How to Pilot Finance Automation with TravelBank

TravelBank can help your team pilot finance automation and tackle your travel and expense management automation needs. In this post, we’ll discuss how our comprehensive platform is designed to simplify all aspects of corporate travel and expense management, and how organizations can use TravelBank to easily automate travel and expense management processes for maximized productivity and cost savings.

Introducing TravelBank: An Easy-to-Use Platform for Expense and Travel Management Automation

At its core, TravelBank is one platform for all your business spend management needs so your team can consolidate the work associated with managing expense and business travel, gain more visibility into spend, and maximize productivity. Some key features of the TravelBank platform include:

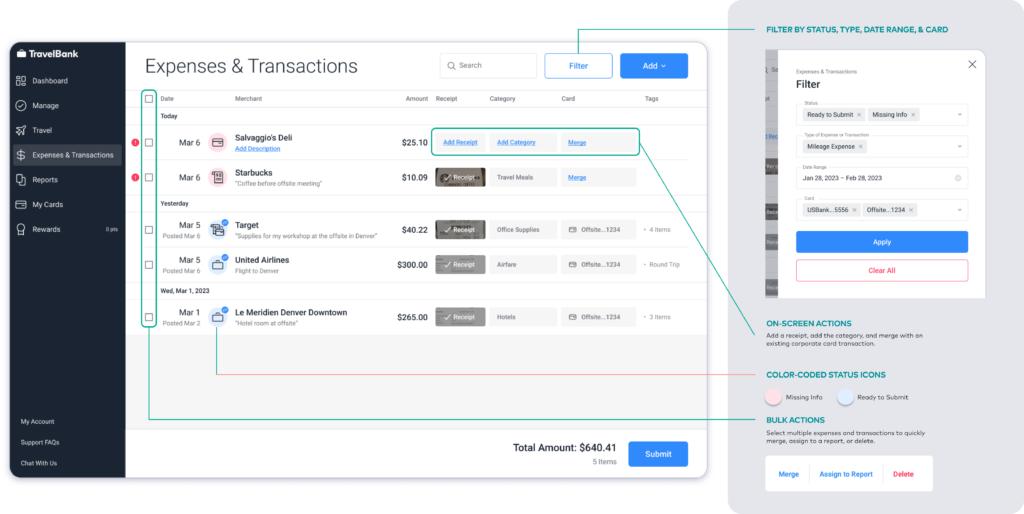

An intuitive expense tracking and management system

TravelBank allows your finance team to streamline your expense management with automated expense reports, one-tap approvals, and visibility into your company’s spend.

When your employees use TravelBank to track their expenses, they can snap a photo of their receipt on the go or sync their personal, corporate, or virtual card to import transaction details. When they snap receipt photos OCR (optical character recognition) and machine learning help fill in the expense details.

TravelBank technology helps match imported transactions with receipt photos and flags potential duplicate expenses, reducing the occurrence of time-consuming errors. If the employee tries to submit an incomplete report, flags will alert them of any missing expense details or missing receipts, so your finance team is rejecting fewer expense reports and doesn’t have to chase down missing details.

Upon submission of an expense report, TravelBank generates a PDF of the report and emails it to the employee and their manager, and the report is routed through the approval flow designated for their department. Approvals can be done in one tap and are documented for auditing purposes. Approved expenses automatically sync with your general ledger or ERP, and reimbursements can be processed in as little as 24 hours.

>> Related: How Much Does Expense Management Software Cost? <<

Built-in policies that guide employees to compliance

As a part of onboarding, your team will be guided to set up expense and travel policies that range from out-of-the box to fully customized. When employees start booking and tracking expenses, in-app guidance ensures employees follow the policy rules you’ve dictated.

On the TravelBank booking platform, a trip budget is automatically calculated for every search based on real-time market rates and your policy parameters. Search results highlight travel options within budget and flag the options that go over budget. Your finance team has the option to prevent over budget bookings or trigger an approval process if an over budget booking is selected.

Your finance team also has the option to take compliance one step further and encourage employees to spend under their trip budgets in exchange for rewards. If opted in to the TravelBank rewards program, travel search results will display potential rewards earning for under budget options to encourage employees to make better decisions.

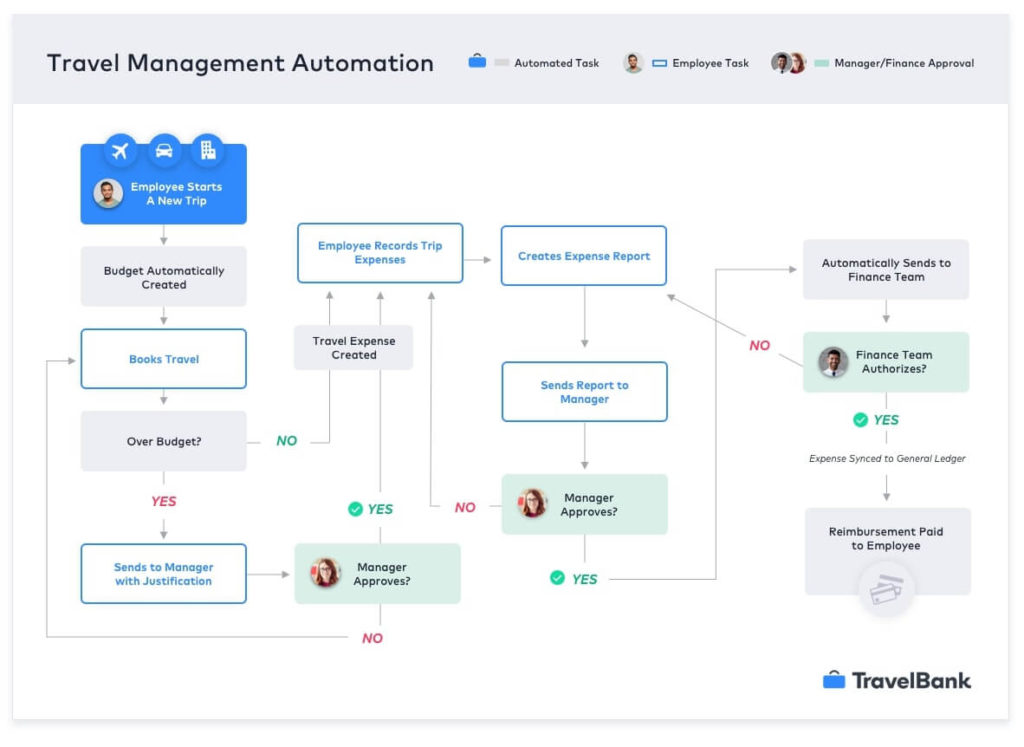

Automated approval routing for trip bookings and expense reports

Our software routes trip bookings and expense reports through the necessary approvals as defined by your policies and company settings. These flows can be as light or nuanced as your team needs, to provide the preferred amount of oversight when managing travel and expenses.

Automatically routed approval flows keep things moving and prevent requests from falling through the cracks or getting stalled on someone’s desk. Each approver is alerted in app and via email, and can review and approve with one tap. If a request needs to be rejected, comment fields allow the approver to communicate the justification or required changes back to the employee directly within the approval flow.

>> Related: The Guide to Finance Automation <<

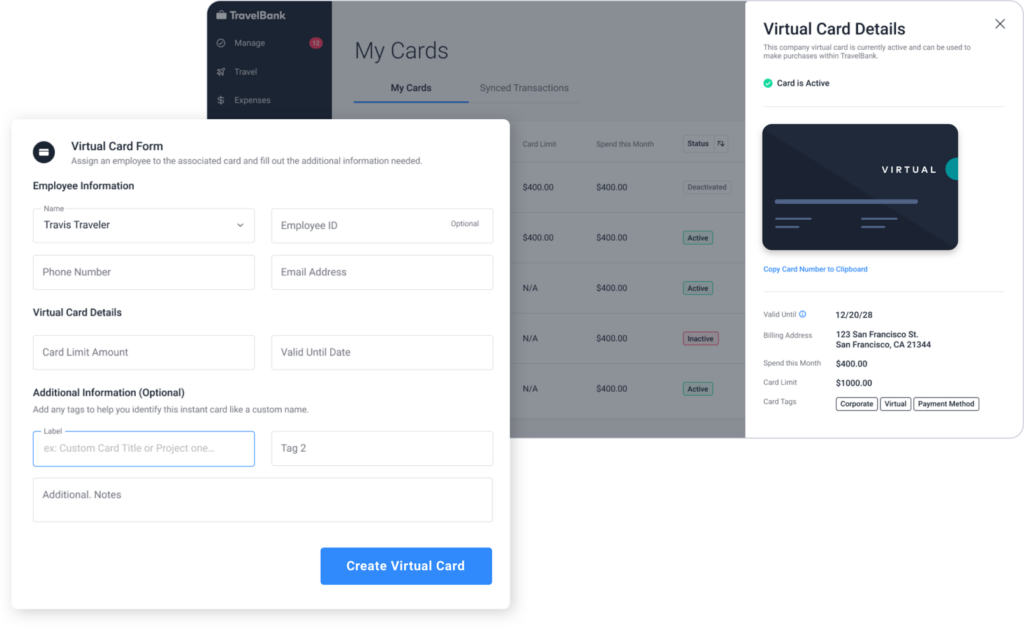

Card management and transaction sync

TravelBank supports and imports transactions from over 48,000 personal and corporate cards and banks so your team can see exactly which transactions have and have not been submitted.

This also allows employees to easily merge expenses and your receipts with card transactions. TravelBank technology helps match imported transactions with receipt photos and flags potential duplicate expenses, reducing the occurrence of time-consuming errors.

Additionally, with TravelBank your finance admin and managers can issue virtual cards to travelers’ wallets, alleviating employees of the burden of fronting travel costs while they wait for reimbursement. Virtual cards can also provide your company with more control over spend because you can restrict virtual card spend based on merchant codes, expiration dates, and more.

Real-time data and analytics for cost control and compliance

TravelBank increases visibility for your finance team with a user-friendly and fully customizable dashboard (including our most popular reports out-of-the-box) that allows you to monitor all of your spend, employee expenses, leakage, and trends in one place.

This allows your team to replace monthly manual reporting, and allocate that time to other strategic tasks. You can also build custom reports, set the run frequency, and schedule delivery if you want certain reports sent to your inbox.

Easy integration with existing financial systems

TravelBank integrates with the software and tools you’re already using including ERPs like QuickBooks Online, QuickBooks Enterprise, NetSuite, Bill.com, and Xero.

TravelBank also syncs with HR software for employee user management to make adding and deactivating employees simple, and with your banking software to capture more of your spend.

>> Related: Checklist for Finding Your New Expense and Travel Solution <<

Business Benefits of Using TravelBank for Finance Automation

The benefits of TravelBank are numerous, including helping your finance team save time, optimize costs, and simplify reporting.

Greater Efficiency

With TravelBank, it takes users less than a minute to complete an expense report, and thanks to TravelBank’s automated approval flows, managers and finance teams can approve reports in minutes. On average, users this past year saw their report approved within 6 hours. TravelBank users qualify for reimbursement within 24 hours of approval.

Simple data entry errors are costly, both in terms of the mistakes themselves and the hours of lost productivity finding and correcting them (or even manually entering expense information in the first place!). TravelBank significantly reduces the risk of human errors and omissions during expense reporting. With TravelBank, Finance departments save 5-10 hours/month on reconciliation alone.

Cost Savings

Minimizing wasted costs and using resources effectively is a continuous challenge. TravelBank streamlines expense tracking, improves accuracy and compliance, and empowers managers and finance to correct spendy behaviors early.

The average TravelBank customer reduces:

- the total cost of their travel program by 15-25%

- hotel spend by 18-41%

- and flight spend by 10-14%

Better Experience

Using TravelBank’s automated expense and travel management platform provides your team with access to:

- A dedicated customer support team that is available to assist with any questions or issues

- Best-in-class technology that is designed to simplify and streamline corporate travel and expense management

- One platform for all your business spend management needs so your team can consolidate the work associated with managing expense and business travel, gain more visibility into spend, and maximize productivity

With TravelBank’s advanced and easy-to-use platform, automated travel and expense management has never been easier.

Contact us today to learn more about the benefits TravelBank offers and how we can help drive success in your finance automation initiative.