business expenses and travel needs. Your team can capture receipts on-the-go and we’ll automatically scan them into expenses. You may also invite managers to automate approvals and reimbursement, or simply use it as a business expense tracker for tax purposes.

What Features Should a Business Expense Tracking App Have?

If you have yet to implement a business expense tracking app, or are looking to change providers, it’s important to understand the available features and review the strengths and weaknesses of what is available in the market today.

Here are the eight top features your business expense app evaluation team should think about:

1. Ease of expense capture

Can employees easily upload photos of receipts? Is there a mobile app? Can employees or admins bulk import transactions or sync a credit card?

2. Transparent pricing

Fine print matters. Some vendors require you to switch your current corporate credit card to theirs, or pay double if you don’t.

3. Fast and instant receipt scanning ability

Does the platform offer OCR (Optical Character Recognition) so that employees and accountants do not have to hand-enter receipt costs?

4. Automated reports

Both admins and department managers should be able to track and report on every metric within their respective teams. Look for reporting capabilities that help you visualize real-time spend, monitor compliance, schedule reports, and track outstanding expense reports.

5. Transparent expense visibility

Are approved expense reports automatically synced to the general ledger? Can you see draft expense reports and anticipate future expenses?

6. Easy and hassle-free approvals

Can managers review and approve expense reports from any device. Are notifications and “red flags” automated? How many clicks does it take to approve a trip or expense report? If a manager needs to reject a trip or report, can they add comments explaining why?

7. Sync with personal and corporate cards and banks

Can employees import transactions from their virtual or plastic cards? Personal or corporate cards? Or are they limited to certain providers?

8. Travel expense management functionality

Can employees book all flights, hotels, and cars on a single platform? Are trip fares automatically converted to draft expense reports? Can employees troubleshoot with travel agents 24/7 via phone, chat, Slack, and/or email?

For an in-depth review of features for your evaluation committee to consider when looking into an expense tracking app and other tips, check out our post, Making the Leap to Managed Travel: Buying Process Considerations.

Best Business Expense Tracker Apps

In the meantime, here’s a quick comparison of the strengths and weaknesses for some of the most popular expense management options on the market today for small-to-midsize businesses (SMBs).

Microsoft Excel

Microsoft Excel is a spreadsheet editor. It has calculation or computation capabilities, and pivot tables for manual tracking. Here is a sample business expense template that you can clone >

- Strengths: Excel is the lowest cost option available, but it requires a good amount of manual lift. It is still leveraged by SMBs that don’t want to spend money on an expense management tool.

- Weaknesses: While the spreadsheets can be customized, they leave lots of room for human error thanks to the manual data entry component. Due to the inability to put in controls; poor policy compliances and additional work for the finance team is an absolute weakness.

- TravelBank Advantage: In comparison, TravelBank integrates expense and travel policies into one platform and makes it easy to keep guidelines current and ensure employee compliance. Finance teams benefit from more accurate data and reconciliation thanks to features like general ledger sync, and due to the user-friendly platform, expense submission is more timely and accurate. Additionally there are time and cost savings associated with automation of expense reporting.

Expensify

Expensify offers a user-friendly platform with an in-house corporate card to simplify policy compliance and reconciliations.

- Strengths: The receipt scanning portion of the app is very accurate and it integrates with accounting, human resource management systems, and travel platforms.

- Weaknesses: Expensify is known for its poor customer support, a very light touch account management team, and aggressively pushing their corporate card on its customers. For non-card users, the pricing is very high. Additionally, it does not offer a travel management component and relies on integrations with other managed travel companies.

- TravelBank Advantage: TravelBank offers a clear advantage over Expensify. First, TravelBank works with all company cards, not just one, and customers aren’t penalized for not using a certain card. Second, and most importantly, we offer an all-in-one travel and expense management solution, not just expense management. This allows you to roll-out a single platform to capture expenses and book travel to your team, and wrap policies directly into the tool to enhance compliance.

SAP Concur

SAP Concur is a suite of softwares that automate, connect, and simplify expense, travel, and AP processes.

- Strengths: SAP Concur has a large market presence and is well known by finance leaders for its strong reporting, reconciliation tools, and enhanced features for admins. Concur also provides a decent integration between its travel and expense platforms.

- Weaknesses: Concur is known for its sub-par customer support, extremely high price point for small-to-midsize businesses, antiquated technology and app, and slow implementation.

- TravelBank Advantage: TravelBank can deliver the key functionality needed by SMBs, but at a fraction of Concur’s price tag. We provide personalized onboarding, fantastic chat support, and a seamless sales and implementation process. Our ability to rapidly change policy and workflows is a user favorite and our customers know they are getting an industry-leading travel and expense management tool.

The TravelBank Difference

If you are looking to have better control over your travel and expense management, improve adoption and compliance through a superior user experience, all while saving significant time through automated accounting processes, we’ve got a solution for you.

TravelBank’s customers enjoy the benefits of the first all-in-one natively built travel, expense, and virtual card solution for SMBs across three platforms (Web, iOS, and Android). In addition to a unique rewards program that drives up to 30% cost savings, TravelBank offers a one-stop-shop for T&E management, and strong integrations with HR systems, employee resource planning software, and general ledger tools to reduce manual entry.

Frequently Asked Questions

1. Why should I use a business expense tracker app?

Using a business expense tracker app can bring numerous benefits to small business owners. It helps to streamline the expense tracking process, ensures accurate record-keeping, provides better control over business spending, enables real-time expense tracking, and simplifies the task of generating expense reports.

2. What is the best business expense tracker app?

The best business expense tracker app may vary depending on your specific needs and preferences. However, some popular options include TravelBank, Concur, Excel, Zoho Expense, Expensify, QuickBooks Online, FreshBooks, and Shoeboxed. It is recommended to compare the features, pricing, and user reviews of different apps to choose the one that aligns with your requirements.

3. Can I try a business expense tracker app before purchasing?

Most business expense tracker apps offer free trials for a limited period. This allows you to test the app’s features and functionality before making a purchase decision. Take advantage of the free trial to determine if the app meets your business needs and if it is easy to use.

4. How can a business expense tracker app help me with expense reporting?

A business expense tracker app can significantly simplify the expense reporting process. By using the app, you can easily categorize expenses, attach receipts, and generate comprehensive reports with just a few clicks. This eliminates the need for manual calculations and reduces the time and effort required for expense reporting.

5. Is there a business expense tracker app that offers a free plan?

Yes, TravelBank and some other business expense tracker apps offer a free plan with limited features or usage restrictions. This can be a good option for small businesses with minimal expense tracking requirements. However, keep in mind that the features and functionality offered in the free plan may be limited compared to paid plans.

6. How can a business expense tracker app help small businesses?

A business expense tracker app can help small businesses in several ways:

- Expense Tracking: The app allows small businesses to easily track their expenses in a digital format, eliminating the need for manual record keeping.

- Expense Categories: It provides predefined expense categories that can be customized to suit the business’s specific needs.

- Expense Management: The app enables businesses to manage their expenses effectively, helping them identify areas for cost savings and budgeting.

- Record Keeping: It allows businesses to securely store and organize their expense data, making it easily accessible for future reference or tax purposes.

- Financial Analysis: The app provides insightful reports and analysis of the business’s expenses, allowing owners to make informed financial decisions.

- Mileage Tracking: Some business expense tracker apps also offer mileage tracking features, which are beneficial for businesses that require frequent travel.

- Integration with Accounting Software: Many expense tracker apps integrate with popular accounting software, such as TravelBank Expense, simplifying the process of syncing expense data.

Ready to learn more? Check out our Expense Buyer’s Guide >