Expert Advice: Reducing Costs in Face of COVID-19 Economic Impacts

TravelBank’s CEO & Co-Founder, Duke Chung, and Head of Business Operations, Iris Yen, were recently joined on a webinar by Rafael Casas, Senior Accountant Advocate for Sage to discuss the challenges of streamlining operating costs in a market downturn. The recording is available and below we’ve covered some highlights from the tactical advice they shared.

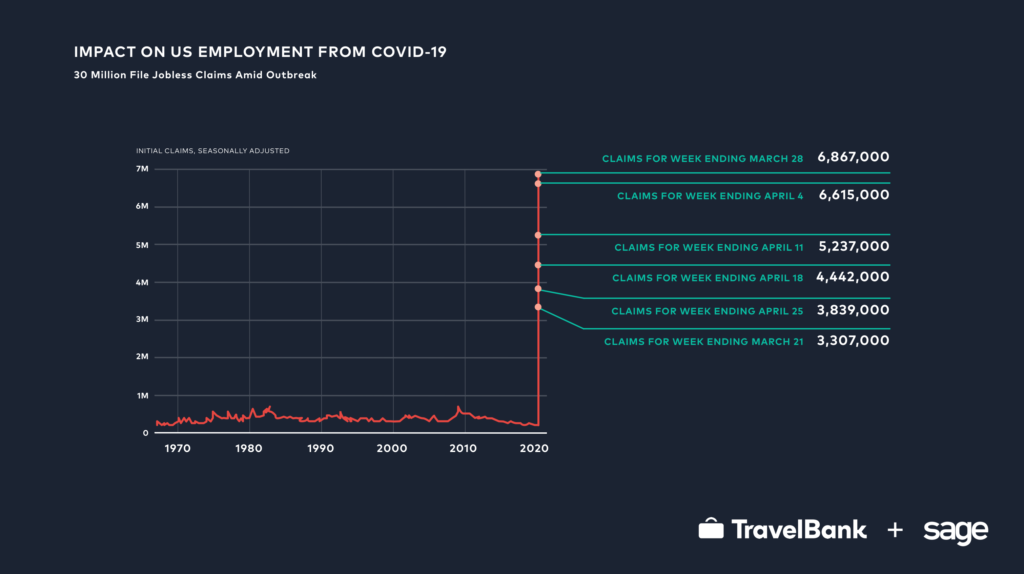

COVID-19 Current Economic Impact

The economic impacts of COVID-19 are astounding. In the past few decades, there hasn’t been anything quite like it.

There are very few businesses that are going to see net neutral financial impact. For most businesses, we’re seeing anywhere from 25% to, scary enough, 90%-plus revenue impact. An example of that would be our industry, the travel industry.

We started 2020 with a strong economy in a high growth phase, and suddenly we’re seeing a deep shock. Conserving cash and preserving your runway is going to become the top concern for all businesses. The hardest part of this current crisis is that it’s unknown when business will return to normal.

Opportunity for Understanding

Everyone is feeling some effect financially but this is an opportunity to understand a couple of things. How are you set up for success to understand what your business and financial position actually looks like? Do you have the tools in place?

It’s important to understand your cash flow. You may have thought you were healthy, but you may not have the technology to understand what your business should look like. For example, only three months runway shows that a business wasn’t healthy to begin with. Some fundamental things that any business can do are to have the right accounting package, understand where that data is stored, and align to a CPA to help you understand the story behind the data.

When You Need to Shift Operating Costs Quickly, What Do You Focus on First?

As a corporate travel startup, we were at the vanguard of seeing that very scary drop in which revenues dropped significantly in a short time. It was like “skydiving without a parachute.”

We had to take a step back, take a deep breath, and plan.

Planning is really important. First, you need to have a good fundamental understanding of your cash flow and your cash position, and that starts with scenario planning. Creating a matrix of revenue impact is a great exercise.

Categorize Costs

Create multiple scenarios and really understand how much cash you need to sustain your position. Model out anywhere from 25% to 75% impact, which will obviously vary depending on your industry. The other axis would be when you expect your business to return to normal. Again, sadly for us in the travel industry, the return to business as normal is quite uncertain.

Second, take an inventory of all of your expenses and sort them into categories such as:

- Variable or fixed

- Mission critical or discretionary / nonessential

- Department

- Type

Low-Hanging Fruit for Reducing Costs

Good areas to start trimming back include costs that are variable, discretionary, and don’t have substantial business impact, such as:

- Parking and commuter benefits

- Marketing and PR

- Recruiting

- Events and conferences

- Software licenses

Small businesses can see if they can mitigate costs from vendors and defer payments on bank loans. That revolves around the financial modeling you’ve built with your finance team.

Reevaluate Your Business Holistically

The prerequisite of all this is to reevaluate your business. Look at it holistically and understand what areas of your business may be costing more than you thought. Getting aligned with a CPA is really important as it can help you find areas for financial improvement where you may not have the expertise. It’s also important to have the right tech stack that helps you pivot to quickly shift operational costs and as well as shift revenue.

>> Related: Strategic Business Spend Management for Growing Businesses <<

Controlling Costs in Today’s Environment

Discipline of Cost Control Must Prevail

The recovery from COVID-19’s economic impact could be much longer than anticipated. Even when we come out of shelter-in-place, business as usual may not be what we were accustomed to two months ago. For the travel industry, 9/11 is the closest analog. It took two to three years for travel to resume to previous levels.

In the short term, do as much as you can to sustain yourself. Businesses should be looking into loans to tide you over, such as the PPP program, the economic injury disaster loan, and various SBA loans available from city and state governments. However, discipline of cost control has to be a prevailing mindset for a period of time, even once things pick up.

Flowing with The Go for a Marathon

Like the jujitsu principle, “It’s not that you have to go with the flow. It’s flowing with the go.” Everything is going to be completely adaptive and you have to focus not just on the next step, but what’s five steps ahead. This is where financial modeling is really important to look at different scenarios and plan for them. This is going to be a marathon, and PPP, SBA loans are not going to be right for everyone.

But there is hope out there. During the 2008-2009 recession, some big companies like Venmo, Uber, Slack, and WhatsApp were able to shift their business models and do really well. Just make sure you’re aligned internally and with the right partners.

Rethink how you previously set up expense categories

The hardest expenses to adjust are those that are fixed, for example long-term lease. Most commercial leases are from five to 10 years. Your negotiating stance depends a lot on the outcome you desire, as well as your cash position. For example, if you have just a few months left on your lease, you can talk to your landlord about potentially doing an early termination. Also consider rent abatement or rent deferrals. Some companies are choosing to relinquish their security deposit as an early termination penalty.

Get Creative with Contracts

Carefully study various cancellation terms and policies in contracts. Some contracts have a force majeure: a legal term for an extraordinary event that prevents you from fulfilling your obligations and therefore frees both parties. For example, during the pandemic, an events venue provider cannot fulfill their obligations. That may be an avenue for you to work with and potentially defer payments or change to another date.

In This Together

Try being transparent about your situation. Most partners and vendors you reached out to will be very helpful and understanding. We’re in this together, all experiencing varying degrees of impact.

Benchmark items to see if your cash flow estimations are reasonable and get an indication of over or under spend. This will help you prioritize the partners and vendors you reach out to. If you don’t have a CPA who can help, this SOS business planning guide is a great resource.

Balancing Employee Needs

Your employees are going through difficult, disheartening times. So how does a company balance the needs of employees with ensuring business continuity?

At TravelBank, general understanding and a culture of flexibility have been hugely beneficial and helpful. We have a lot of trust that people will get their tasks done, but we all acknowledge that the timelines have to be more fluid. In this environment, small steps can go a long way, such as enabling employees to expense their lunch for virtual lunch hours to help maintain team bonds.

Sage has encouraged employees to go outside, get creative routines, and be mindful, including partnering with meditation app Headspace.

Innovation doesn’t have to be shiny and wild. Smaller disruptions can make a difference.

How to Negotiate Discounts

Your negotiation stance will differ depending on several factors:

- How critical is getting this contract to the ongoing business?

- How much does it cost?

- What’s the length of the contract?

- What’s your desired outcome, maintaining a strong business relationship with this vendor or driving the lowest cost?

Resources to Help Businesses Streamline and Reduce Costs

- Sage COVID-19 Resource Center

- AICPA COVID-19 Resource Center

- CARES Act Overview: Small Business Guide and Checklist

- Collective CPA SOS Business Planning Guide

Not all programs will be great for your business, which is why aligning with your finance team is important. Many smaller banks were able to get funded, so going through small community banks as opposed to the larger banks may help when you apply for the PPP loan. There’s an SBA loan finder on the treasury sites and you can find institutions around your area.

Negotiating Existing Contracts

For existing contracts, talk with your vendors and considering the following options:

- For solutions you may use in the near future, just not presently, ask about deferring the contract and payments for a few months.

- If you do not foresee yourself using it the near future, such as recruiting software, see if you can gracefully part ways.

Consider shifting payments to a different product the vendor sells instead.

Renegotiate for a lower quantity, such as fewer software licenses.

If you haven’t yet signed a contract, think about what kind of flexibility you can build into the contract. For example, commercial real estate, you could ask for discounts, a shorter lease period, or more tenant improvements. Putting more wiggle room into these contracts, whether from a cost or cancellation perspective, could be a lifesaver for your business.

Vendors and Customers Helping One Another

Doing what you can to help your vendors and customers is going to speak volumes right now. Duke, TravelBank CEO, shared, “Many of TravelBank’s vendors are our customers too. In the last couple weeks, I’ve been approached by a few of the CEOs of our vendors. They offered us their software for free for the next six or 12 months to help us get through this process. I couldn’t believe it actually. It was really unexpected and amazing.”