Highlights from the 2023 State of Business T&E Report

What does T&E look like in 2023? In our newest report, TravelBank selected and analyzed travel bookings and a random sample of 15,000 expense reports submitted on our platform from July 1, 2022 through August 24, 2023. The highlights:

- General merchandise retailers, such as Amazon, are now some of the most commonly expensed merchants.

- Personal vehicle usage nearly tripled since 2019, as far fewer business travelers and employees are expensing Uber, Lyft, and taxis.

- Food delivery and grocery stores are rising in popularity within the meals expense category.

- Fewer business travelers are opting for budget airlines.

>> Skift Survey: Post-Pandemic Corporate Travel Trends <<

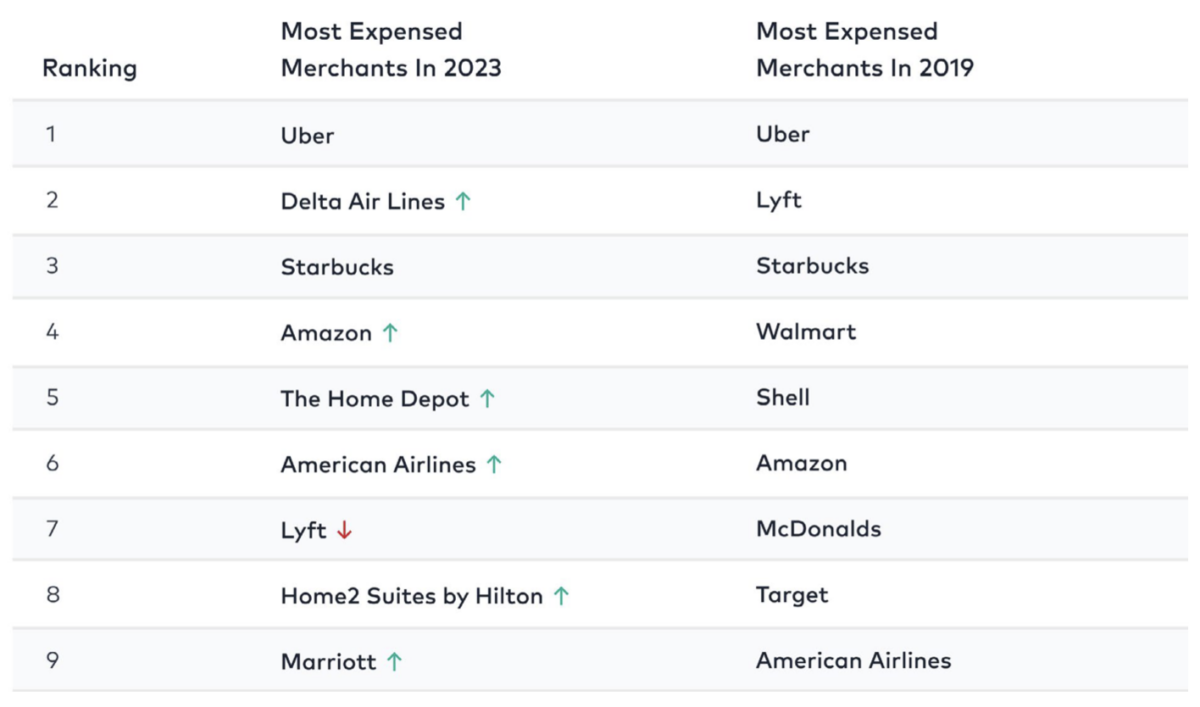

The most expensed merchants overall

Business travel is very much back: Uber remains the most-expensed merchant, and Delta Air Lines and American Airlines surged to the #2 and #6 spot. But new this year, general merchandise retailers are on the rise, with Amazon now in the top 4 position.

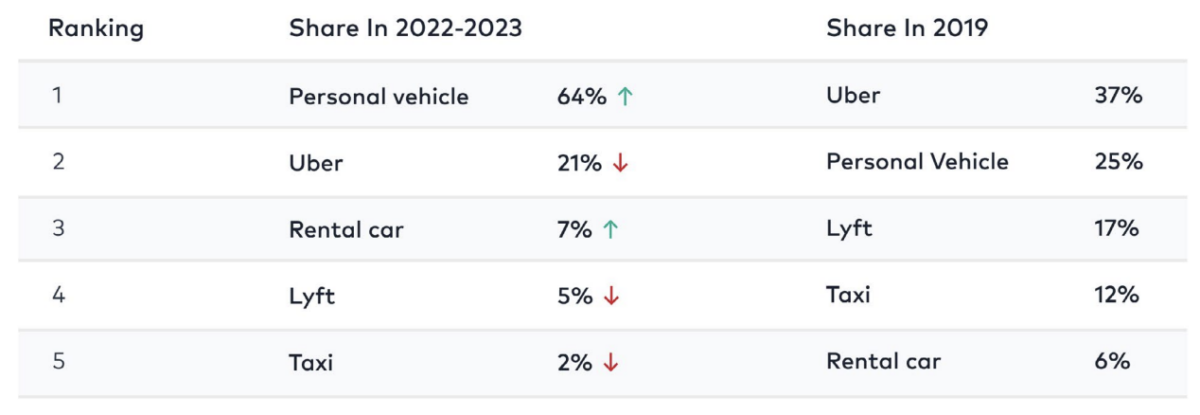

Ground

One of the most dramatic changes in post-pandemic business travel is the exponential use of personal vehicles. Far more business travelers are now traveling in their own cars and expensing gas and mileage.

From 2019 to 2023, the share of personal vehicle usage nearly tripled from 25% to 64% of ground expense reports. In the same time period, the share of business travelers using Uber fell by 16 points, Lyft by 12 points, and taxis by 10 points.

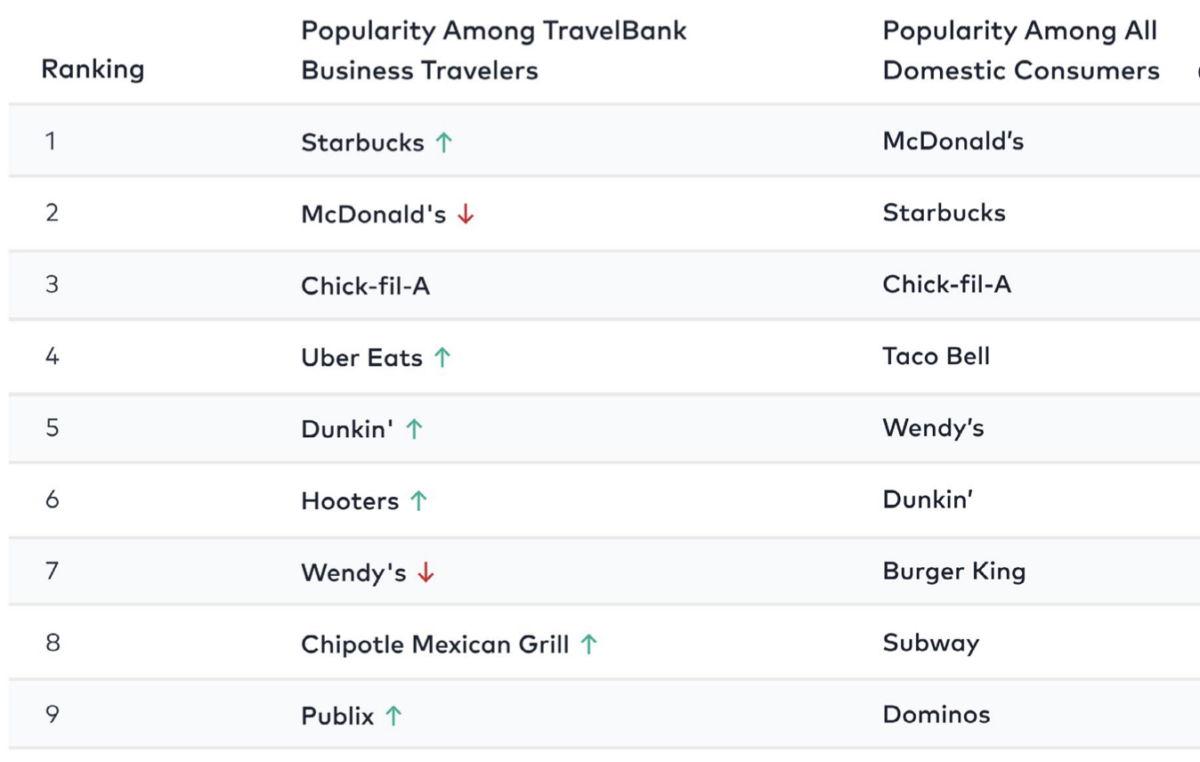

Meals

In 2023, Starbucks overtook McDonald’s as the top eatery for business meals, and was more common than eateries 2-6 combined.

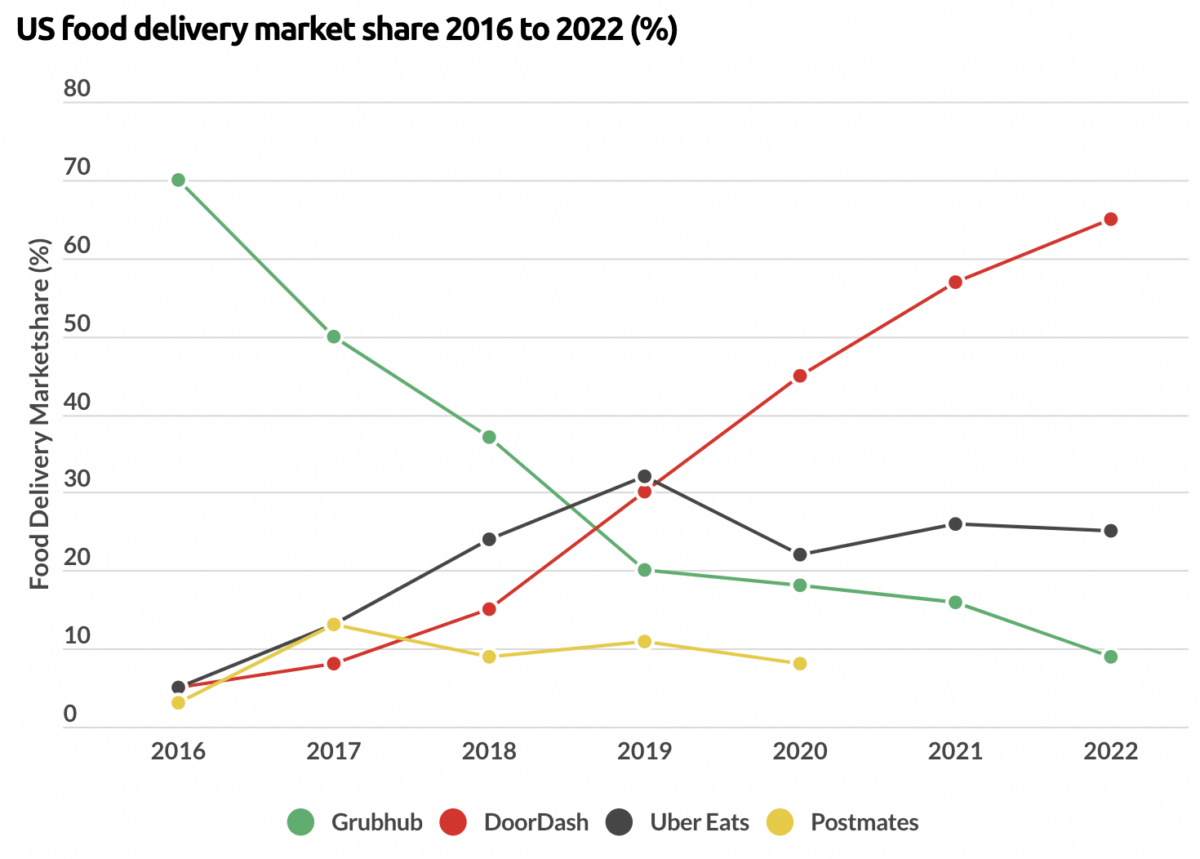

New this year, UberEats is now a top 4 vendor, reflecting remote workforce trends like lunch stipends and the explosion of delivery apps during the pandemic.

(Source)

Grocery stores have also risen in popularity, with Publix and Wawa now in the top 10, continuing the theme of employee self sufficiency in home offices and on the road.

Air

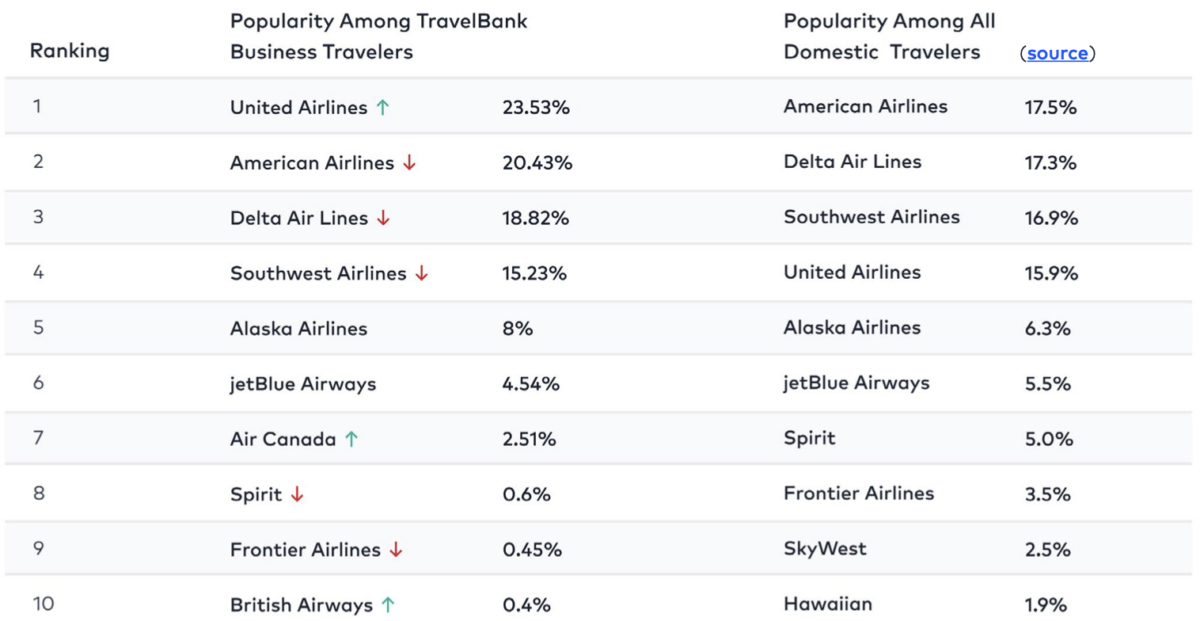

In the past year, the top business airlines across TravelBank business travelers are United Airlines, American Airlines, Delta Air Lines, and Southwest Airlines:

Based on TravelBank’s user data, United enjoys outsized popularity with business travelers. And <1% of business travelers opt to fly budget airlines like Spirit or Frontier. This could reflect a shift towards higher, but refundable, fare classes. During the pandemic, businesses scrambled to recoup unused tickets, and many companies now encourage employees to book refundable fares when available and within policy.