Introduction to Business Travel Expense Reimbursement: Here’s Everything You Need to Know

It’s typical for an organization to cover the travel expenses incurred by employees, associates, and representatives on a business trip. And the way a company handles it’s travel program can increase employee morale, or detract from it. For example, straight-forward expense reporting processes and prompt reimbursement for out-of-pocket expenses can be incentives that get employees excited about the company’s travel program and help foster a positive work culture. In this post, we focus on business travel expense reimbursement and break down the reasons why it is such an essential aspect of corporate travel.

Table of Contents

What Is Business Travel Expense Reimbursement?

In a nutshell, travel expense reimbursement is the process of compensating employees for out-of-pocket business-related expenses.

Recently, cost-averse corporate managers have been sold on video conferencing and virtual meetings as cheaper and permanent replacements for business travel. This couldn’t be further from reality. Corporate travel is here to stay. In fact, 78 percent of customers prefer face-to-face meetings, once again portraying personal interaction as a rather strategic – and necessary – investment. And like every strategic initiative, there are associated expenses that will be passed down to the company.

All travel expenses are captured and reported as an expense report, whether they are reimbursable or non-reimbursable. This allows the accounting team to track and reconcile company spend. Some companies may also require separate reimbursement claims to be recorded and submitted to finance, accounting, or HR for review and approval.

What Supporting Documentation Is Required for Business Travel Expense Reimbursement?

Not all expenses are approved for reimbursement. When employees submit expense reports or reimbursement claims, T&E departments require detailed information for each transaction and documentation for a number of reasons. This helps the business meet the burden of proof required by the internal revenue service (IRS), ensures transactions are legitimate and took place during the business trip, and roots out fraudulent and non-reimbursable transactions.

Credit card statements or bank statements can be used to corroborate transactions. Other documentation such as the boarding passes, rental car receipts, conference name badges, gas receipts, parking receipts, and hotel invoices may also be required to elaborate on the nature of the expense.

Matching original receipts and invoices validate the specifics of the transactions highlighted in the expense report or reimbursement claim form. Itemized receipts take it a step further and provide even more detail about each transaction alongside important dates, vendors, modes of payment for services, and specific amounts.

It is worth pointing out that different companies will have different documentation requirements. There are also some federal and state reimbursement laws that may vary from your current reimbursement policy. It’s good practice to review and update your business travel expense reimbursement policy regularly to support business goals, control spend, and stay compliant with relevant laws.

Typically, the burden of tracking expenses, gathering supporting documents, and submitting reports to justify itineraries and decisions falls on the employee. Meanwhile, the finance and accounting teams are responsible for reviewing, approving, and reconciling expense reports. T&E automation can help alleviate the burden on both sides of the travel expense reimbursement process.

What Are Best Practices for a Seamless Travel Expense Reimbursement Process?

Needless to say, business travel expense reimbursement is plagued with challenges. Negative employee experience tops this list, while fraudulent exchange and human error can significantly undermine the efficiency of your company’s travel program. To achieve a more seamless travel expense reimbursement process, corporate travel managers turn to the following best practices:

Establishing a Robust Expense Reimbursement Policy

An expense reimbursement policy is more than just a document separating reimbursable and non-reimbursable expenses. It goes on to highlight clear guidelines for filing and submitting expense claims to the relevant departments. This policy sets the standard for transparency and consistency in the reimbursement process, promoting trust between employees and the company.

Guidelines for filing and submitting expense claims should be clearly stated in the reimbursement policy. For example, “Monthly and specific trip and meeting expense reimbursement requests can be submitted by filling out the designated Travel Expense Claim Form, which can be obtained from the company’s finance or HR department.”

The spending limits established in the travel expense policy should be followed. This helps prevent surprise charges or possible abuse of the reimbursement system. And even when the policy is followed, most policies require receipts and invoices to verify transactions before any claims can be paid out to an employee.

Reimbursement methods should also be addressed in the reimbursement policy. Expense reimbursements could be transferred to employees through a direct deposit, cash, checks, or any other method designated by the company. Additionally, deadlines for receipt submission should be specified to ensure expense reports and reimbursement claims are processed in a timely fashion.

Finally, T&E expense reimbursement policies should provide an estimate of how long the process is expected to take to set clear expectations with employees.

Maintaining a Dynamic Travel Expense Reimbursement Policy

Travel and expense reimbursement policies should be ever-evolving. Relying on an aged policy may seem like the easy option, but it can lead to issues. Aged policies may not be compliant with the latest laws and regulations, they may not reflect the current interests and goals of your business, and they may create unnecessary work for your staff.

It’s also important to communicate policies with employees. When employees are aware of the reimbursement guidelines and have ongoing conversations with their managers or the travel department, they can take proactive steps to minimize unexpected expenses. Fresh discussions about expense limits, travel plans, and other adjustments should be held regularly so stakeholder feedback can be considered in the updated policy.

Transitioning from Manual Data Entry to End-to-End Travel Management Software

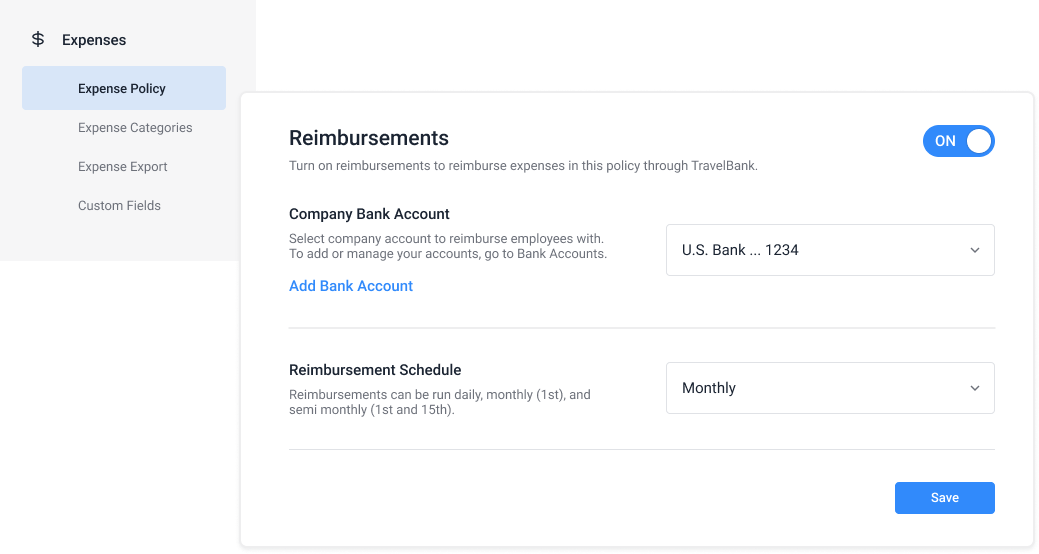

Travel management software incorporates technological features and tools that ease the travel management process, and consequently, accelerate reimbursement. End-to-end travel management platforms such as TravelBank simplify travel booking, expense reporting, card management, and expense tracking by eliminating the need for paper records and automating parts of the process.

The integration of the software provides several benefits for organizations as follows:

Streamline Your Expense Reimbursement Process Right from the Start

When several employees file for their business travel expense reimbursement, the paperwork becomes onerous to deal with. Finance and travel departments have to sort through dozens of reports in a short time, sift through mass volumes of data, and ensure timely reimbursement for the employees.

With an automated travel management platform leading the charge, expense reports can be created, submitted, approved, and validated much more efficiently. There is no need to manually compile the expense reports; employees and travel managers collaborate seamlessly within the app supported by instant messaging, integrations, and a wealth of data analytics and visualization tools.

Keep Manual Data Entry at a Minimum

Incoming and outgoing expense reports can pile up over time. Come end of the accounting period, manually curated and stored records may consume too much precious time that could have been spent on other high-priority duties.

Automating the travel management process and swapping out legacy systems for newer, powerful, feature-packed T&E expense management software minimizes the time spent on manual records.

Boost Accuracy and Efficiency to Unprecedented Levels

Manual workflows are prone to error. During the creation of expense reports, employees may key in the wrong entries. Whether this is intentional or negligent is subject to debate. However, the Association of Certified Fraud Examiners (ACFE), in a recent report, found that financial statement fraud, payroll, billing, and expense reimbursement fraud could last two years on average before being uncovered.

Travel expense automation software can soothe the pain that financial managers go through with tools such as receipt scanning and data extraction with optical character recognition (OCR) technology. These tools enable employees to simply snap a picture of receipts, extract data, and populate it on the expense report on the go.

Conclusion

Delayed reimbursements cause financial inconvenience and frustration for employees who spend personal funds on corporate travel. TravelBank facilitates faster workflows leading up to reimbursement and can automate reimbursement processing. However, be sure to reinforce the importance of diligently filling and submitting reports in a timely manner on the employee’s part.

FAQs

What common types of travel expenses qualify for deductible expense reimbursement?

There are several common types of travel expenses that qualify for deductible expense reimbursement including transportation (airfare, train tickets, or car rental) or gas mileage if using a personal vehicle. Transportation between the airport or station and the hotel, accommodation, and meals are also generally considered deductible expenses.

Does travel expense reimbursement qualify as a deductible travel expense?

Travel expense reimbursements to your employees can qualify as a deductible travel expense for your business if it meets certain criteria. According to IRS guidelines, the reimbursement amount must be directly related to travel away from home for business purposes. Also, the amount reimbursed should be reasonable and not excessive and must be properly documented and supported by valid receipts or other relevant documentation.

How do expense reports play a role in a business’s expense reimbursement policy?

Expense reports are the backbone of a systematic and organized way for employees to report their expenses and for finance departments to validate reimbursement claims. They facilitate T&E policy compliance at the individual level. Expense reports provide a detailed breakdown of the expenses incurred during the corporate travel, revealing employee spending patterns and laying the groundwork for improved processes and cost controls.

How much travel expense can I claim?

How much travel expenses you can claim is determined by how much was actually spent on travel and the allowed reimbursable expenses highlighted in the reimbursement policy. For example, if you can prove that certain expenses are directly related to the business, these are viable for reimbursement. Some reimbursable expenses are also dependent on the category and nature of the expense itself.

Can a company refuse to reimburse travel expenses?

A travel expense claim may be rejected by the company’s finance department due to a number of factors. Lack of proper documentation is a common reason. If there is some information missing in the claim forms or a failure to submit the proof of transaction then reimbursement can be withheld. Alternatively, if the claim amount exceeds the company’s set limit, then the company may refuse to pay back the excess of the cost.