Research Shows it’s Time to Lessen Policy Violations (Before They Become a Bigger Problem)

Table of Contents

CFOs are transforming how their departments operate by deploying digital technologies, and they are realizing improvements in the process. New TravelBank research has found that a full 66% of finance executives report they have made technology investments to apply automation to their departments, measured the impact, and found they have experienced improvements.

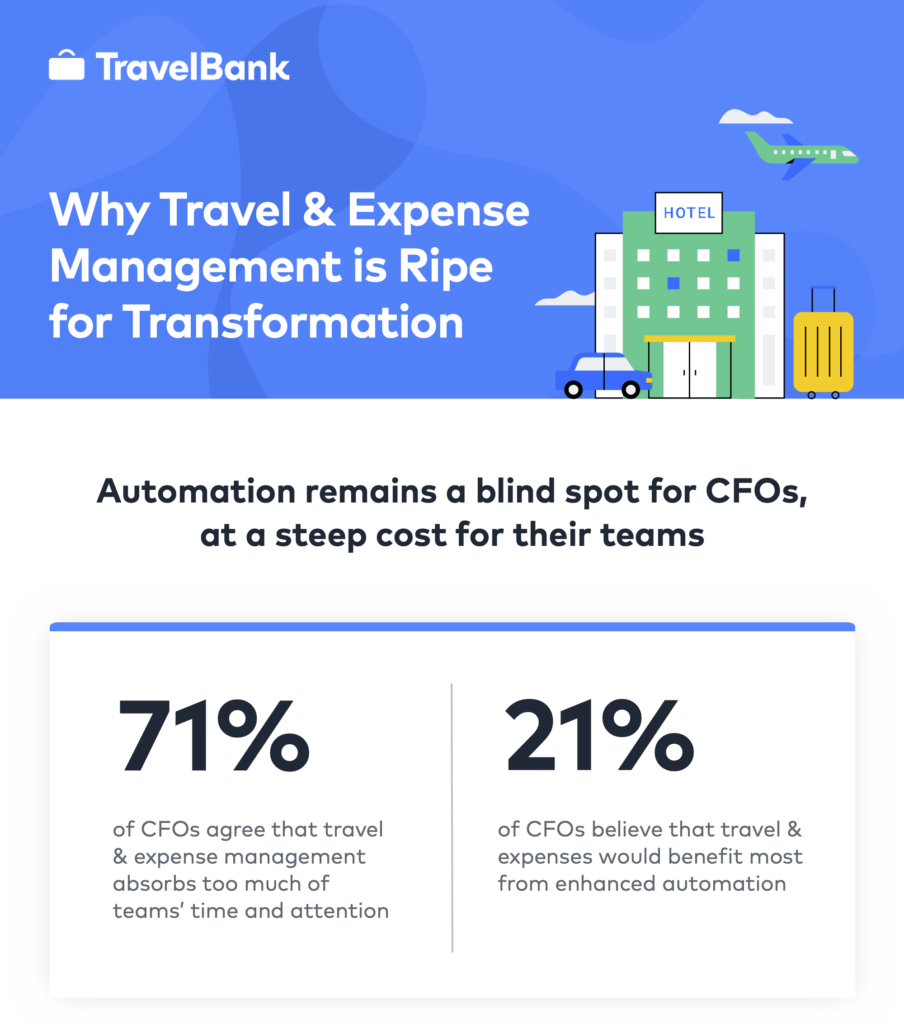

The trend is poised to continue, with 42% of finance executives reporting that their highest priorities for 2023 are adopting new technologies or replacing legacy systems in the finance department. But the same research shows that travel and expense management may be an overlooked area — and that could be problematic for businesses in the future.

>> Related: 71% of CFOs Say T&E Management Absorbs Too Much Time <<

The Current Outlook

At present, the travel and expense management function already tends to experience a significant number of policy violations. (A full 61% of finance executives report that their travel and expense policies are frequently or sometimes violated.) But CFOs expect to see the problem worsen as their businesses get bigger: 73% of finance executives agree that employee violations of travel or expense policies will become a bigger issue as their companies grow over the next five years.

Why Travel & Expense Policy Violations Happen

Violations of travel and expense policies tend to happen when policies are overly rigid and cost-conscious. Strict policies can help businesses lower costs, but they are harder for employees to adhere to — often because they fail to account for variables such as the time of year or cost between destinations.

Outdated policy documentation, such as PDFs that employees must track down and read on company intranets, may also inadvertently increase the likelihood of violations.

“Who’s actually reading them?” asks Duke Chung, Founder and CEO of TravelBank, in the new TravelBank research report. “That static approach to travel and expensing opens up a lot of slack between the employer and employee. There’s not much control on either side.”

The Impact on Finance Teams

Without control, travel and expense policy violations pile up — leading to a substantive amount of manual work for finance departments. This issue is affecting productivity considering the large majority (71%) of finance executives agree that travel and expense management absorbs too much of the finance teams’ time and attention. And with the problem of policy violations only poised to grow as companies do, now is the time for CFOs to invest in solutions that can rectify it.

>> Related: The Importance of Well-Defined Travel and Expense Policies for Businesses <<

How to Reduce Travel & Expense Policy Violations

Deploying a travel and expense management solution that automatically applies dynamic budget controls and other rules to employees’ travel bookings eliminates the slack that leads to violations.

TravelBank, for example, is capable of calculating a unique budget for each employee trip based on real-time travel pricing data as well as the company’s policy.

“Employees booking travel don’t need to be an expert on the policy,” says Chung. “The policy is built into the system and it will tell you if a trip is approved or not approved, or if it’s over- or under-budget.”

Ultimately, incorporating that kind of automation into travel and expenses makes the function more efficient, streamlined, and capable of scaling with company growth. As CFOs look toward their businesses’ futures, it’s important for them to invest in digital solutions for travel and expense management that can help make policy violations a thing of the past.